-

Print

-

We would now like to begin the Financial Results Briefing session of SQUARE ENIX HOLDINGS (the “Company” for Q1-Q3 of the fiscal year ending March 31, 2023 (“Q1-Q3 FY2023/3”). Today’s presenters are:Yosuke Matsuda, President and Representative Director, andAtsushi Matsuda, Chief Accounting Officer.

-

First, Mr. Matsuda, Chief Accounting Officer, will give an overview of the Company’s financial results for Q1-Q3 FY2023/3, and then our president Mr. Matsuda will discuss the progress made by each of the Company’s business segments.

-

I am Atsushi Matsuda, the Chief Accounting Officer. I will be providing an overview of our Q1-Q3 FY2023/3 results.

-

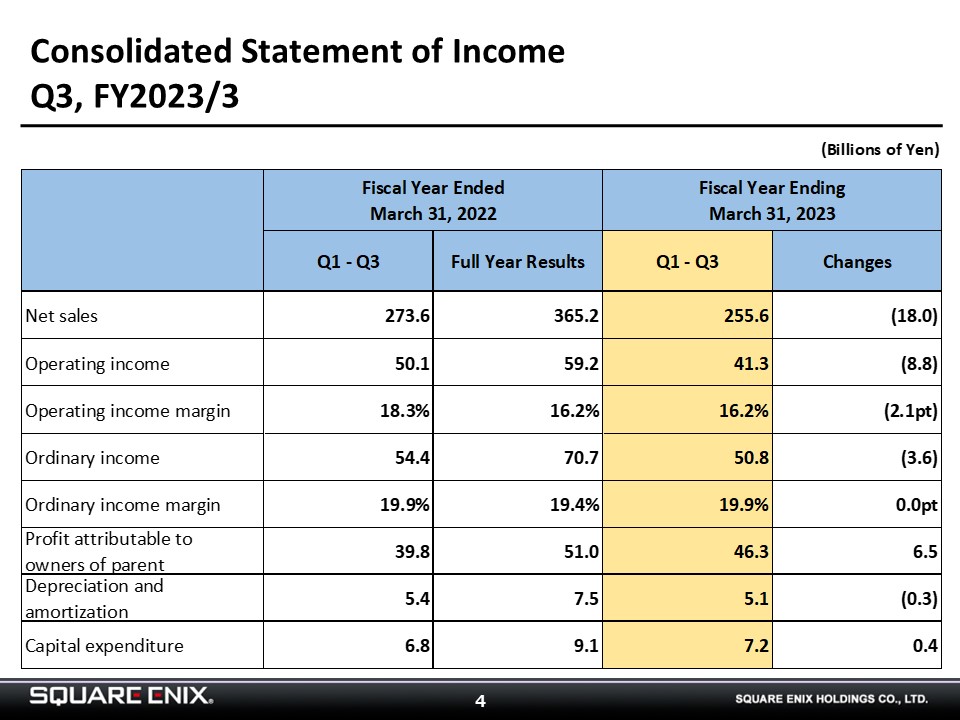

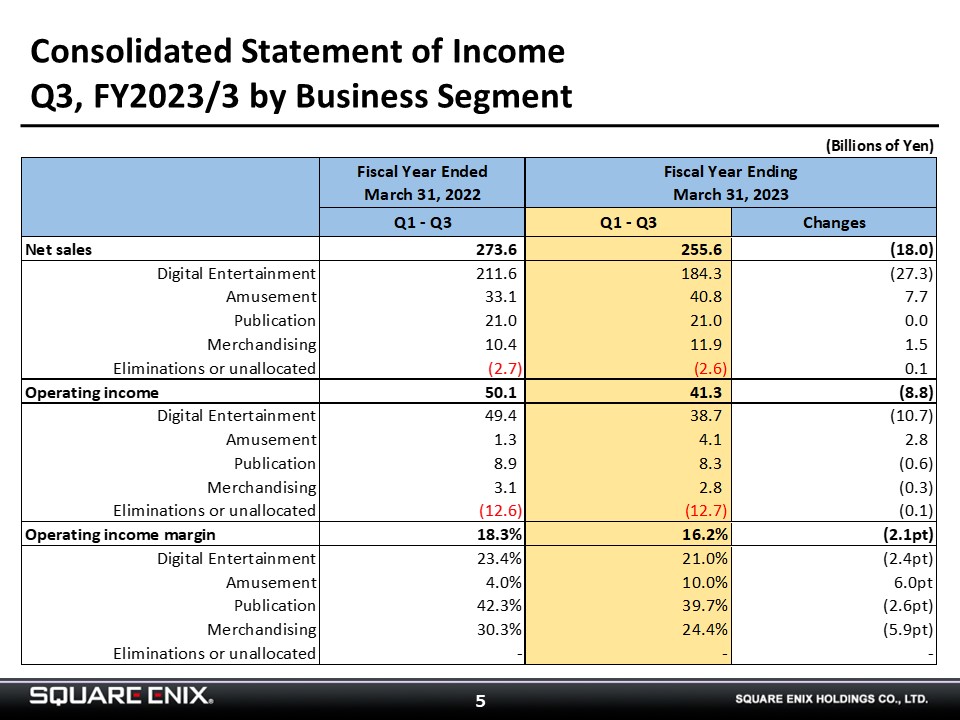

In Q1-Q3 FY2023/3, the Company booked net sales of ¥255.6 billion (down ¥18.0 billion YoY), operating income of ¥41.3 billion (down ¥8.8 billion), ordinary income of ¥50.8 billion (down ¥3.6 billion), and profit attributable to owners of parent of ¥46.3 billion (up ¥6.5 billion).

-

I will next break down our results by segment.

The Digital Entertainment segment posted net sales of ¥184.3 billion (down ¥27.3 billion YoY) and operating income of ¥38.7 billion (down ¥10.7 billion).

Net sales declined YoY in the HD Games sub-segment despite the release of such titles as “CRISIS CORE—FINAL FANTASY VII—REUNION,” “DRAGON QUEST TREASURES,” “DRAGON QUEST X,” as earnings from new titles were lower than in the same period of the previous year, which had seen the release of “OUTRIDERS,” “NieR Replicant ver.1.22474487139...,” and “Marvel’s Guardians of the Galaxy.”

Net sales fell YoY in the MMO sub-segment, partly due to the lack of a release of a “FINAL FANTASY XIV” expansion pack.

The Games for Smart Devices/PC Browser sub-segment also saw a YoY decline in net sales, in part because of weak performances from existing titles.

The Amusement segment booked net sales of ¥40.8 billion (up ¥7.7 billion YoY) and operating income of ¥4.1 billion (up ¥2.8 billion). Net sales and operating income rose YoY due to significant growth in same-store sales.

The Publication segment booked net sales of ¥21.0 billion (up ¥6 million YoY) and operating income of ¥8.3 billion (down ¥600 million). Both digital and print sales were solid, but profits fell YoY due to a rise in Cost of Goods (COGs), resulting from higher prices on printing paper, as well as increased advertising expenses.

The Merchandising segment posted net sales of ¥11.9 billion (up ¥1.5 billion YoY) and operating income of ¥2.8 billion (down ¥300 million). Sales of new merchandise based on key IP were strong, but the sales mix changed, resulting in higher net sales but lower operating income than a year earlier.

This concludes my overview of our Q1-Q3 FY2023/3 financial results.

The information on the future forecasts described in this material is current as of February 3, 2023. The company is not obliged to update or correct forecasts concerning the Company’s future results, including forecasts or outlook, if new information becomes available and/or events occur after February 3, 2023.