-

Print

-

I am Yosuke Matsuda. I will be providing additional details on how we did in Q1 FY2023/3.

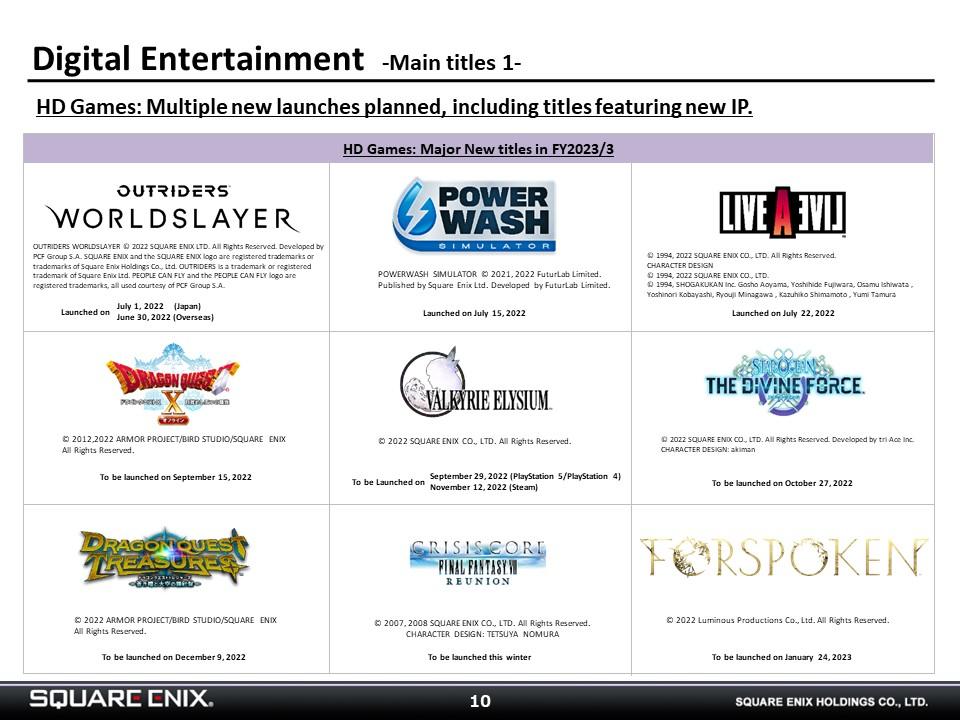

In Q1 FY2023/3, net sales and operating income declined YoY in the HD Games sub-segment due to new titles generating fewer earnings than those of the previous year, but the sub-segment’s progress was in line with our expectations. We plan to roll out a succession of new titles in Q2 and beyond, so we believe that sales trends going forward will be key.

We have left our earnings forecasts for the fiscal year ending March 31, 2023 undetermined because we are currently assessing the earnings impact of the transaction described in our May 2, 2022 release entitled “Execution of Share Transfer Agreement with Change to Subsidiaries.” This makes it difficult to arrive at reasonable calculations at present, so we will disclose our forecasts as soon as we are able to calculate them.

