-

Print

-

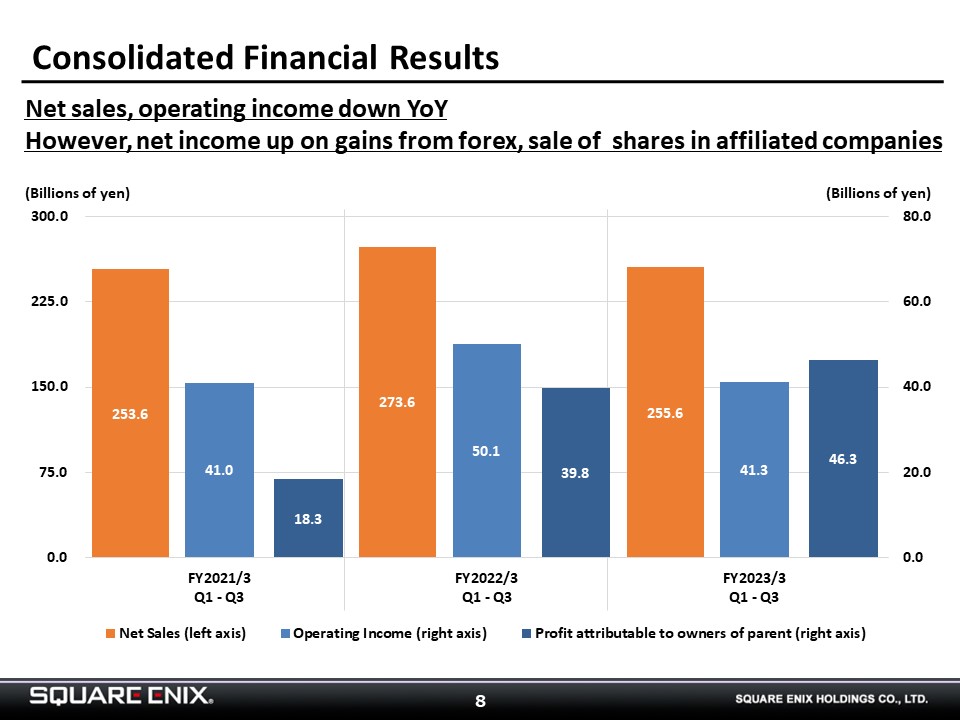

While our net sales and operating income were down YoY in Q1-Q3 FY2023/3, our net income was up, mainly because we booked foreign exchange gains and gains on the sale of shares of subsidiaries and associates.

