-

Print

-

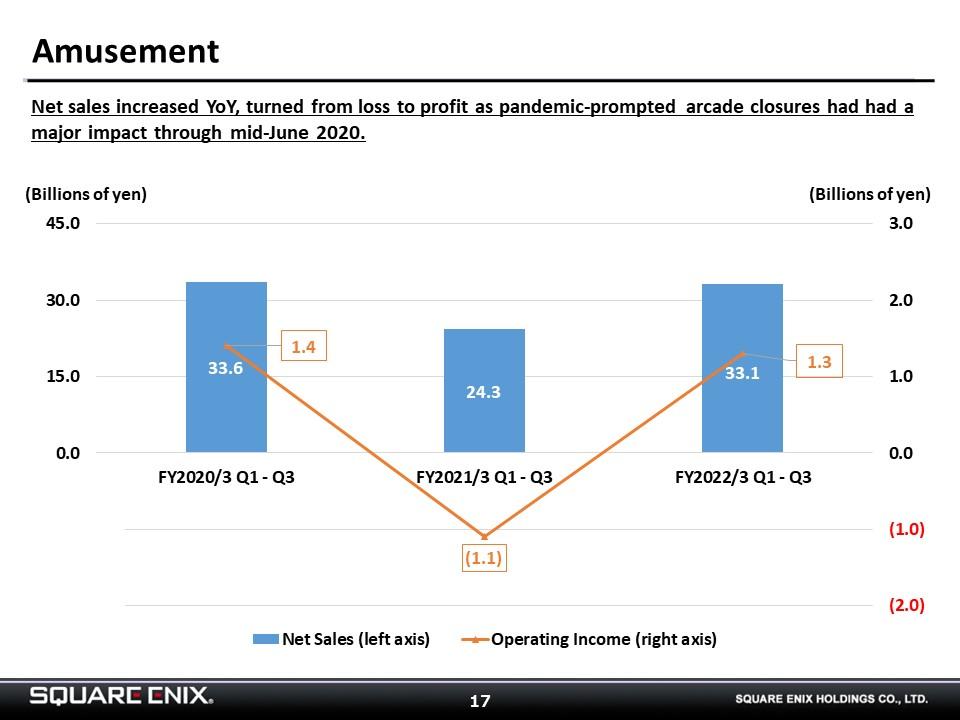

The Amusement segment saw net sales rise YoY, and the segment turned into the black at the operating line. The number of new COVID-19 cases has been on the rise, and we are closely monitoring the impact of that trend on the segment.