-

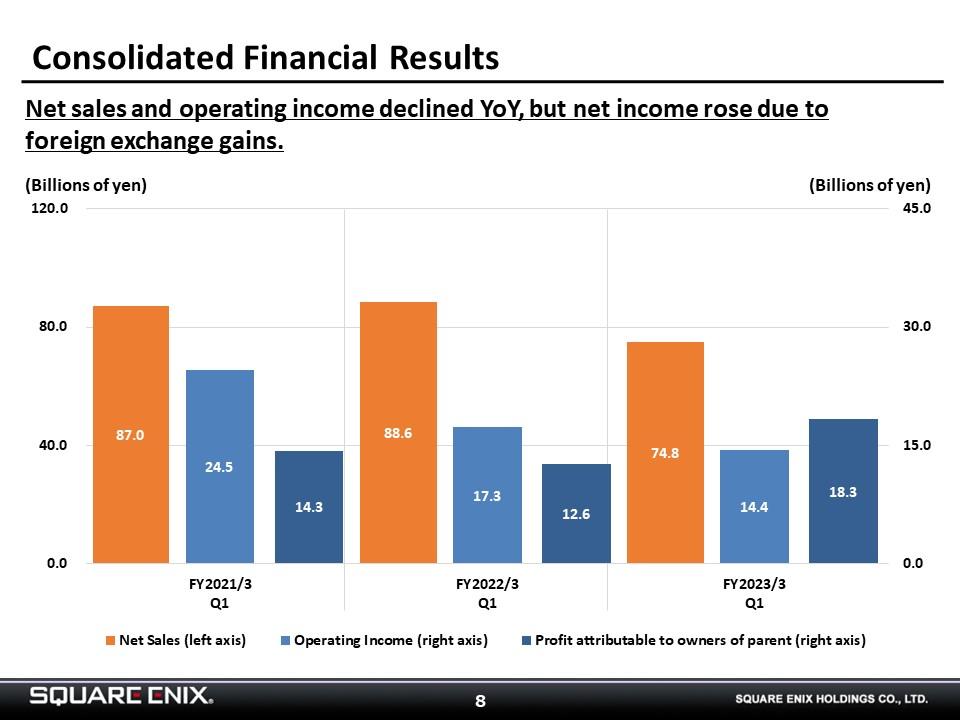

As previously noted, consolidated net sales and operating income declined YoY in Q1 FY2023/3, but net income rose because we booked foreign exchange gains.

