-

Print

-

One of our business strategies calls for developing ten strong IPs, and we are proud to introduce SD as one of them. Extraordinary time and effort went into making this exciting title, which has already been highly acclaimed. We recently received over 80 points on Metacritic scores.

-

Previously, I have repeatedly mentioned the need to change the HD Games business model in order to gain revenues through PDLC instead of relying only on disk sales. To follow this, SD is fully equipped with various additional elements.

SD is a story of an undercover cop in Hong Kong. We have an optional DL content in zombie mode in the exact same setting as the original game. Zombie games are very popular in the US, however since the story is based in Hong Kong, players will be fighting against Jiang Shi (Cantonese version of zombies).

I am confident that SD would grow to be one of our ten strong IPs, and I am very optimistic for great results in lifetime sales. Just to reiterate, we expected greater revenues from SD in the First Six-month Period planning, and what we are seeing now is simply the difference between actual and aggressive projections.

-

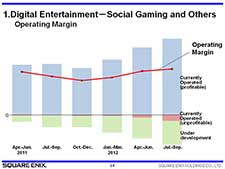

Here is our progress on Social Gaming & Others. We left the scale out of this graph, but you can see the quarterly profit and loss for titles already in operation and those still under development.

Unlike package software, which is usually developed on a massive scale, projects in the Social Gaming & Others area are much smaller in size. Development costs are expensed as they occur, instead of being capitalized as assets under the content production account.We are enjoying growing revenues from Social Gaming & Others, however in order to secure even greater profits, we are ready to expand our investment plans in this area. For this reason, the red line indicating operating income does not show a dramatic increase. We are approximately ¥1 billion less of our profit planning, which is not because we are unable to release titles, or because we are suffering from negative earnings, but simply because we went ahead and invested upfront.

Looking at profit and loss including operating costs, game titles in a deficit are only those seen in the red portion of this graph, which indicates that we are working on appropriate investment in this area.

In HD games, we usually have a mixture of profitable and unprofitable titles, generating profit as a whole. As for our Social Gaming & Others, we only have very few titles that are unprofitable. You can compare operating black and red titles in this graph and notice that our chances of developing profitable games are pretty good.

In line with all this, we are prepared to increase investments, followed by sales contributing to the overall revenues after a few months.

Operating income for Social Gaming & Others has been flat in the First Six-month Period, however, sales have been increasing significantly on a quarter-by-quarter basis. We are at a point where we can expect to see a smash hit title anytime.

Although it is likely for Social Gaming & Others to show upturns in sales, these positive figures are not reflected in our FY2013/3 earnings forecasts. We can certainly say at this point that the Social Gaming & Others business is making steady and sound progress.