-

Print

-

We would now like to begin the Financial Results Briefing session of SQUARE ENIX HOLDINGS (the “Company”) for the fiscal year ended March 31, 2022 (“1Q FY2022/3”).

Today’s presenters are:Yosuke Matsuda, President and Representative Director, andAtsushi Matsuda, Chief Accounting Officer.

-

First, Mr. Matsuda, Chief Accounting Officer, will give an overview of the Company’s financial results for 1Q FY2022/3, and then our president Mr. Matsuda will discuss the progress made by each of the Company’s business segments.

-

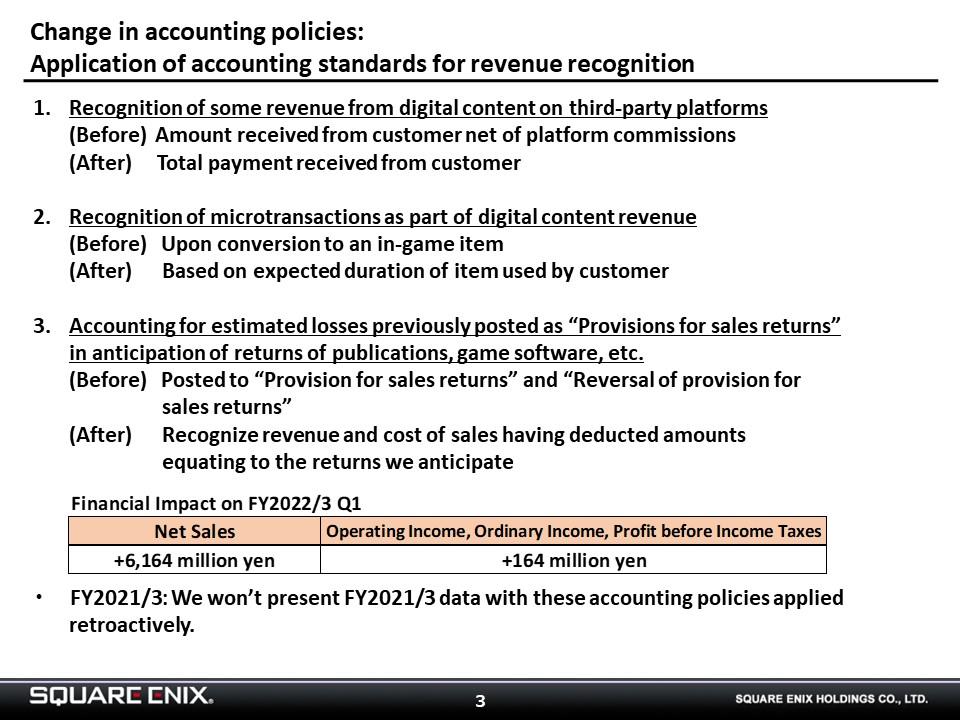

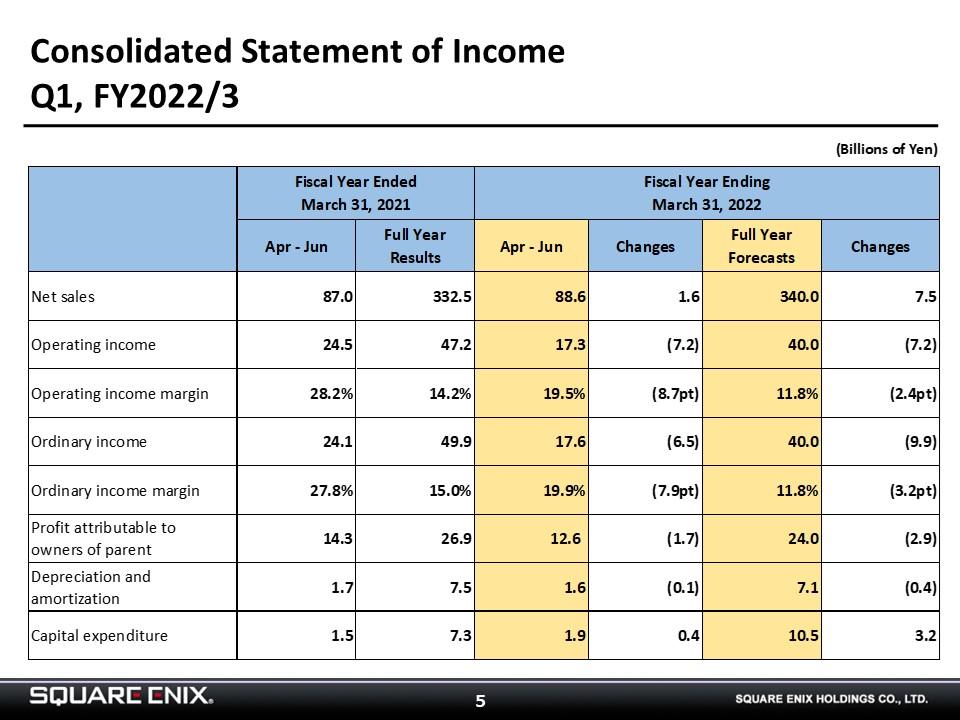

I am Atsushi Matsuda, the Chief Accounting Officer. I would firstly like to note changes to our accounting policies. We began applying the Accounting Standard for Revenue Recognition as of 1Q, resulting in a boost of ¥6,164 million to net sales and a boost of ¥164 million to operating income, ordinary income, and profit before income taxes. Please refer to our Earning Releases for further details.