-

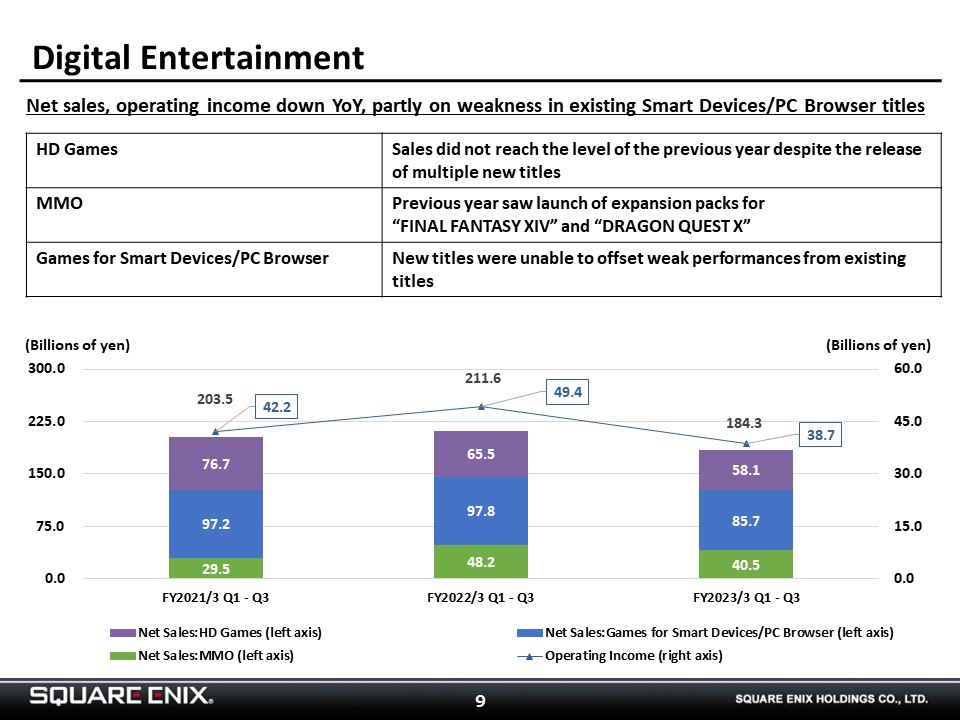

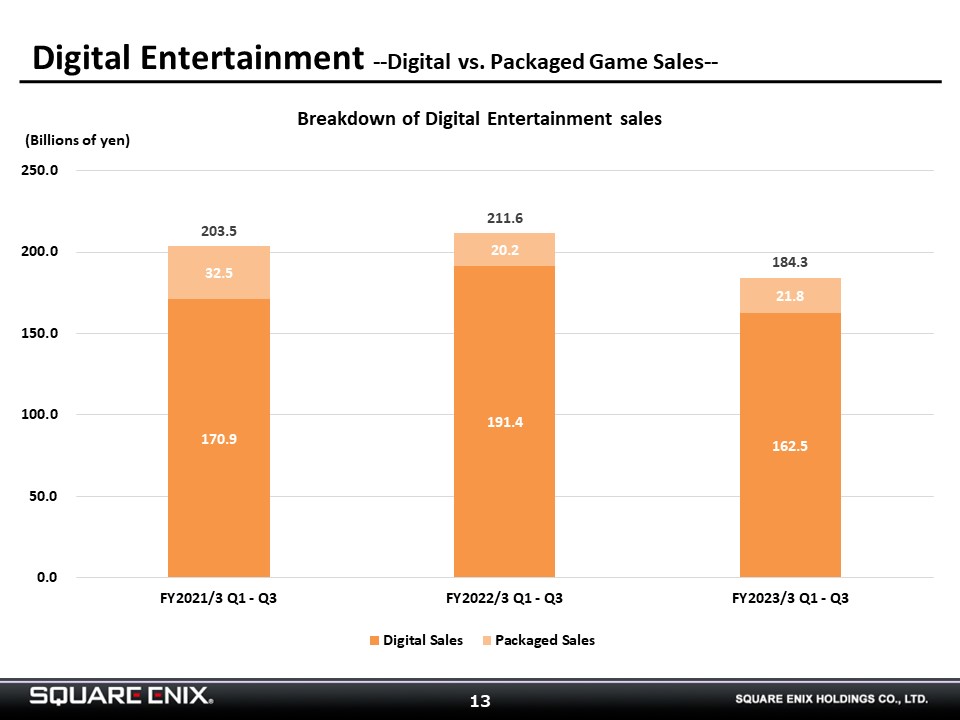

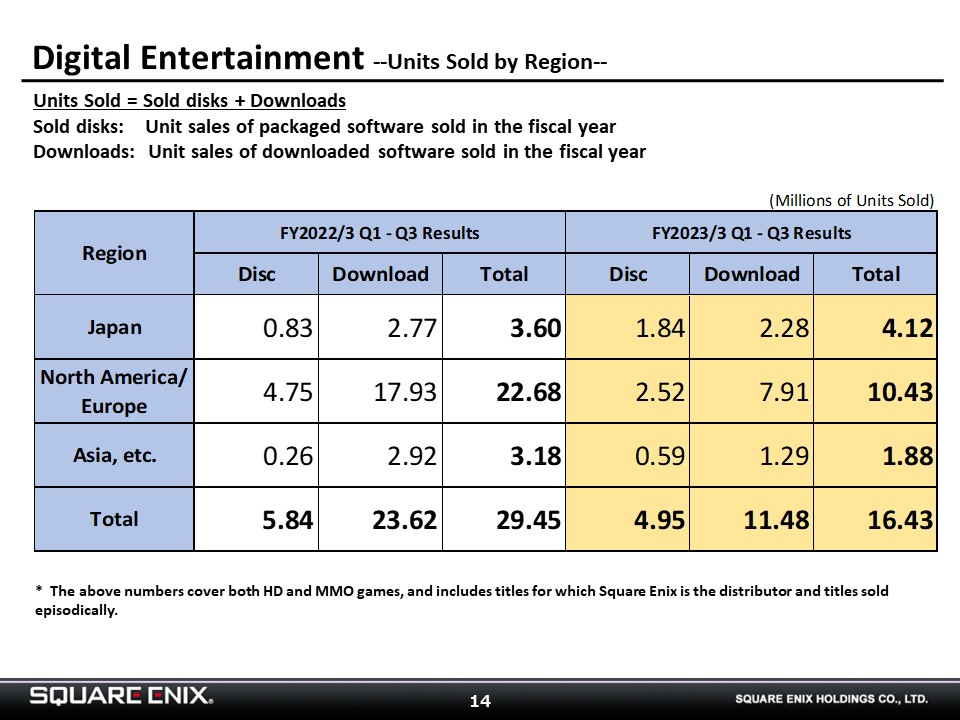

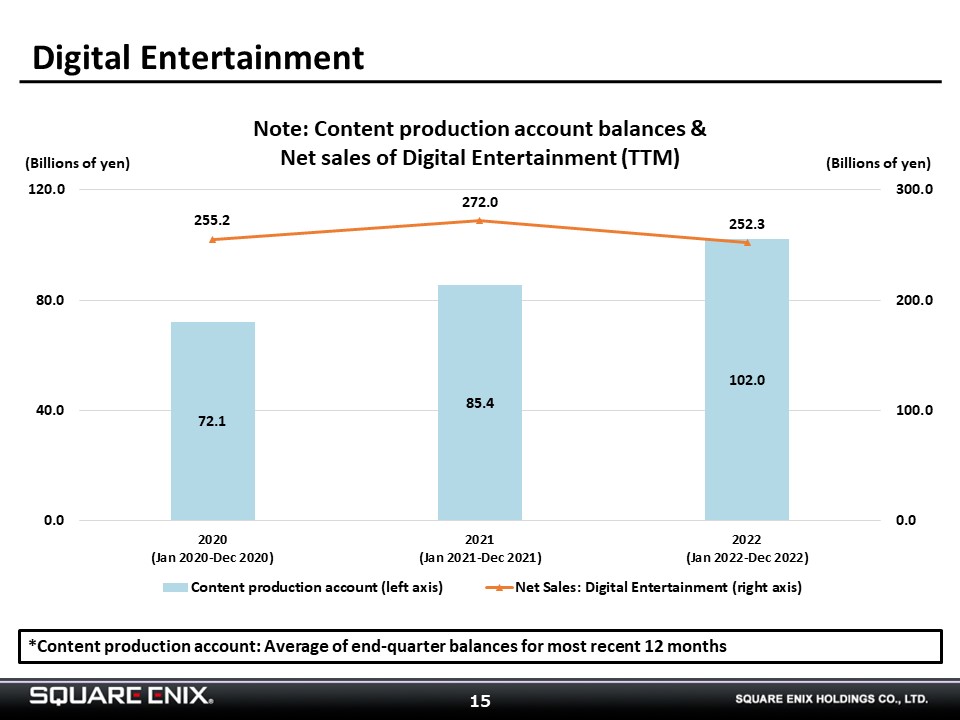

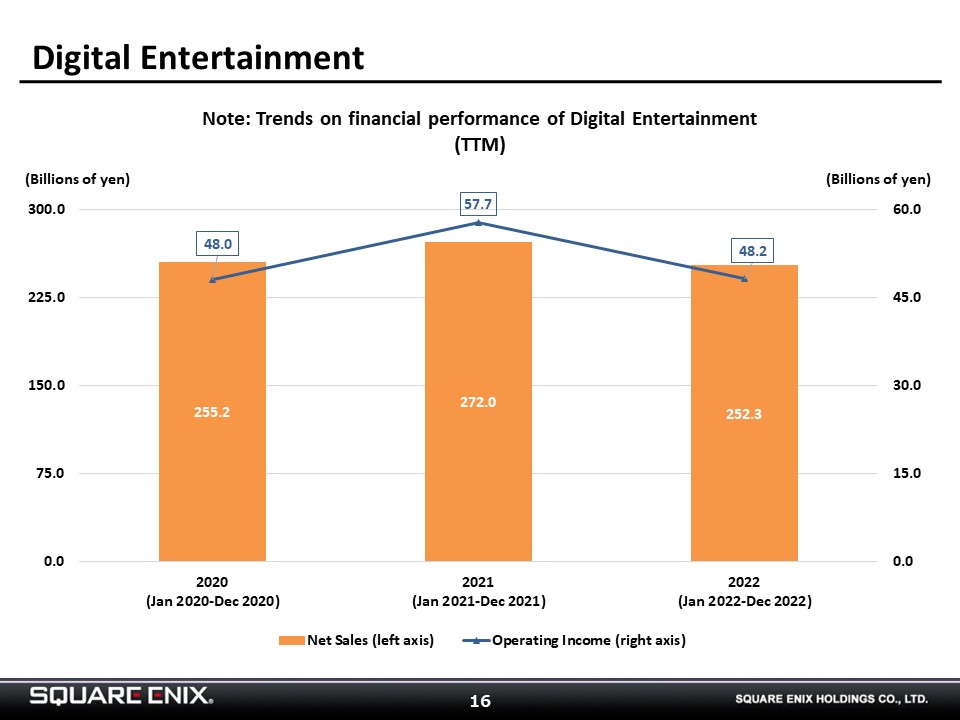

Net sales and operating income declined YoY in the Digital Entertainment segment. This is a breakdown of the segment’s performance.

Net sales declined YoY in the HD Games sub-segment, partly because the release of major