-

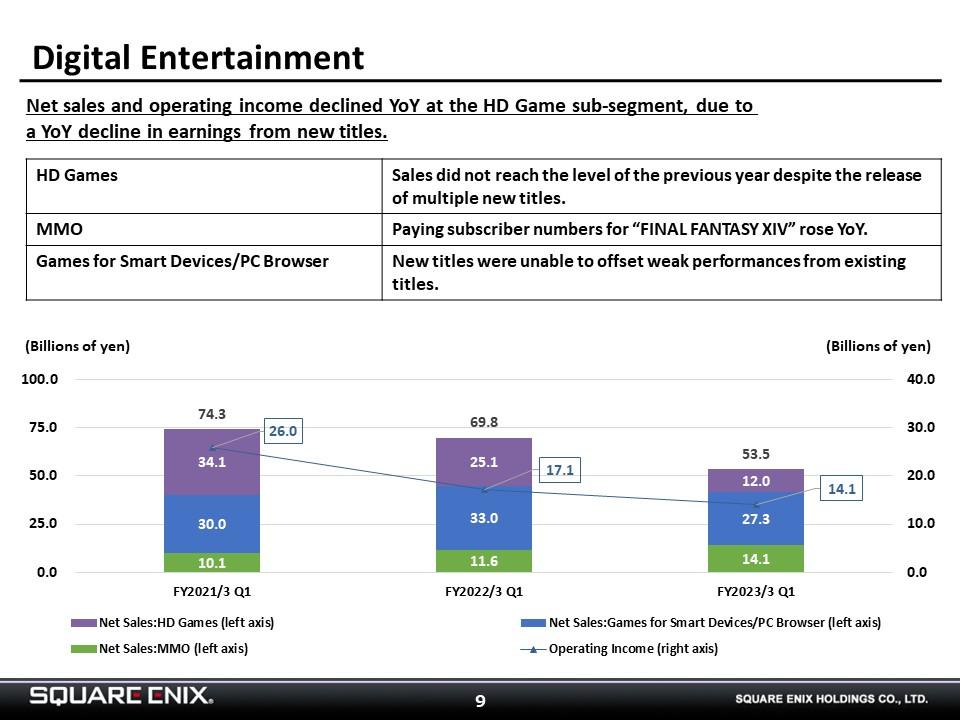

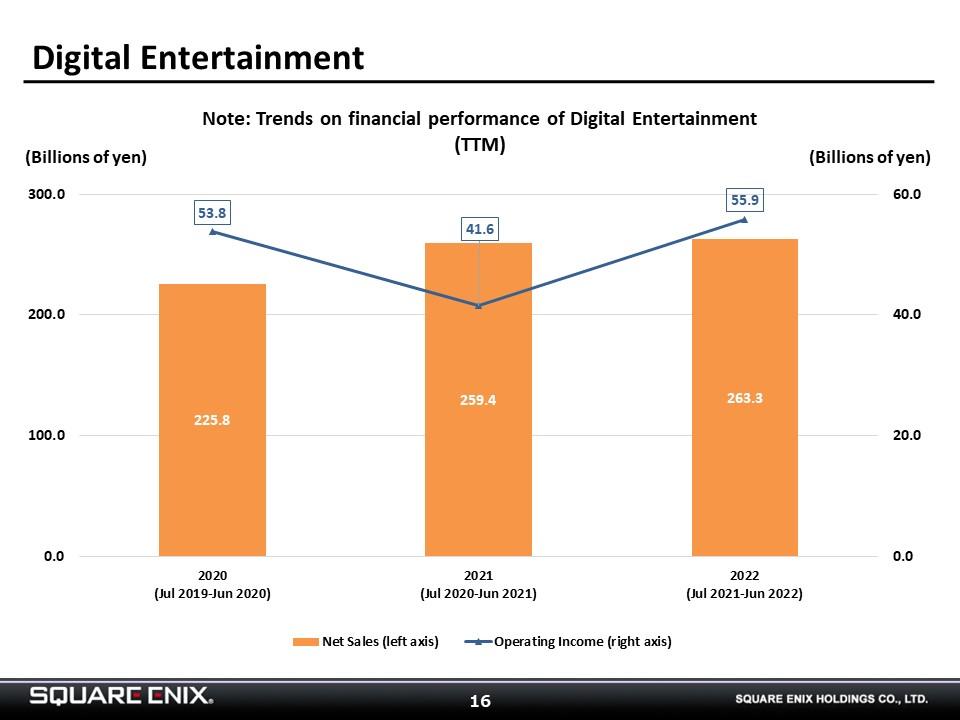

This is a breakdown of the Digital Entertainment segment’s performance.

Net sales and operating income declined YoY in the HD Games sub-segment due to new titles generating fewer earnings than those of the previous year.

-

Both “FINAL FANTASY XIV” and “DRAGON QUEST X Online” are delivering solid performances in the MMO sub-segment. The number of paying subscribers for “FINAL FNATASY XIV” peaked with the release of the most recent expansion pack and has subsequently settled down, but the count is rising with each passing year, and we are hoping that we will be able to further activate our user base through a variety of operational initiatives going forward.

-

This is a list of the main titles in the Games for Smart Devices/PC Browser sub-segment.

The new title “ECHOES OF MANA,” which we launched in April, got off to a solid start. We are looking forward to earnings contributions from multiple new titles slated for release in Q2 and beyond, including from “FULLMETAL ALCHEMIST MOBILE,” which we launched on August 4.