-

In 1Q FY2022/3, the Company booked net sales of ¥88.6 billion (up ¥1.6 billion YoY), operating income of ¥17.3 billion (down ¥7.2 billion), ordinary income of ¥17.6 billion (down ¥6.5 billion), and net income attributable to parent company shareholders of ¥12.6 billion (down ¥1.7 billion).

-

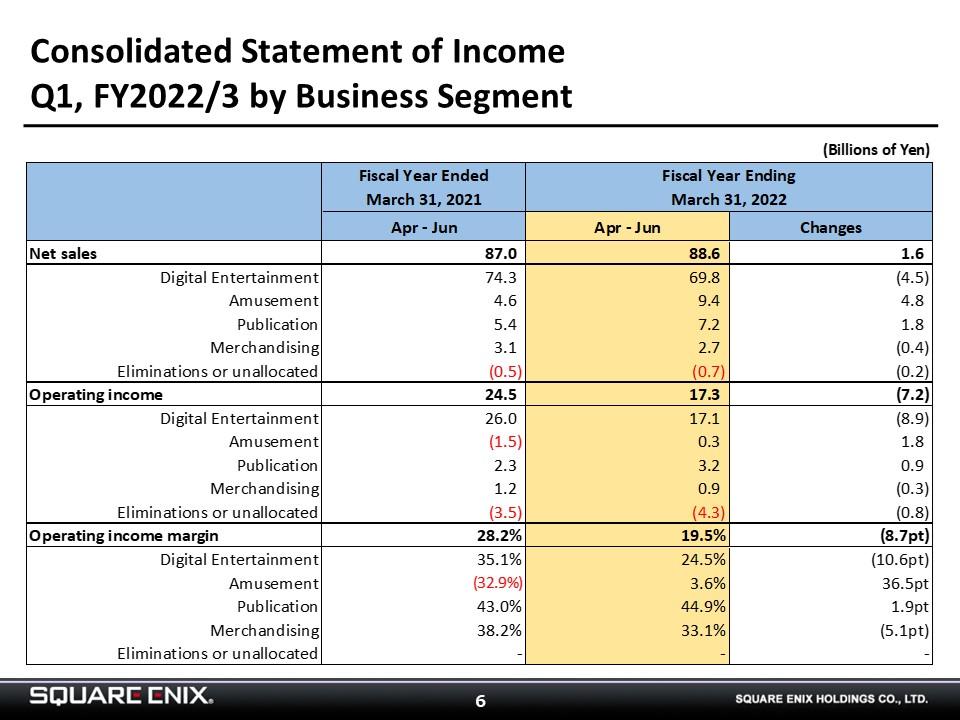

I will next break down our results by segment. The Digital Entertainment segment posted net sales of ¥69.8 billion (down ¥4.5 billion) and operating income of ¥17.1 billion (down ¥8.9 billion).

While the HD Games sub-segment released such titles as “NieR Replicant ver.1.22474487139...” and “OUTRIDERS,” its net sales were lower than in the same period of the previous fiscal year, which had seen the release of “FINAL FANTASY VII REMAKE.”

Net sales rose YoY in the MMO sub-segment thanks to growth in paying subscriber numbers for “FINAL FANTASY XIV.”

The Games in the Smart Devices/PC Browser sub-segment saw YoY sales growth, not only because of contributions from “DRAGON QUEST TACT,” “NieR Re[in]carnation,” and “OCTOPATH TRAVELER: Tairiku no Hasha,” but also due to the change in how revenue is reported under the newly adopted accounting standard.

The Amusement segment booked net sales of ¥9.4 billion (up ¥4.8 billion YoY) and operating income of ¥300 million (versus an operating loss of ¥1.5 billion a year earlier). The segment had been heavily impacted in the previous year by the temporary closure of our amusement facilities in Japan, a move taken to help prevent the spread of COVID-19 in keeping with the Japanese government’s state of emergency declaration. As such, net sales rose substantially YoY, and the segment moved into the black at the operating line.

The Publication segment booked net sales of ¥7.2 billion (up ¥1.8 billion YoY) and operating income of ¥3.2 billion (up ¥900 million). Both sales and profits rose YoY thanks to substantial growth in sales of e-books and other digital media, as well as brisk sales of print media.

The Merchandising segment posted net sales of ¥2.7 billion (down ¥400 million YoY) and operating income of ¥900 million (down ¥300 million). Both sales and profits were down, as the previous year had seen the release of new character goods and other merchandise based on the Company’s IP.That concludes my overview of our 1Q FY2022/3 financial results.

The information on the future forecasts described in this material is current as of August 5, 2021. The company is not obliged to update or correct forecasts concerning the Company’s future results, including forecasts or outlook, if new information becomes available and/or events occur after August 5, 2021