Corporate Governance Report(as of July 3, 2025) (578KB)

Basic Views on Corporate Governance

The Company is a pure holding company governing SQUARE ENIX Group, which develops a wide range of content and services. The Company believes that it is essential for the achievement of the Group's continuous growth and the maximization of its corporate value in the medium and long term to respect the interests of all of the Company's stakeholders such as shareholders, customers, business partners, employees and society, and to maintain good relationships with them under an agile, transparent, and sound management system.

As such, the Company recognizes that the enrichment and enhancement of its corporate governance platform is a key management challenge, and the entire SQUARE ENIX Group devotes itself to that end on an ongoing basis.

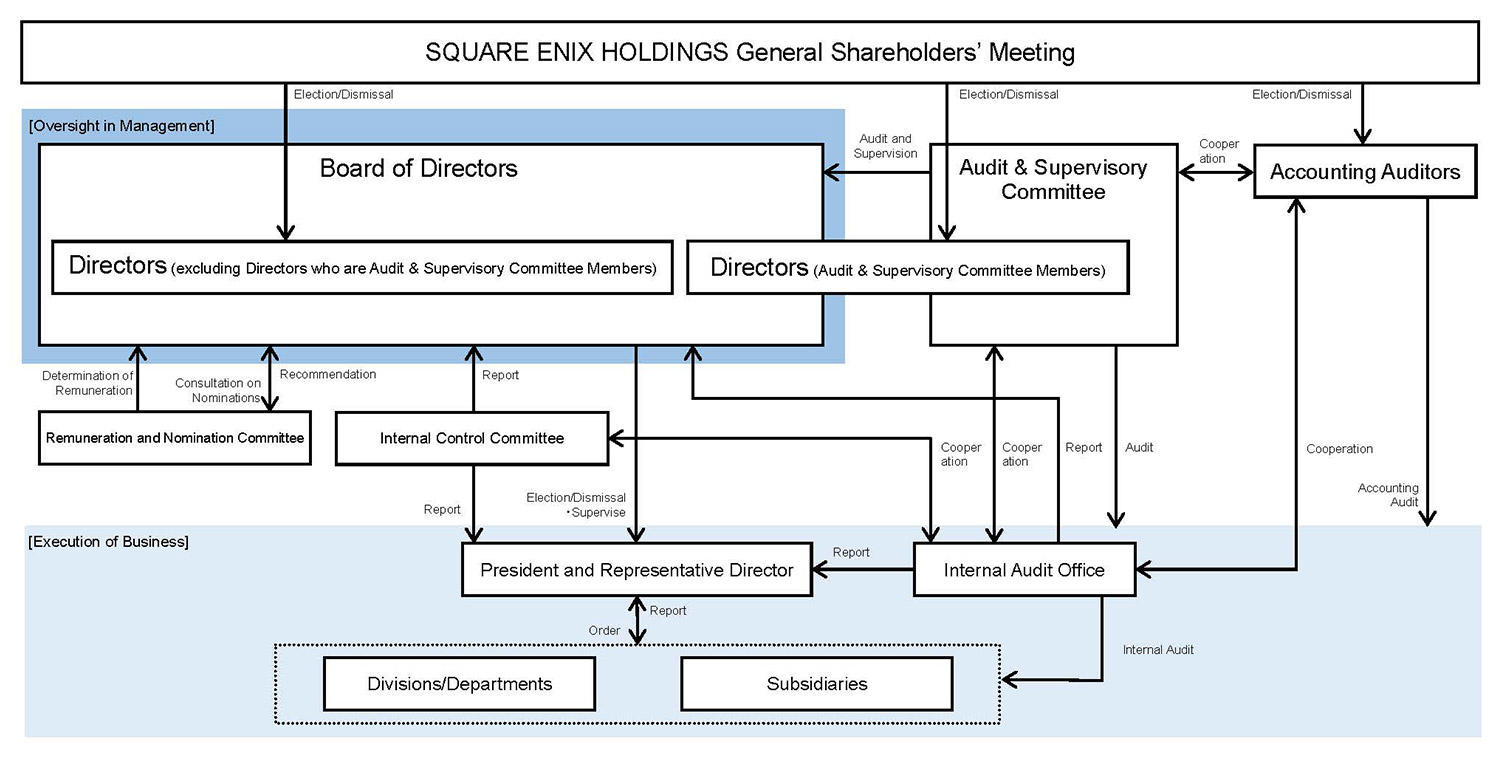

Overview of Corporate Governance System

(1)In an effort to enhance its corporate governance, the Company transitioned to a Company with an Audit & Supervisory Committee as of June 22, 2018. The establishment of an Audit & Supervisory Committee comprising only outside director works to strengthen the Company's auditing and supervisory functions over its management.

Moreover, in order to clarify the separation between management and execution, the Company will strengthen the monitoring functions of the Board of Directors by staffing it primarily with outside directors. Meanwhile, the Company has established an organization to increase the efficiency and speed of operational execution by dictating in its Articles of Incorporation that the Board of Directors can empower directors to make decisions regarding the execution of key operational matters.

The Company has 9 directors (excluding those who are members of the Audit & Supervisory Committee), 6 of which are outside directors, and 3 directors who are members of the Audit & Supervisory Committee, all of which are outside directors, with 1 being full time. The Company designates all of its outside directors as independent directors as defined by the Tokyo Stock Exchange.

As a general rule, meetings of the Board of Directors are convened once a month, and deliberations and exchanges of opinions between the individual directors brings greater vitality to the management of the Company while also serving to sufficiently enhance the checking and balancing function that directors play for one another.

(2)As a general rule, the Audit & Supervisory Committee meets once a month and based on the Audit & Supervisory Committee Standards and in light of the status of the development and operation of internal control systems, audits the legality and appropriateness of directors' execution of their duties, in coordination with the internal audit functions. Some Audit & Supervisory Committee Members have considerable knowledge of finance and accounting. In addition, full-time Audit & Supervisory Committee Members attend important meetings other than those of the Board of Directors, such as those of the Remuneration and Nomination Committee and the Internal Control Committee, and they share information that they have obtained by reviewing minutes of key meetings, contracts, approval requests, and accounting data with other Audit & Supervisory Committee Members.

(3)In order to ensure the objectivity and transparency of decisions made regarding executive remuneration and candidates for director positions, the Company has at its discretion established a Remuneration and Nomination Committee on which the majority is formed by independent outside directors and the chairperson is an independent outside director. This committee decides the individual amounts and the nature of remuneration for directors (excluding Directors who are Audit & Supervisory Committee Members) based on Basic Policy on the Executive Officer Remuneration System, decides the Guidelines on the Nomination Criteria for Directors and also decides candidates for directors, etc. to be submitted to the Board of Directors.