-

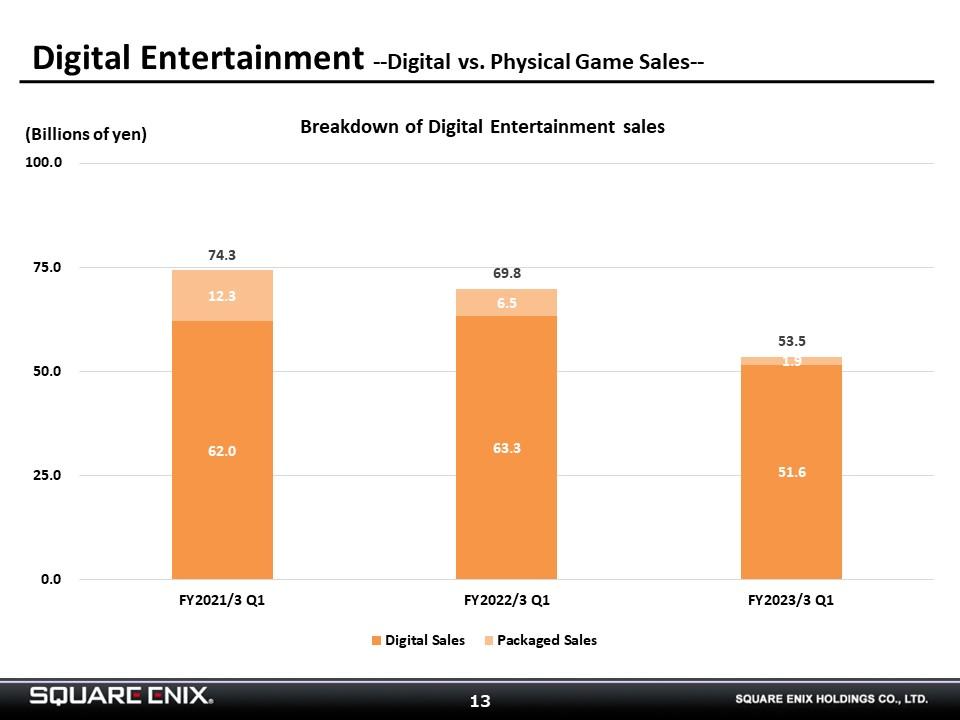

This shows the split between digital and physical game sales in the Digital Entertainment segment.

With digital downloads likely to remain the primary source of sales, we see making our content available on PCs as important, given that they are accounting for an increasing share of the market.

-

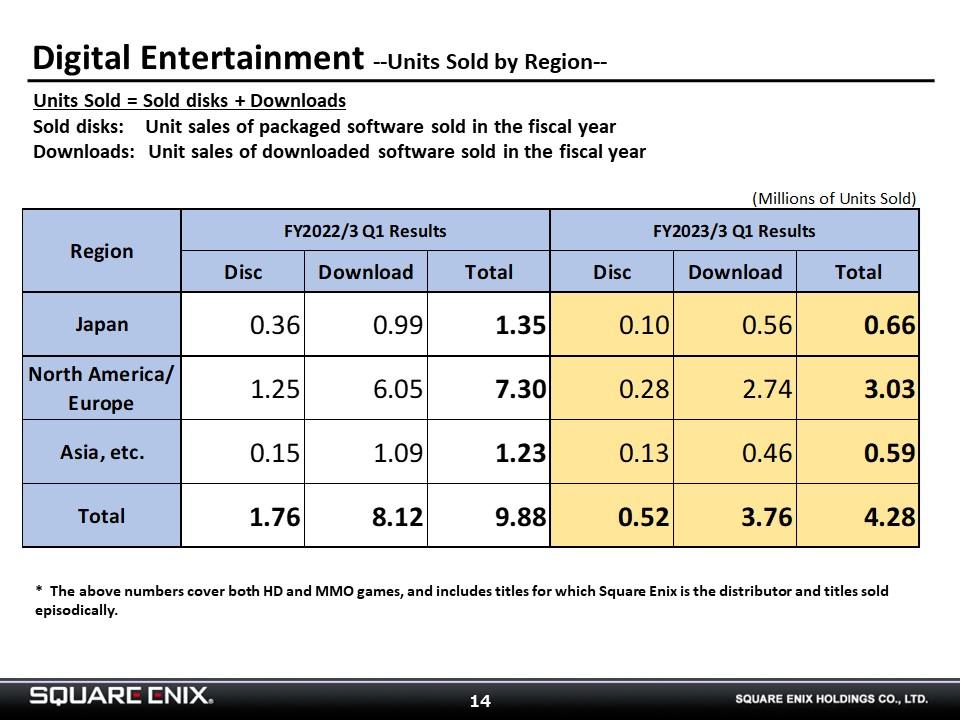

This slide shows units sold by region.

Units sold were down sharply YoY primarily because of weaker sales of new titles than in the previous year. Another reason for the decline is that we separated the profits and losses of businesses associated with IP to be divested from those arising from ordinary business activities by posting them under non-operating income as of Q1. As such, we excluded the relevant titles from our count of units sold starting in Q1.

