-

Print

-

We would now like to begin the Financial Results Briefing Session of SQUARE ENIX HOLDINGS (the “Company”) for the fiscal year ended March 31, 2020 (“FY2020/3”).Today’s presenters are:Yosuke Matsuda, President and Representative Director andKazuharu Watanabe, Chief Financial Officer.

-

First, Mr. Watanabe will give an overview of the Company’s financial results for FY2020/3, and then Mr. Matsuda will discuss the progress made by each of the Company’s business segments.

-

Good afternoon. I’m Kazuharu Watanabe. I will be presenting an overview of the Company’s financial results for FY2020/3.

-

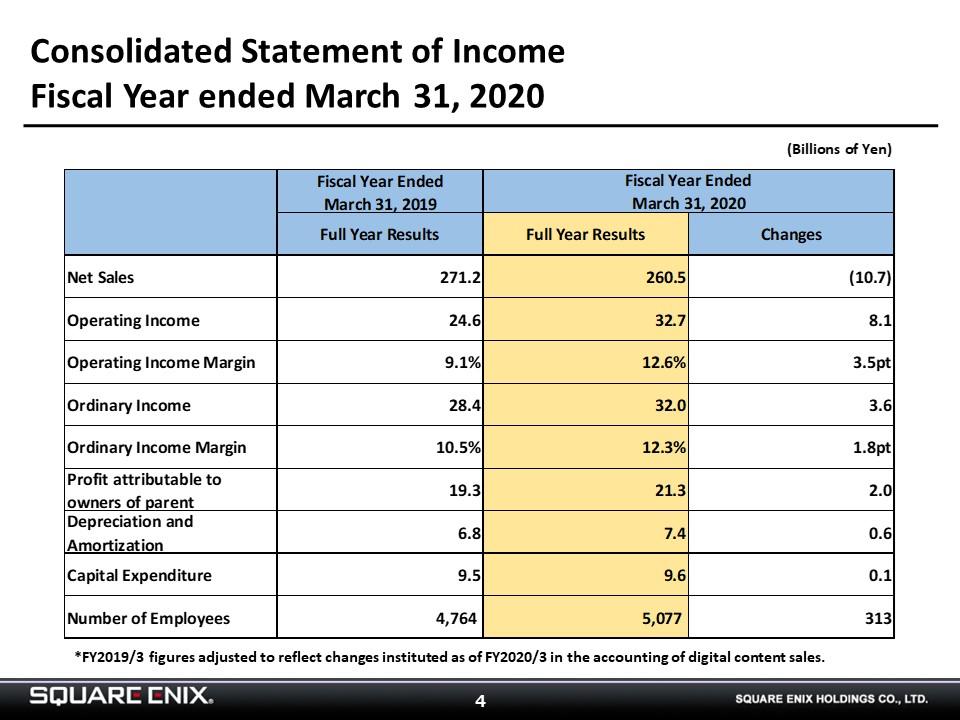

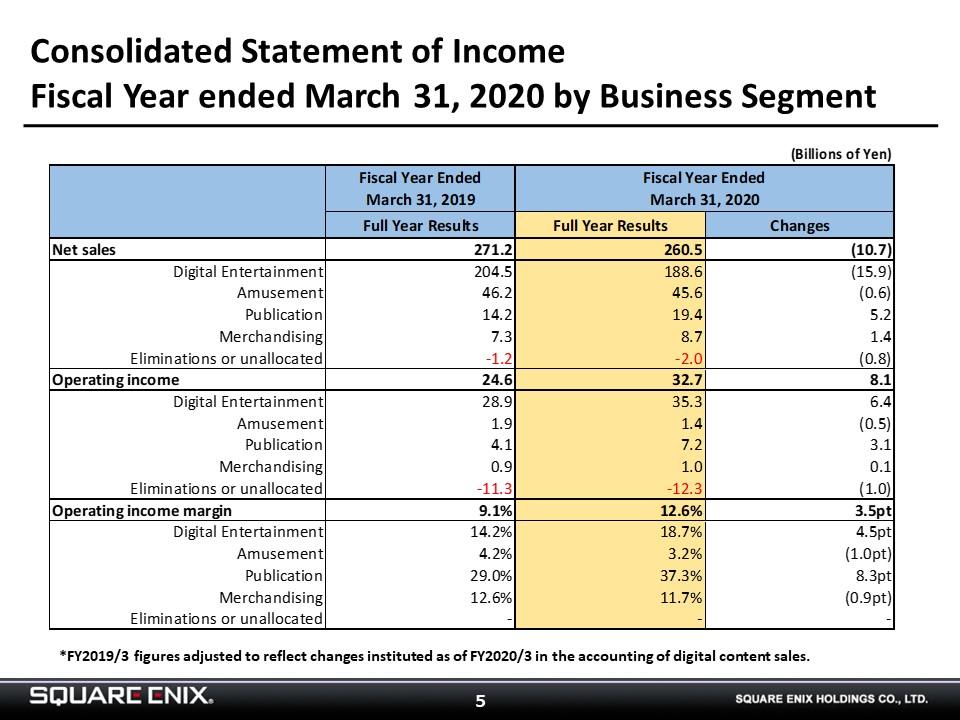

In FY2020/3, the Company booked net sales of ¥260.5 billion (-¥10.7 billion YoY), operating income of ¥32.7 billion (+¥8.1 billion), ordinary income of ¥32.0 billion (+¥3.6 billion), and net income attributable to parent company shareholders of ¥21.3 billion (+¥2.0 billion).

I will next break down our results by segment.

The Digital Entertainment segment posted net sales of ¥188.6 billion (-¥15.9 billion YoY) and operating income of ¥32.7 billion (+¥8.1 billion).

The HD Game sub-segment benefitted from the launch of “DRAGON QUEST XI S: Echoes of an Elusive Age – Definitive Edition” and the booking of advanced shipments of “FINAL FANTASY VII REMAKE,” which was launched in April 2020.

However, sub-segment sales fell YoY due to the high bar set in the previous year by the release of multiple major new AAA titles. Furthermore, additional sales of titles released in the previous year were weak, and we booked write-downs on the content production account, resulting in an operating loss for the HD Game sub-segment.

The MMO sub-segment saw both net sales and operating income rise YoY due to the release of expansion packs for “FINAL FANTASY XIV” and “DRAGON QUEST X” and the resulting rise in monthly paying subscriber numbers.

Net sales and operating income rose YoY in the Games for Smart Devices/PC Browsers sub-segment thanks to strong performances by “Romancing SaGA Re;univerSe” and “DRAGON QUEST WALK,” the latter being launched in September 2019.

The Amusement segment posted net sales of ¥45.6 billion (-¥600 million YoY) and operating income of ¥1.4 billion (-¥500 million). Arcade operations were solid, but a decline in amusement machine sales resulted in YoY declines in net sales and operating income.

The Publication segment booked net sales of ¥19.4 billion (+¥5.2 billion YoY) and operating income of ¥7.2 billion (+¥3.1 billion). Sales in digital formats, such as from the “MANGA UP!” manga application and e-books, rose sharply. Sales in printed formats were also brisk, resulting in YoY growth in net sales and operating income.

The Merchandising segment posted net sales of ¥8.7 billion (+¥1.4 billion YoY) and operating income of ¥1.0 billion (+¥100 million). The YoY rise in net sales and operating income was due to the release of new character goods based on our owned IP.

This concludes my overview of our financial results.

The information on the future forecasts described in this material is current as of May 13, 2020. The company is not obliged to update or correct forecasts concerning the Company’s future results, including forecasts or outlook, if new information becomes available and/or events occur after May 13, 2020.