-

Print

- (Continued from previous page.)

-

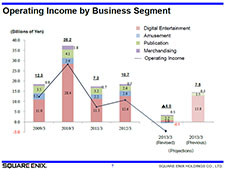

The first half results for Digital Entertainment was an operating loss of ¥2.1 billion. In order to achieve an operating profit of ¥1 billion in the full-year, Digital Entertainment needed to earn ¥3.1 billion in operating income in the second half. Our forecast for the second half was ¥15.9 billion in operating income, as announced in the previous revisions, which results in a negative variance of ¥12.8 billion in the second half against the previous forecast.

Then, we have the Amusement segment not performing as well as in previous FYs. Operating income in the past were ¥3.2 billon in FY2009, ¥2.9 billion in FY2010, ¥2.2 billion in FY2011, and ¥2.6 billion in FY2012. We are expecting a loss of ¥500 million for FY2013. Factors causing poor performance in the first half continued to linger in the second half. However, the loss in actual amounts in Amusement is not as great as the loss we expect to incur in Digital Entertainment.

As for Publications, we are estimating ¥2.2 billion in operating income. For your reference, operating income for Publications in the past were ¥3.5 billion in FY2009, ¥4.1 billion in FY2010, ¥3.2 billion in FY2011, and ¥2.6 billion in FY2012. Performance for the current FY does not meet previous FY results, however forecasts proved better than those announced last October.

In summary, the two main points to the current revisions to consolidated forecasts are: even though net sales did not wane considerably, we saw a significant decline in profits; and this variance comes mostly from the Digital Entertainment segment.

-

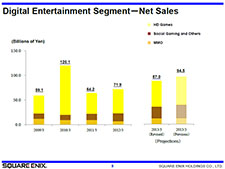

This slide shows a breakdown of net sales in Digital Entertainment.

From the top are HD Games, Social Gaming and Others, and MMO. The revised forecast announced last October was ¥94.5 billion; however we are now expecting that to fall short at ¥87 billion. The breakdown is as follows: ¥53 billion in HD Games, ¥23 billion in Social Gaming and Others, and ¥11 billion in MMO.