-

Print

-

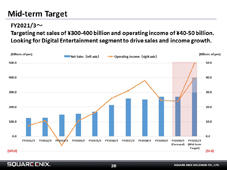

We look for FY2020/3 earnings to be in line with those of FY2019/3, forecasting net sales of ¥270 billion and operating income of ¥24 billion. There are two primary reasons that our plan anticipates a FY2020/3 performance on par with the previous year’s. The first is that it will be challenging for the Games for Smart Devices/PC Browsers sub-segment to be able to generate the earnings that we had initially anticipated given sluggish performances from titles we launched in 3Q FY2019/3. We had looked for full-year earnings contributions in FY2020/3 from multiple titles that we had released in FY2019/3. However, we find ourselves in challenging circumstances as the only new title capable of contributing to earnings is “Romancing SaGA Re;univerSe.” The second reason is that we have been forced to review our outlook for additional sales of titles conservatively we released in FY2019/3, including “SHADOW OF THE TOMB RAIDER” and “JUST CAUSE 4,” given the way they have performed to date.

-

At E3, we plan to unveil the details of our major new HD games for FY2020/3, but due to the progress of our development efforts and out of consideration of competitor release schedules, our major launches will take place after midyear of FY2020/3. As such, the FY2020/3 earnings contribution will be limited. We had initially anticipated to grow up and to the right between FY2019/3 and FY2020/3, but we now look to trend flat given that we will be “rewinding” one year in our earnings trajectory. In light of our forthcoming lineup of titles, we believe that it is FY2021/3 and beyond when we can expect major growth and think we have the potential to generate operating income of ¥40-50 billion