-

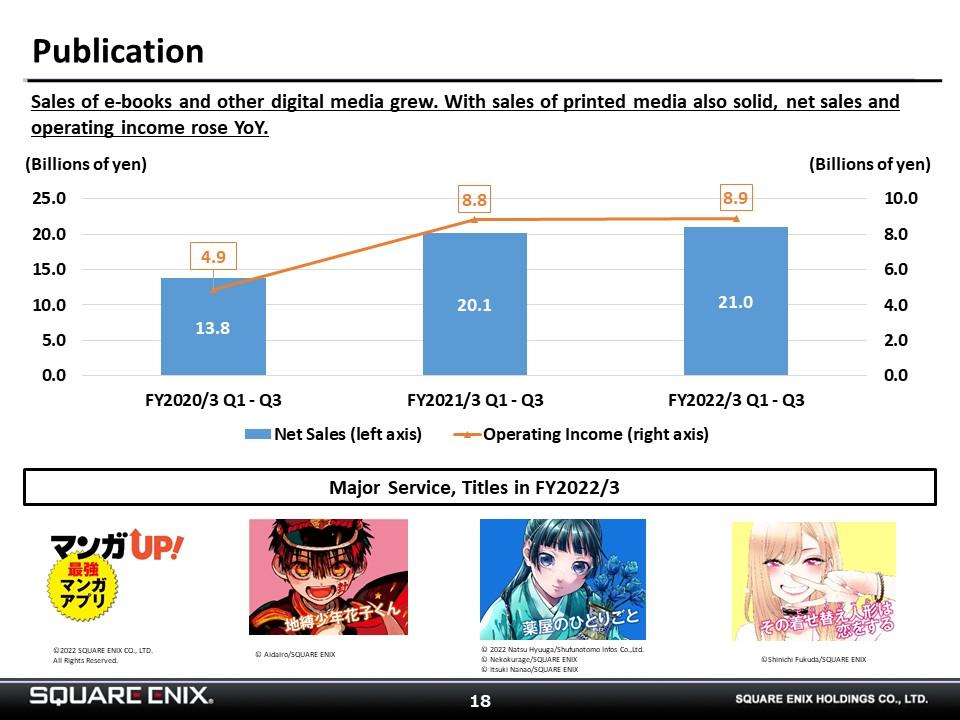

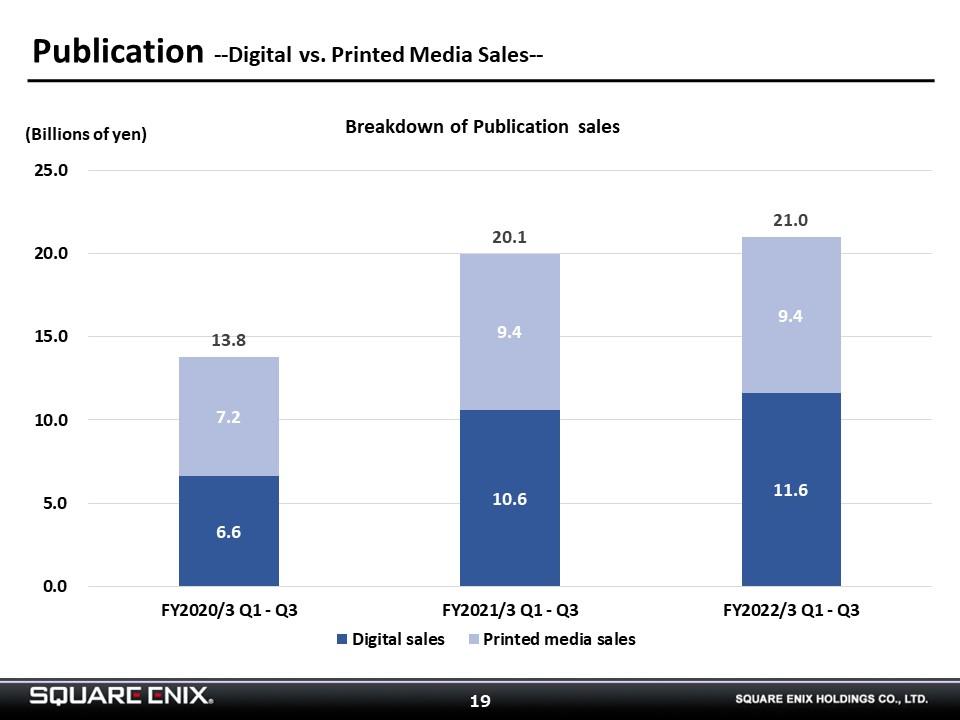

Net sales and operating income grew YoY in the Publication segment, but the segment’s growth has slowed. Our challenge will be to identify how to achieve further growth going forward.

