-

Print

-

I am Yosuke Matsuda. I will be discussing conditions in 4Q FY2020/3 and thereafter.

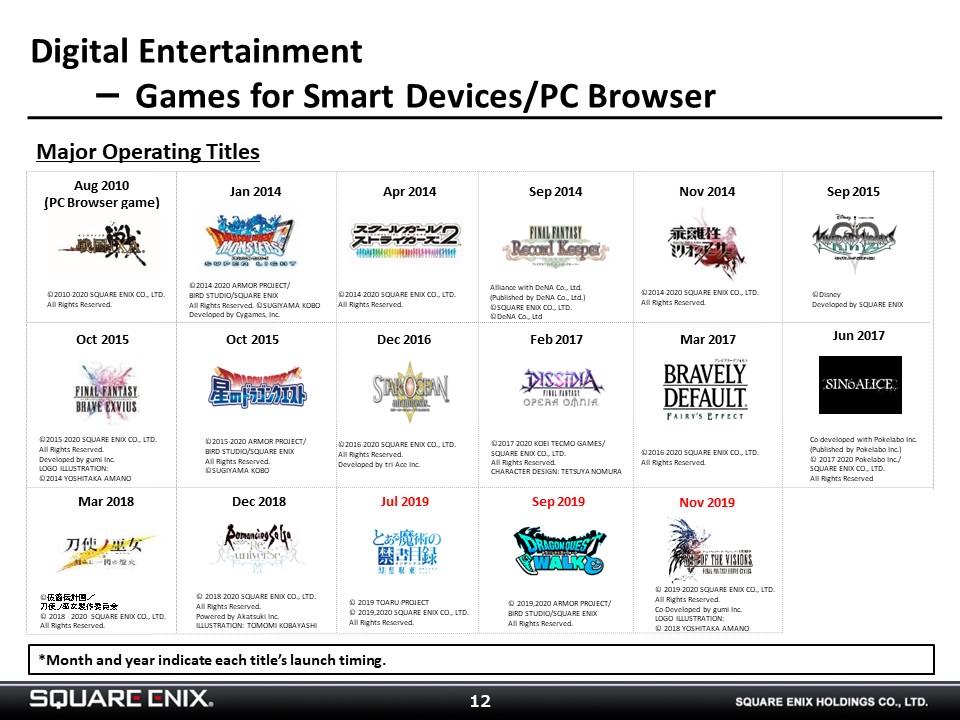

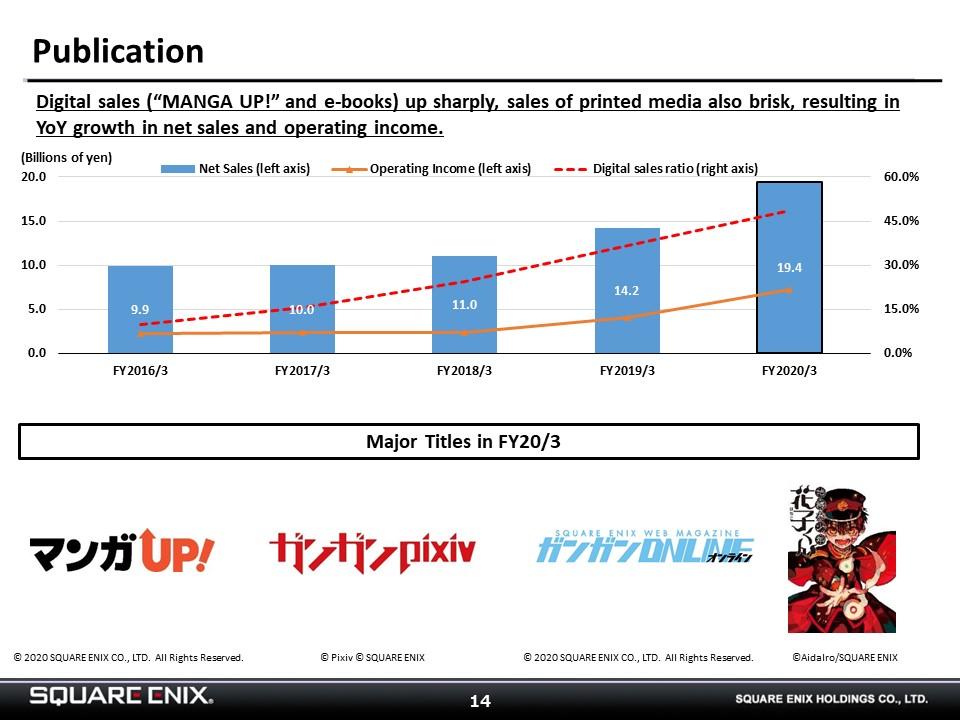

In the Games for Smart Devices/PC Browsers sub-segment, “WAR OF THE VISIONS: FINAL FANTASY BRAVE EXVIUS,” which we launched in November 2019, continued to deliver a strong performance in 4Q as it had in 3Q. In addition, digital sales, such as those from