-

Print

-

We would now like to begin the Financial Results Briefing session of SQUARE ENIX HOLDINGS (the “Company”) for the first quarter of the fiscal year ending March 31, 2023 (“Q1 FY2023/3”).Today’s presenters are:Yosuke Matsuda, President and Representative Director, andAtsushi Matsuda, Chief Accounting Officer.

-

First, Mr. Matsuda, Chief Accounting Officer, will give an overview of the Company’s financial results for Q1 FY2023/3, and then our president Mr. Matsuda will discuss the progress made by each of the Company’s business segments.

-

I am Atsushi Matsuda, the Chief Accounting Officer. I will be providing an overview of our Q1 FY2023/3 results.

-

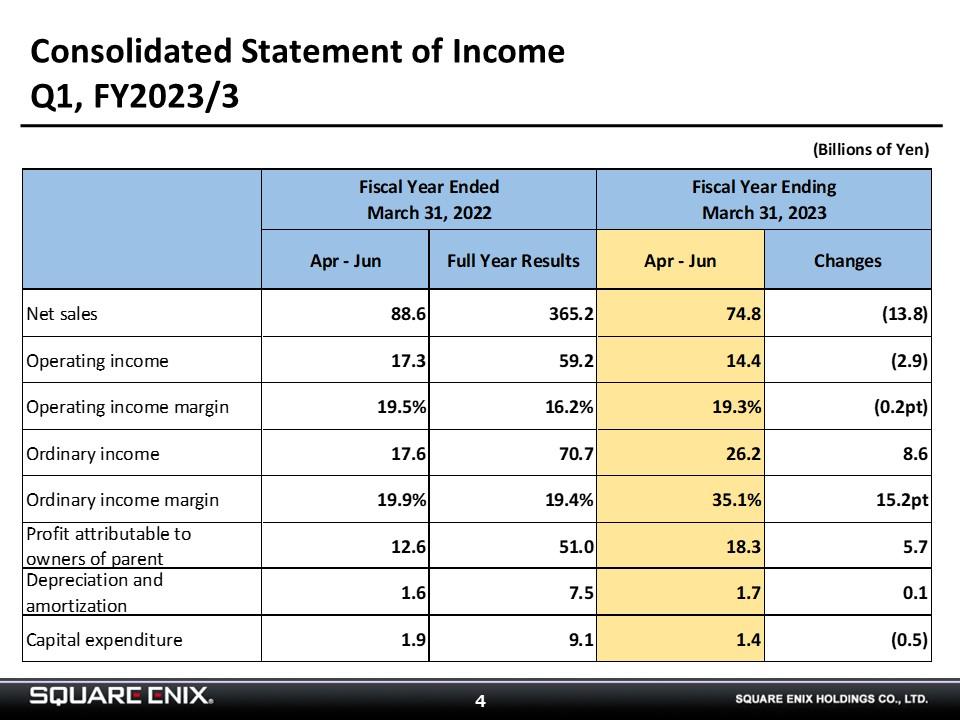

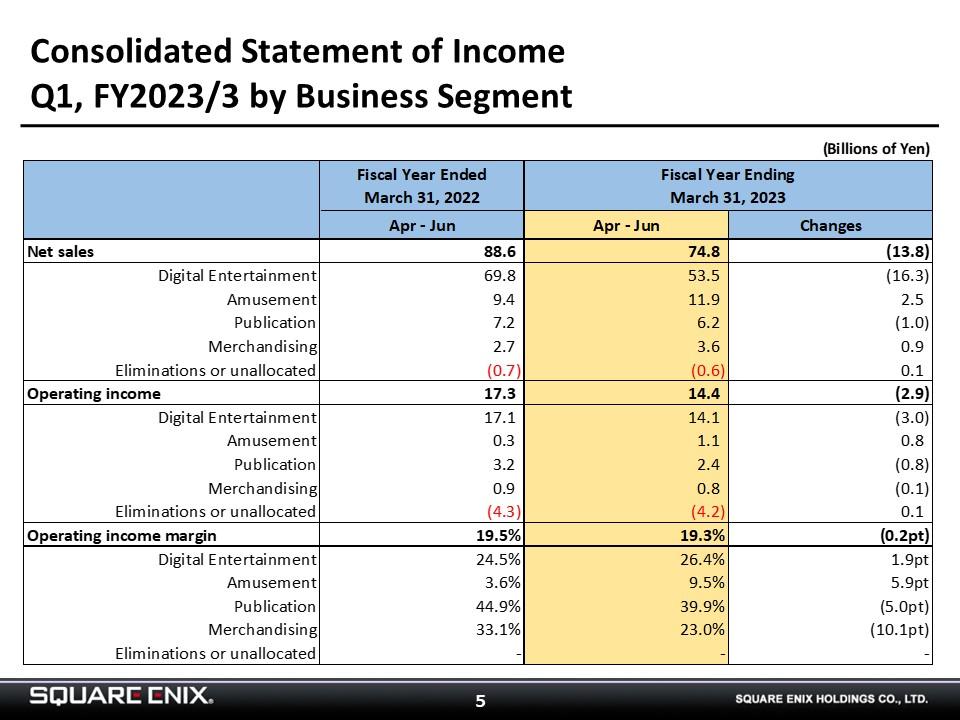

In Q1 FY2023/3, the Company booked net sales of ¥74.8 billion (down ¥13.8 billion YoY), operating income of ¥14.4 billion (down ¥2.9 billion), ordinary income of ¥26.2 billion (up ¥8.6 billion), and profit attributable to owners of parent of ¥18.3 billion (up ¥5.7 billion).

-

I will next break down our results by segment.

The Digital Entertainment segment posted net sales of ¥53.5 billion (down ¥16.3 billion YoY) and operating income of Y14.4 billion (down ¥2.9 billion).

Net sales declined YoY in the HD Games sub-segment, where new titles generated fewer earnings than those of a year earlier, when the sub-segment released “OUTRIDERS” and “NieR Replicant ver.1.22474487139...”

-

Net sales rose YoY in the MMO sub-segment thanks to sharp growth in monthly paying subscriber numbers for “FINAL FANTASY XIV,”

While“ECHOES of MANA,” got off to a solid start following its April launch, net sales in the Games in the Smart Devices/PC Browser sub-segment declined YoY, in part because of weak performances from existing titles.

The Amusement segment booked net sales of ¥11.9 billion (up ¥2.5 billion YoY) and operating income of ¥1.1 billion (up ¥800 million). Net sales and operating income rose YoY due to significant growth in same-store sales.

The Publication segment posted net sales of ¥6.2 billion (down ¥1 billion) and operating income of ¥2.4 billion (down ¥800 million). The YoY decreases in net sales and operating income are due o to declines in both digital and print sales.

The Merchandising segment booked net sales of ¥3.6 billion (up ¥900 million YoY) and operating income of ¥800 million (down ¥100 million). Sales of new merchandise based on key IP were brisk, but the sales mix changed, resulting in higher net sales but lower operating income than in the previous year.

That concludes my overview of our Q1 FY2023/3 financial results.

The information on the future forecasts described in this material is current as of Aug 4, 2022. The company is not obliged to update or correct forecasts concerning the Company’s future results, including forecasts or outlook, if new information becomes available and/or events occur after Aug 4, 2022.