-

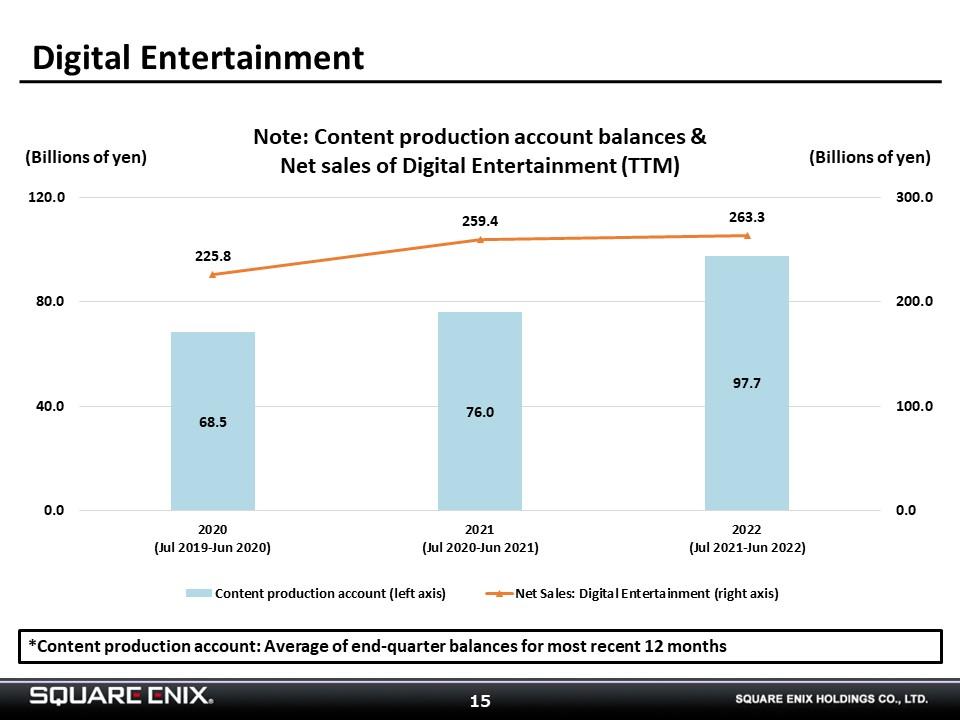

Our content production account stood at ¥111.2 billion as of end-Q1. This is indicative of the richness of our upcoming pipeline, and we hope that you will look forward to the contributions it will make to our earnings.

-

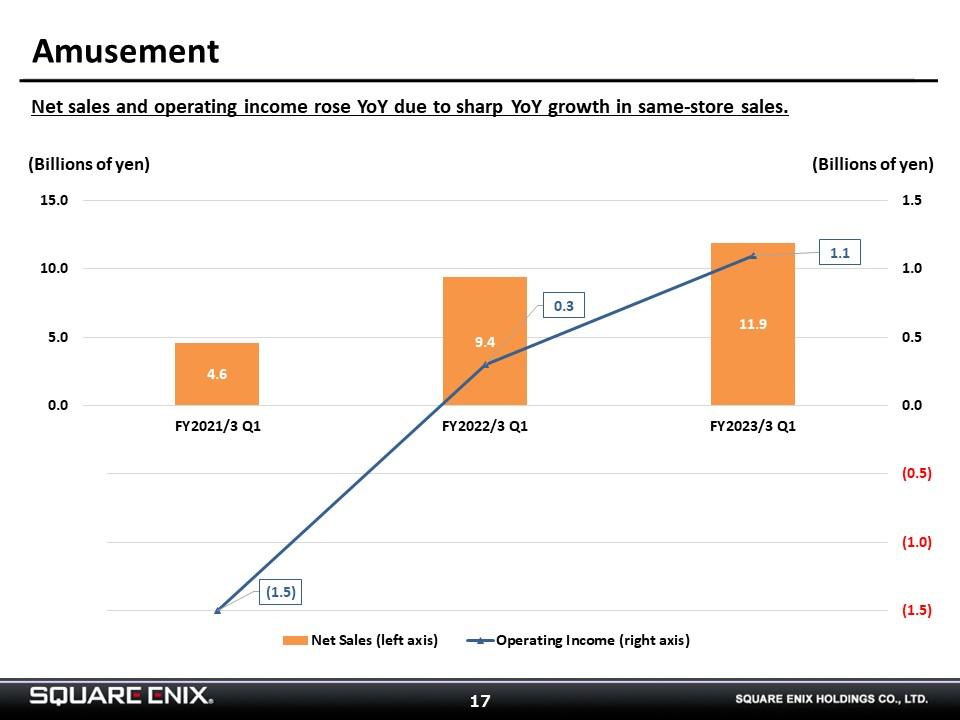

Net sales and operating income rose YoY in the Amusement segment thanks to the absence of restrictions associated with the COVID-19 pandemic in Q1, resulting in a sharp increase in same-store sales compared to the previous year. We cannot deny that uncertainty surrounds the outlook for the segment given that COVID-19 cases are on the rise again of late, but we hope that the segment sees a continued recovery.