titles a year earlier had created a challenging YoY hurdle, but also because many of the new small- and mid-sized titles we launched this year did not perform as well as we had expected.

Net sales were also down YoY in the MOM sub-segment, in part because we released no new expansion packs this year, as originally planned.

New titles were unable to compensate for weak performances by existing titles in the Games for Smart Devices/PC Browser sub-segment, resulting in a YoY decline in net sales.

-

While we do not have any expansion pack launches planned in the MMO sub-segment, it is delivering a solid performance, thanks to the variety of operational initiatives we have undertaken focused on user retention.

-

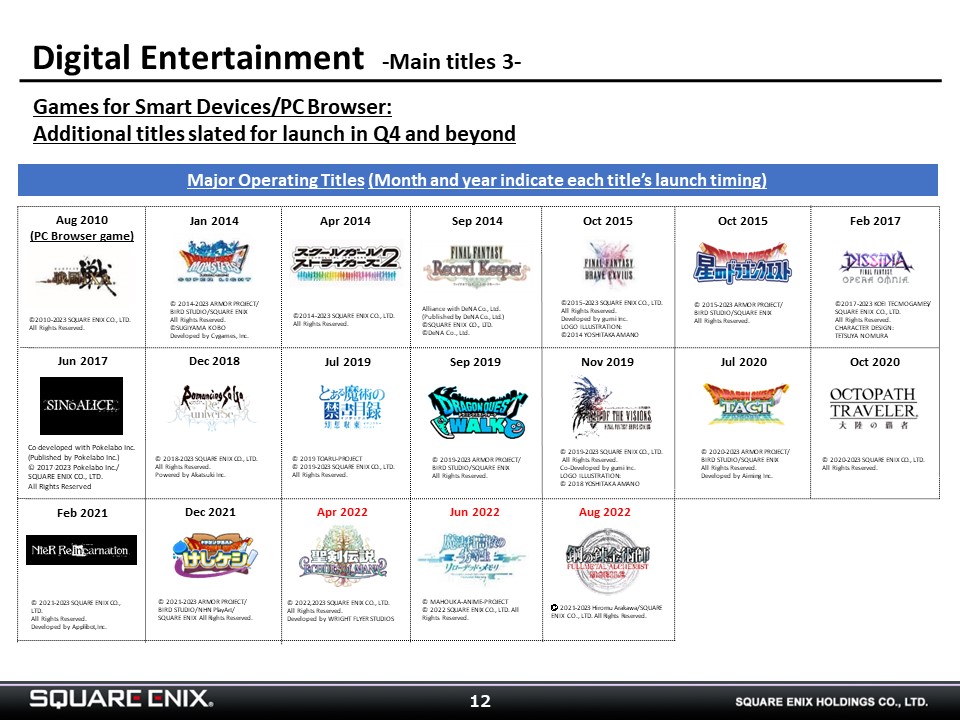

This shows the main titles currently in operation in our Games for Smart Devices/PC Browser sub-segment.

