-

Print

-

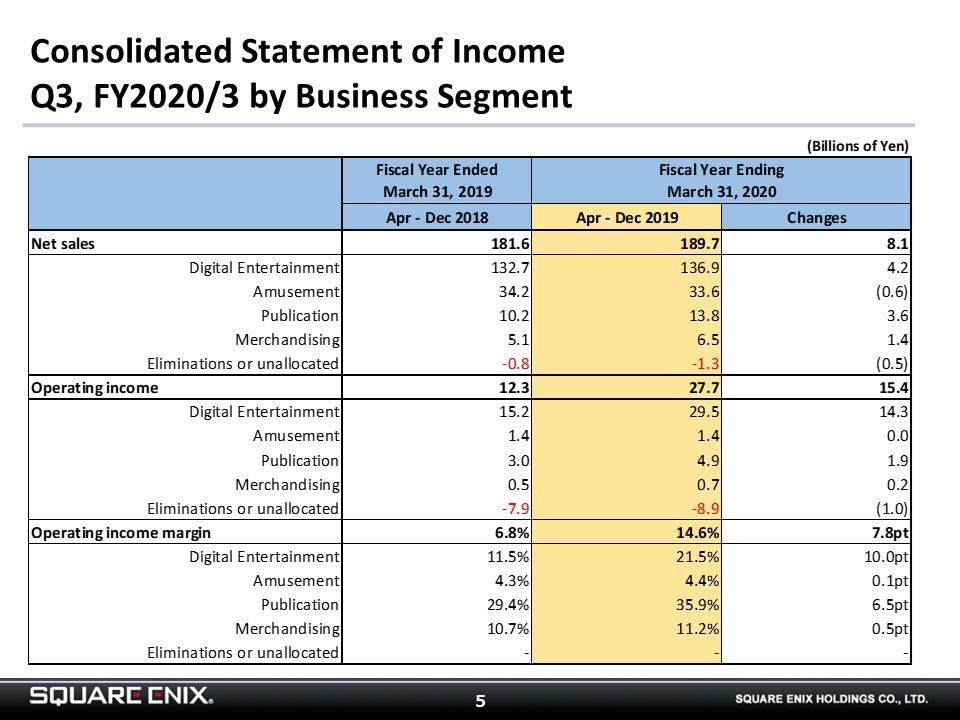

I will next break our results down by segment.The Digital Entertainment segment booked net sales of ¥136.9 billion (+¥4.2 billion) and operating income of ¥29.5 billion (+¥14.3 billion).

In the HD Games sub-segment, we released titles including “DRAGON QUEST XI S: Echoes of an Elusive Age – Definitive Edition” and Nintendo Switch and Xbox One versions of “FINAL FANTASY X/X-2 HD Remaster,” but net sales fell YoY due to the high hurdle set by major releases a year earlier. In addition, the sub-segment generated an operating loss because of weak sales of new titles released in FY2019/3.

Thanks to the release of “FINAL FANTASY XIV: Shadowbringers” and “DRAGON QUEST X” expansion packs and the resulting growth in subscriber numbers, net sales and operating income rose YoY in the MMO sub-segment.

Net sales and operating income also rose in the Games for Smart Devices/PC Browsers sub-segment, which saw strong performances from “Romancing SaGa Re;univerSe” and the September 2019 release “DRAGON QUEST WALK”.

The Amusement segment posted net sales of ¥33.6 billion (-¥600 million YoY) and operating income of ¥1.4 billion (+¥10 million). While we launched no major amusement machine titles, operating income rose YoY due to solid arcade operations.

The Publication segment booked net sales of ¥13.8 billion (+¥3.6 billion) and operating income of ¥4.9 billion (+¥1.9 billion). Sales in digital formats, including via the “MANGA UP!” comic app and of e-books, rose sharply. Sales of printed media were also brisk, leading to the YoY rise in net sales and operating income.

The Merchandising segment posted net sales of ¥6.5 billion (+¥1.4 billion YoY) and operating income of ¥700 million (+¥200 million). The release of new character goods featuring the Group’s own intellectual properties led to the YoY rise in net sales and operating income.

This concludes my overview of our financial results.

-

I am Yosuke Matsuda. I will be discussing our FY2020/3 earnings outlook.

We are making no changes to our consolidated earnings guidance for FY2020/3. While 1-3Q operating income exceeded the initial plan we had released on May 13, 2019, we find it difficult at present to assess the market trends that could impact our financial performance in 4Q and beyond. Allow me to elaborate. Next-generation game consoles are slated to be released in the 2020 holiday season and our competitors have been changing the launch dates of the AAA titles they will be rolling out prior to the console launches. This makes it difficult at present to predict how our major new FY2021/3 releases will be affected, so we need to be careful about determining how much risk to factor into our guidance. As such, we plan to revalue the assets in our content production account at yearend closing for FY2020/3 and maintain our consolidated earnings guidance, as we are unable to quantify the impact of that revaluation at present.