our “MANGA UP!” manga application were strong in the Publication segment.

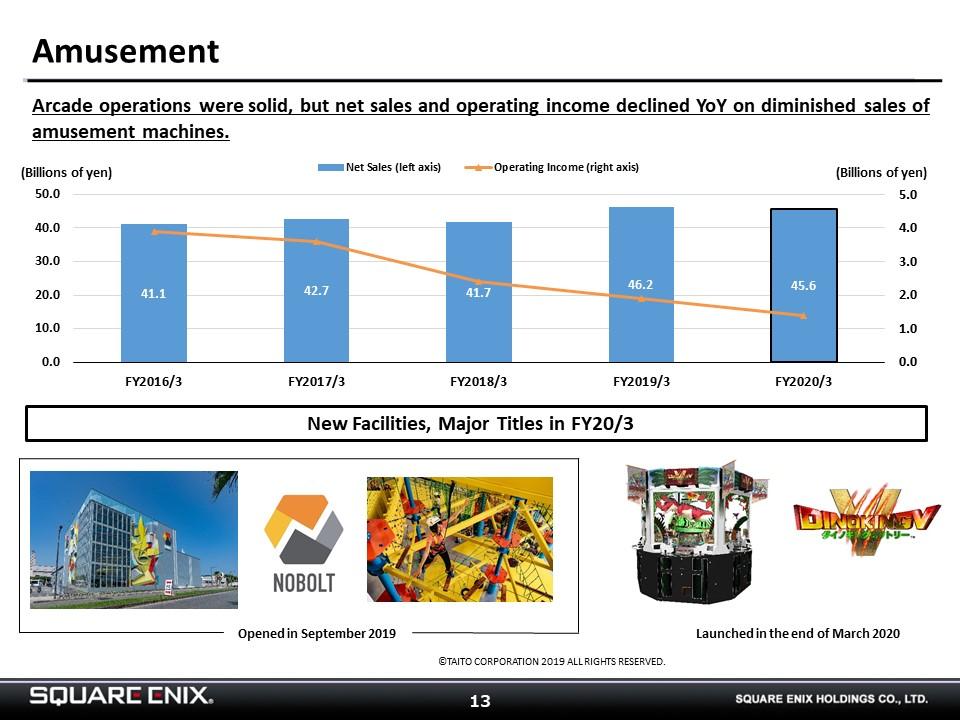

By contrast, conditions were challenging at the Amusement segment. In particular, the coronavirus outbreak reduced March sales at existing arcades to 70% of the previous year’s level, and we expect conditions to remain challenging in FY2021/3 as we comply with municipalities’ requests for closures of arcade facilities.