-

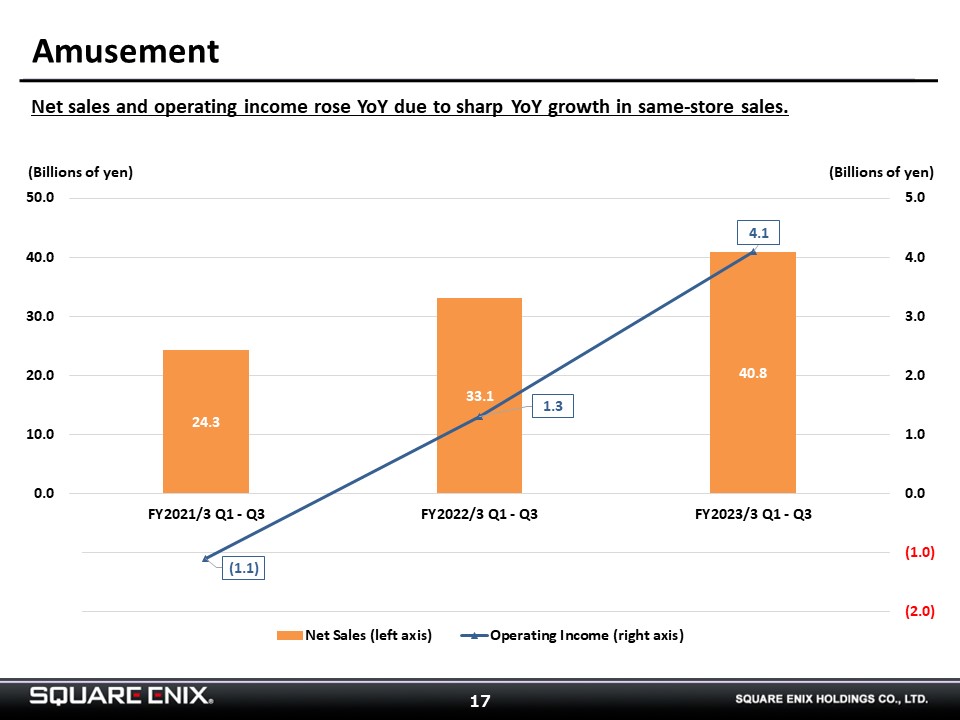

Net sales and operating income rose YoY in the Amusement segment thanks to sharp growth in same-store sales compared to the previous year.

The segment’s profitability improved thanks to cuts we made to fixed costs when COVID-19 cases were on the rise, as well as to the fact that same-store visitor numbers began to return to pre-pandemic levels. We hope to see further growth from the segment going forward.