-

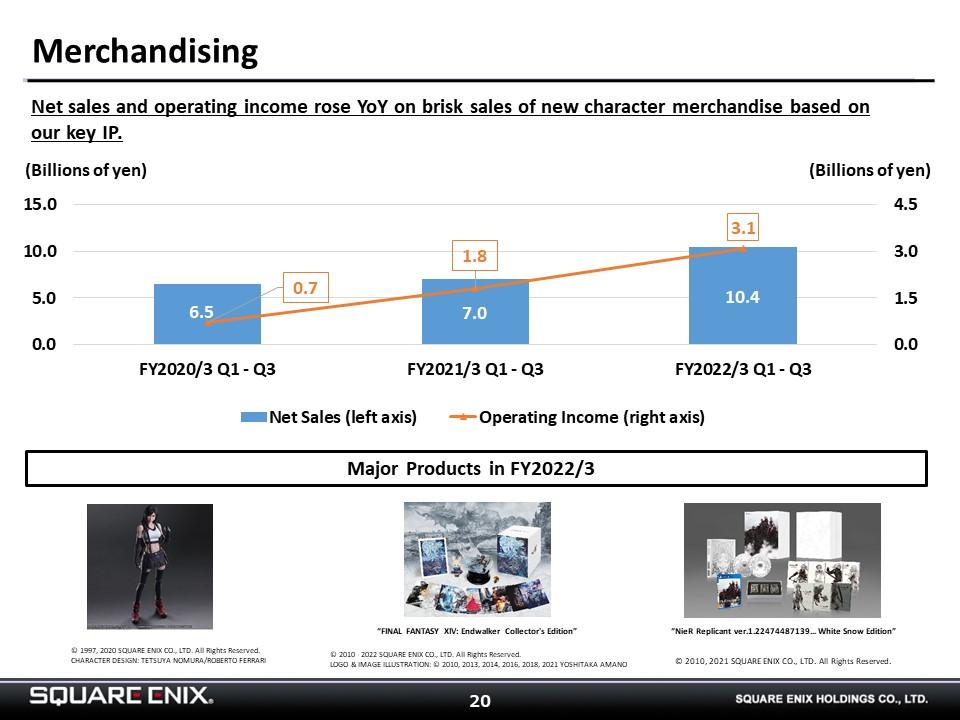

The Merchandising segment saw net sales and operating income grow YoY. We have stated our intention to achieve further growth through the digital transformation of the segment and believe that NFTs will be especially important.

-

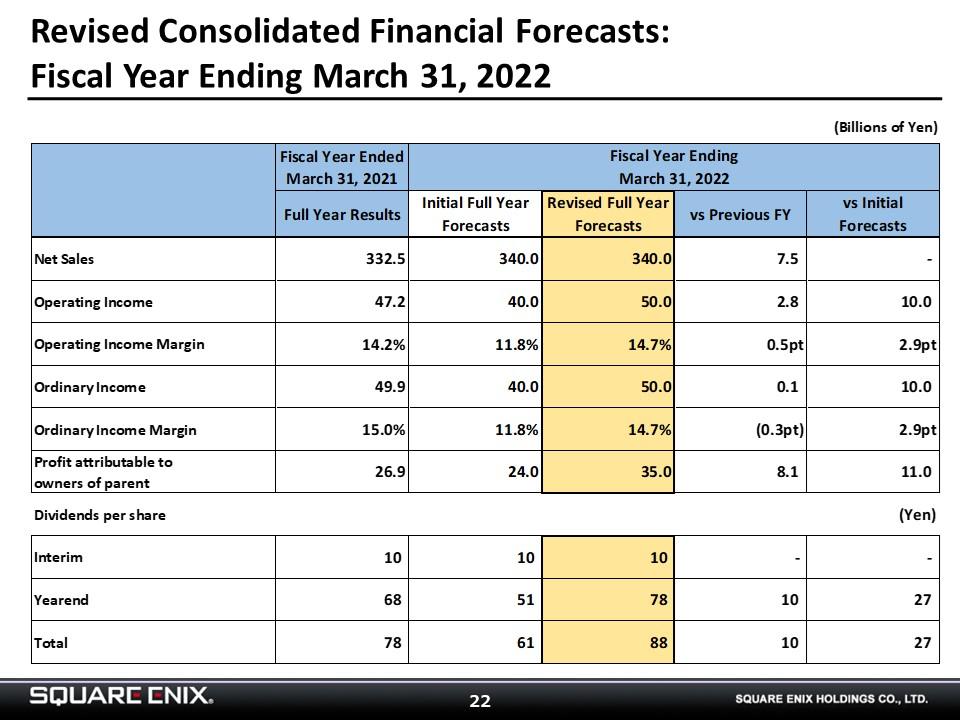

We have maintained our initial FY2022/3 guidance for full-year net sales of ¥340 billion. We have revised our profit forecasts, now looking for operating income of ¥50 billion, ordinary income of ¥50 billion, and net income attributable to parent company shareholders of ¥35 billion.

To forecast our operating income, we deemed that we would need to have a better idea of Q4 trends regarding sales of new HD games, the performance of smartphone games, etc. We therefore have set our operating income forecast at a level on par with our achievement in Q3. We set our ordinary income forecast at the same ¥50 billion as our operating income forecast given the difficulty in quantitatively assessing the impact of foreign exchange rate trends. We forecast net income of ¥35 billion, premised on an effective tax rate of 30%.

We plan a year-end dividend of ¥78 per share based on a consolidated dividend payout ratio of 30%.

We described blockchain game initiatives at our November 5, 2021 Financial Results Briefing session and are working to be able to elaborate on our business plans for FY2023/3 and beyond.