At the HD Game sub-segment, we decided to produce and ship fewer packaged products of “FINAL FANTASY VII REMAKE,” which was launched on April 10, because of the impact on distribution channels we anticipated from the coronavirus. As a result, sales of disks were lower than we had initially expected, but digital sales have gotten off to a good start, and we are hopeful about how sales will continue to build going forward.

-

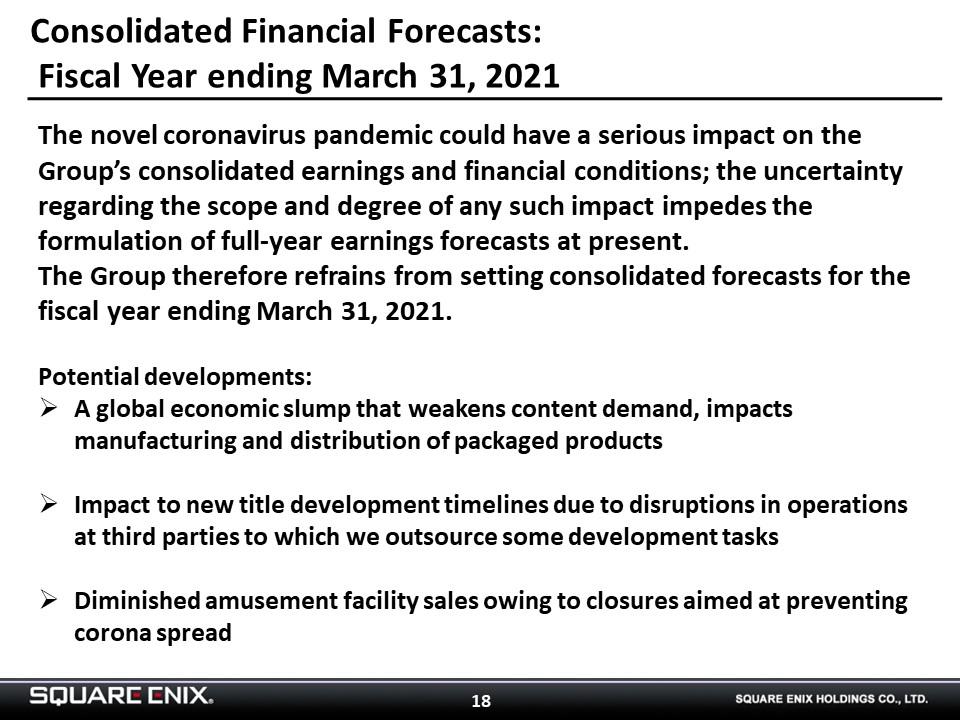

We refrain from setting consolidated forecasts for FY2021/3, as of yet, because of the impact the coronavirus may have on our business as a whole, which limits our ability to estimate earnings for the following primary reasons.

In order to estimate the impact on Amusement segment earnings, we need to know when our arcade facilities will re-open and what operations will look like thereafter, which is difficult to predict at present.

In terms of game development as well, we have made good progress on enabling our internal resources to work from home, but we are beginning to face some issues in terms of the work we outsource, including voiceover audio recording and motion capture. As such, there is risk of impact to our development schedule going forward.

We will disclose earnings forecasts as soon as we are able to make forecasts appropriately and reasonably.

-

Our objective under the mid-term plan that concludes in FY2021/3 has been to create a business structure capable of consistently generating net sales of ¥300-400 billion and operating income of ¥40-50 billion.

We have successfully created a structure whereby we are able to maintain net sales in excess of ¥300 billion, but we have yet to reach the point that we can consistently deliver operating income in this range, so we will work to take our efforts to the next level.

-

I will next discuss our strategy for the way ahead.

Over the short term, we will work to further increase the percentage of sales we generate digitally and to develop content and services from which we can expect recurring earnings contributions, such as microtransactions and GAAS (Games as a Service).

Over the medium-term, we will develop titles and offer services for cloud streaming, which we believe is poised to take off going forward.