-

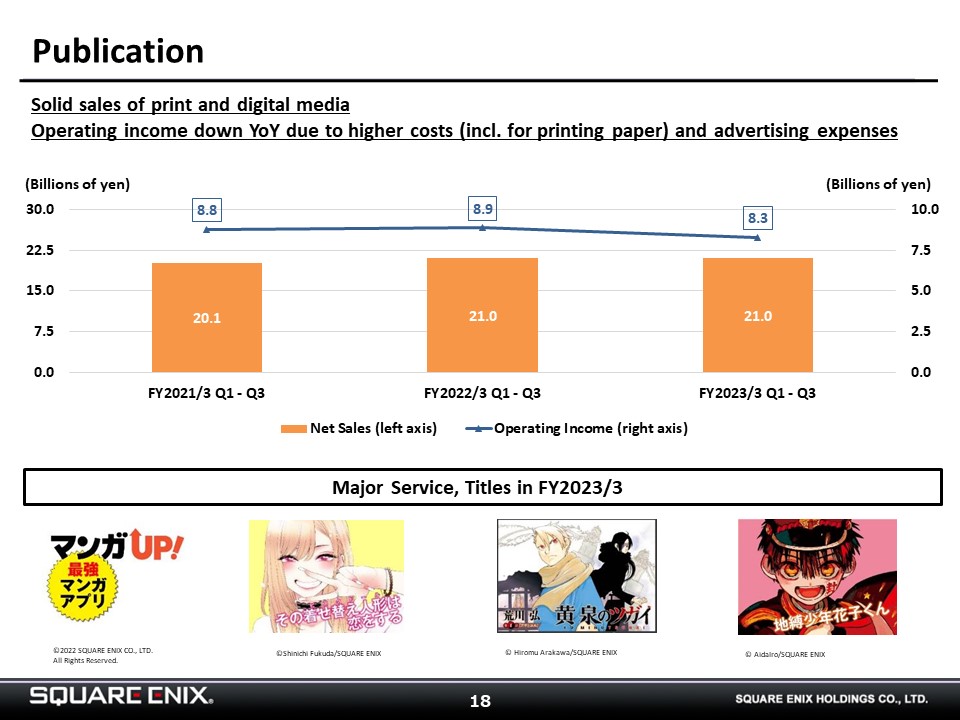

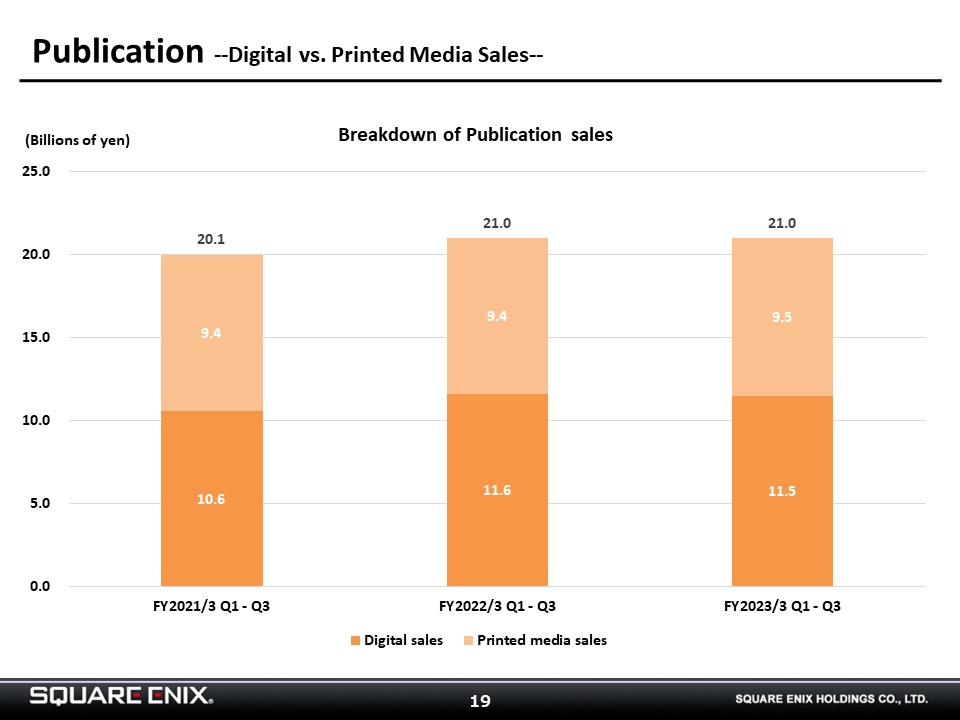

The Publication segment saw solid sales of both digital and printed media, but its operating income declined YoY, mainly because higher prices on printing paper increased our Cost of Goods, and our advertising expenses also increased.

In order to grow the segment further, we believe it will be important not only to bolster our digital sales, but also to capture new growth opportunities such as webtoons and to expand overseas.