-

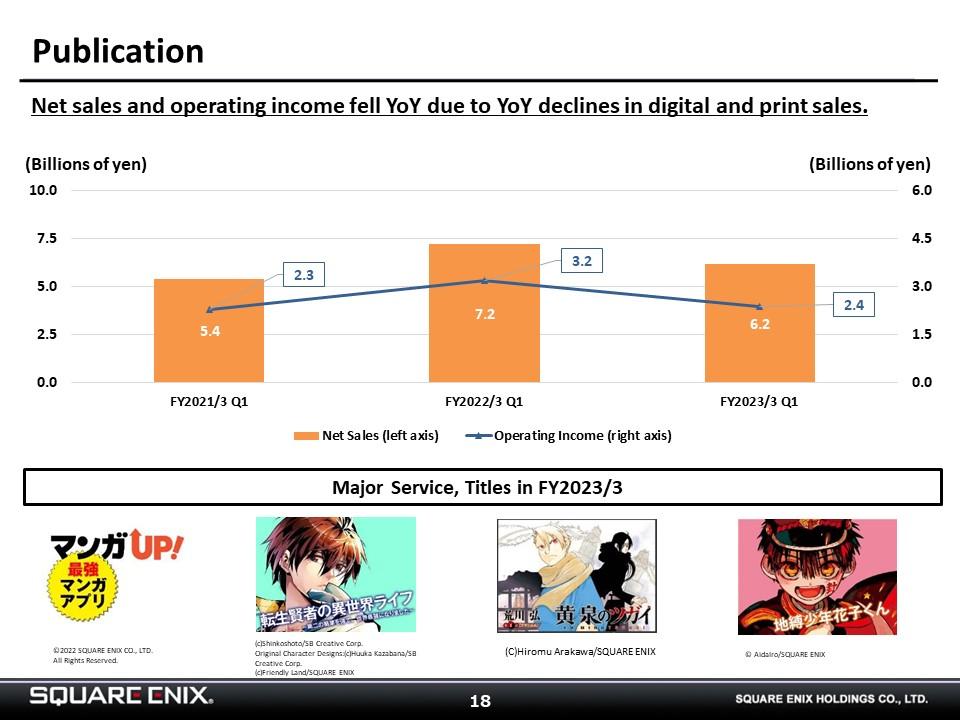

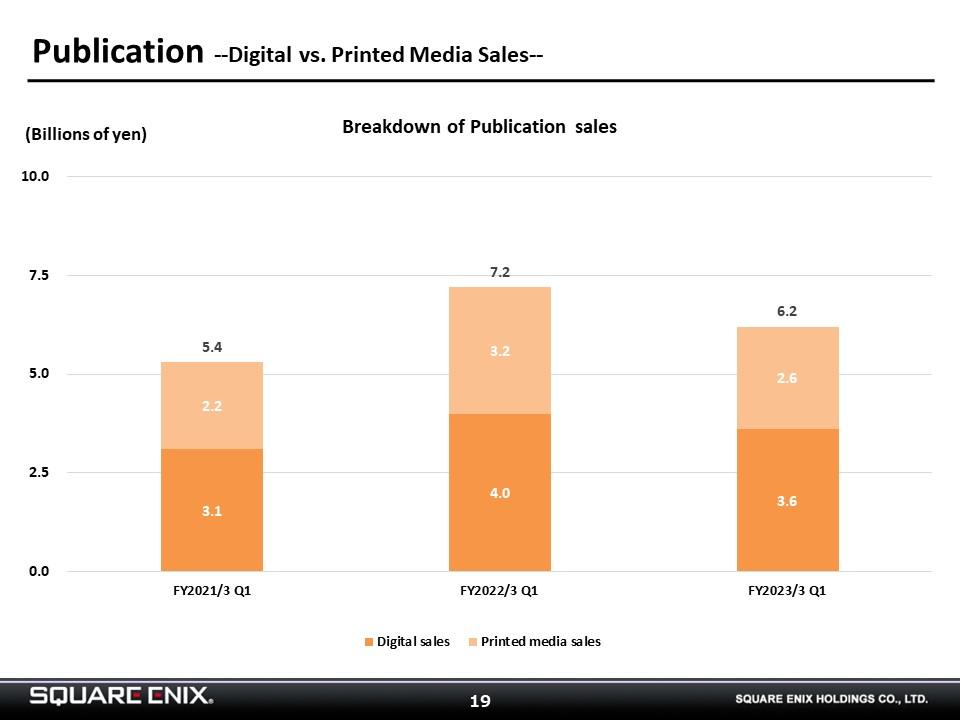

The Publication segment saw net sales and operating income fall YoY due to declines in both digital and print sales. Going forward, we hope to achieve YoY growth driven by earnings contributions from multiple titles including “Daemons of the Shadow Realm.”

-

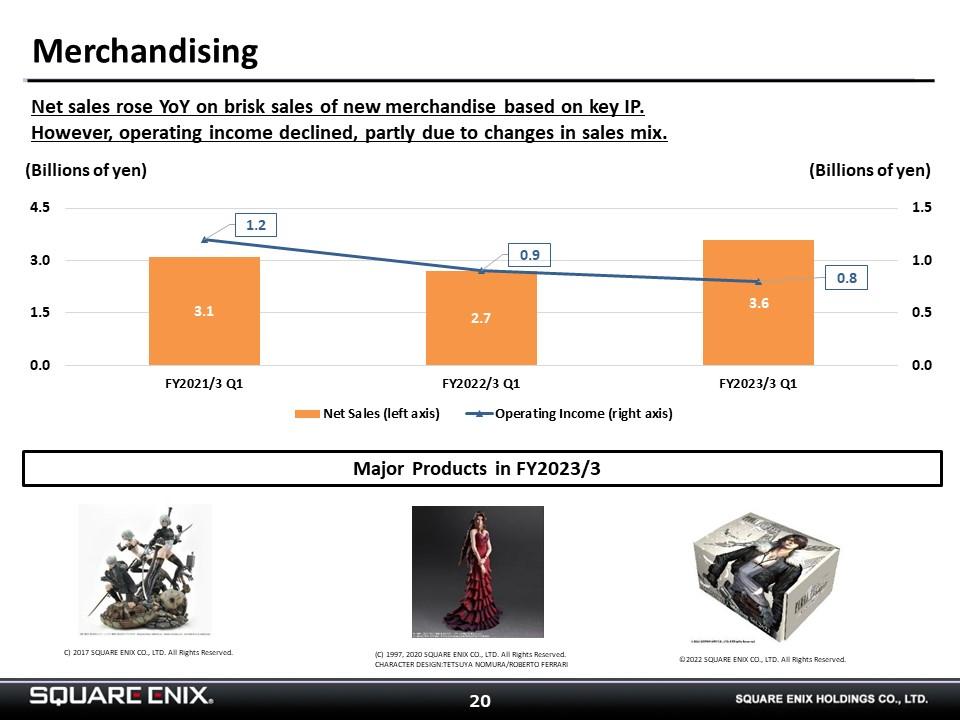

Net sales rose but operating income declined YoY in the Merchandising segment because while sales of new merchandise based on key IP were brisk, the sales mix changed.

We are poised to have more opportunities to sell our merchandise at events, including Tokyo Game Show 2022, which is slated to be held in-person. We expect this to have a positive impact on demand for our products and look forward to it contributing to further growth.

-

Lastly, I would like to discuss our investment strategy for development studios and new domains.

Traditionally, it has been our general policy to own our development studios outright. However, development costs have risen sharply in recent years, and so I want to identify ways of allocating capital to studios that give us greater flexibility. These can include not only full ownership but also joint ventures, equity-method affiliates, and minority stakes. Rather than insisting upon full ownership, we will hedge our risk by investing in studios via a range of capital structures as we work to enrich our portfolio and achieve sustained growth.

In terms of our progress on investing in the new domain of blockchain, we are steadily advancing with content development efforts and a variety of other initiatives, so we hope that you will look forward to forthcoming announcements.