-

Print

-

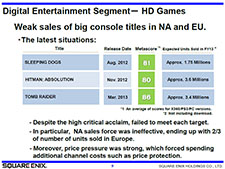

Of the negative variance of ¥12.8 billion against the operating income forecast, a large portion (more than ¥8 billion) originates from HD Games. Console games in the current FY focused primarily on core titles developed for the European and North American markets. Eidos was acquired in 2009; as Eidos contributed greatly to the bottom line in the FY ended March 2010, we have been releasing one or two titles a year ever since. FY2013 was our first big attempt to release hallmark Western titles, such as Hitman and Tomb Raider, without releasing a blockbuster title in Japan. We put considerable amount of effort in polishing and perfecting the game content for these titles, receiving extremely high Metacritic scores. However, we were very disappointed to see that the high scores did not translate to actual sales performance, which is where we see the substantial variance in operation profit/ loss against the forecast. We do not disclose the number of sales units anticipated in our forecast, and although I cannot mention exact unit numbers, I would like to touch on how we approach these figures. Let’s talk about Sleeping Dogs: we were looking at selling roughly 2~2.5 million units in the EUR/ NA market based on its game content, genre and Metacritic scores. In the same way, game quality and Metacritic scores led us to believe that Hitman had potential to sell 4.5~5 million units, and 5~6 million units for Tomb Raider in EUR/ NA and Japanese markets combined. Of course, we want to hedge risk in budgeting these units directly into the forecast, therefore we base the forecast on 80-90% of the total sales potential of each title. However, it is disappointing that our results fell below these marks.

The European market was generally soft, however what affected us the most was the huge slump in North American sales. Not only were sales sluggish, but we were also hit by additional costs in dealing with distribution channels, such as price protection and rebates, which placed huge pressure on our profit and loss. A large portion of the variance against forecast comes from the three titles I just mentioned. As for MMOs, the Dragon Quest X Wii U version was released very close to the end of FY2013. Nearly all development costs are being incurred in the current FY, which is also impacting us in a negative way.