-

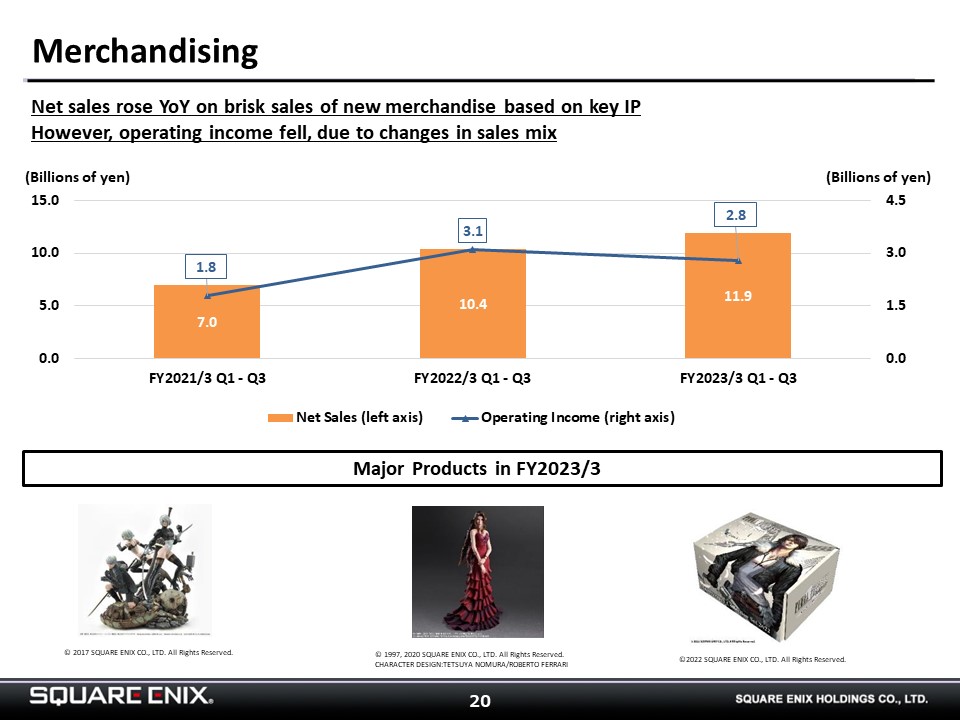

Net sales rose YoY in the Merchandising segment thanks to brisk sales of new merchandise based on key IP. Operating income declined YoY due to changes in the sales mix.

-

Lastly, I would like to discuss our outlook for 4Q FY2023/3 and for the upcoming fiscal year (“FY2024/3”).

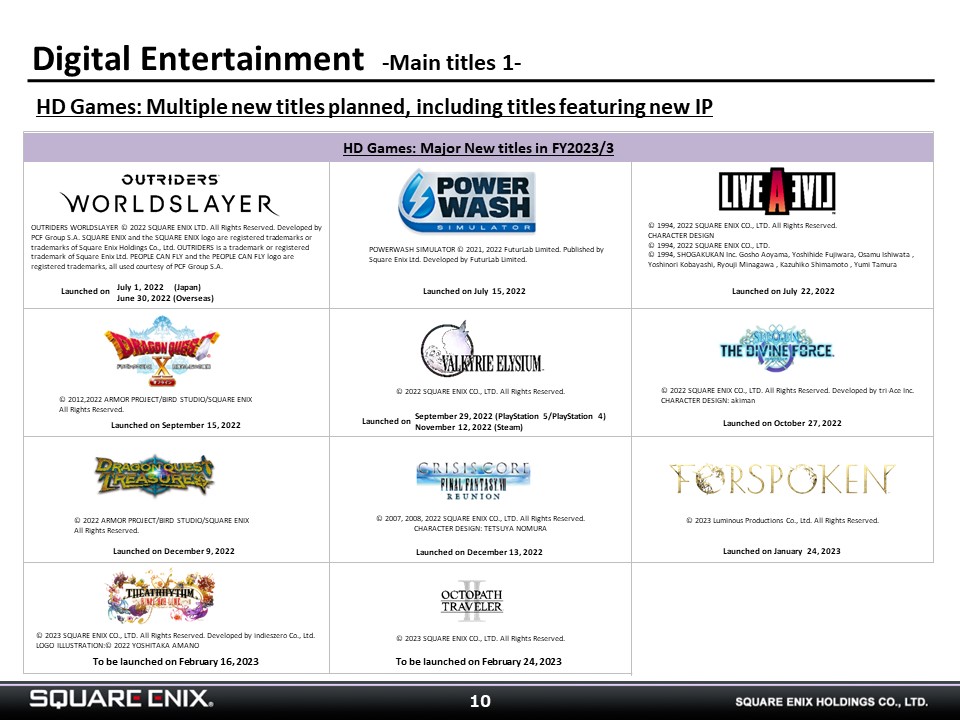

Reviews of “FORSPOKEN,” which we released on January 24, 2023, have been challenging. However, the game has also received positive feedback on its action features, including its parkour and combat capabilities, so it has yielded results that will lead to improvement of our development capabilities of other games in the future. That said, its sales have been lackluster, and while the performance of new titles with February and March release dates will be the ultimate determinant, we see considerable downside risk to our FY2023/3 earnings.

At our 1H FY2023/3 Financial Results Briefing session, I stated that we were designating FY2023/3 as a year in which to lay the foundations that will enable us to achieve our medium-term objectives, but that we nonetheless intended to pursue YoY growth in sales and profits. In light of current conditions, however, I have to admit that this will not be easy.

Meanwhile, our pipeline for FY2024/3 and beyond is extremely strong, including some titles that we have yet to announce. In addition, we believe that the overhauls of our development and publishing structures will for the most part be completed during the remainder of FY2023/3. FY2024/3 is the final year of our current medium-term plan, and to end the plan on the best possible note, we are steadily putting into place a structure that will enable further growth. Please look forward to future developments.