-

Print

-

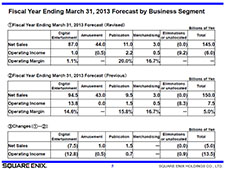

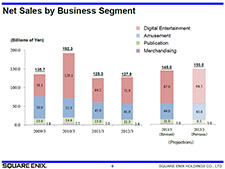

Looking at net sales for the past four years, you will notice that the current FY is not much different from previous FY results. I would also like to point out that although we see changes in a few areas, the net sales forecast made public today is not significantly lower from the previous forecast announced in October 2012. One area that did see significant changes was our Digital Entertainment segment; our forecast was ¥94.5 billion in net sales, where we achieved ¥87 billion, resulting in a variance of ¥7.5 billion. Our presentation today will focus on how this affected our income.

-

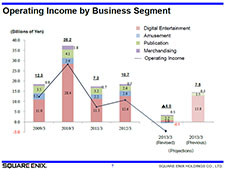

This slide shows operating income for the past four FYs. Operating income is an accumulation of operating incomes from all business segments. Since we still have some unallocated corporate operating expenses, consolidated operating income resulted in the depicted line graph. Our previous forecast of ¥7.5 billion consolidated operating income did fall short of our standards, however I should point out that this figure was only slightly lower than the previous two FYs. However, as we compiled the figures for the current FY, we saw an enormous variance against previous FYs. Operating income for the past four FYs in our core business segment, Digital Entertainment was ¥11 billion in FY2009, ¥28.4 billion in FY2010, ¥11.3 billion in FY2011, and ¥12.6 billion in FY2012. Current earnings forecast for FY2013 sees this plunging to ¥1 billion. The announced revision from last October, ¥13.8 billion, was around the range of previous FYs, however the revisions made official today result in a considerable negative variance of ¥12.8 billion.