-

Print

-

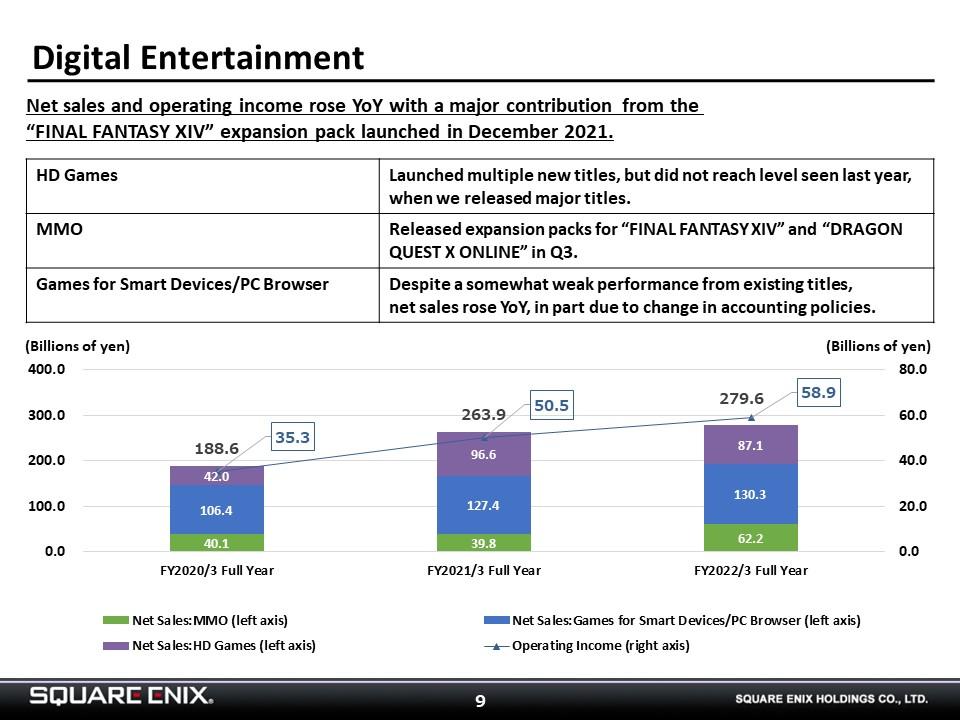

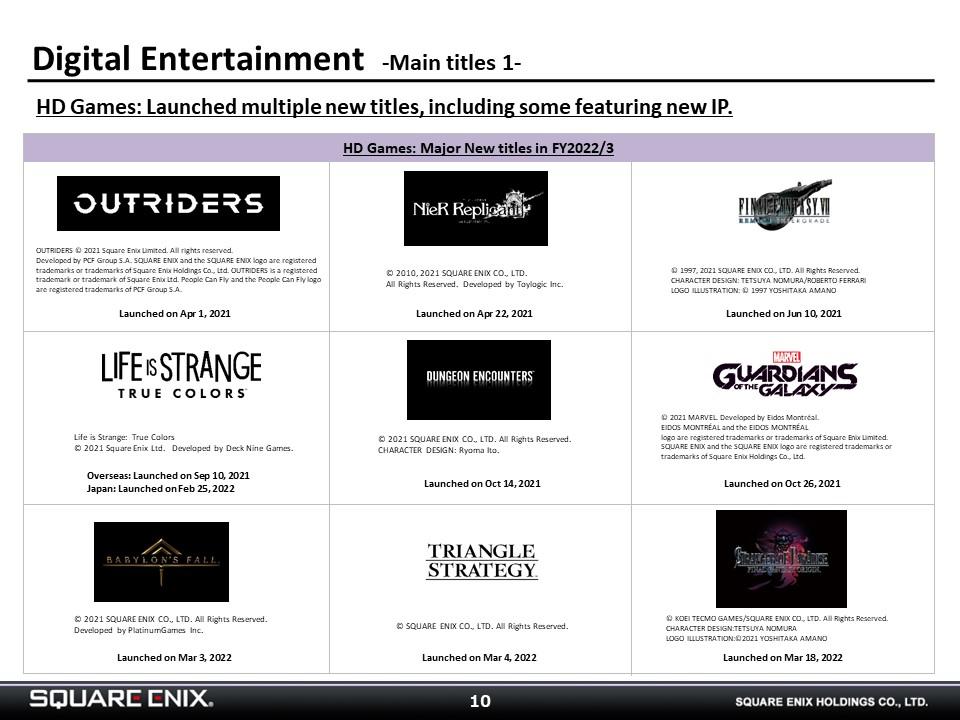

This is a breakdown for the Digital Entertainment segment.

In the HD Game sub-segment, the performances of some of our new titles fell short of our expectations, but we were able to build up our operating income in Q4 thanks to a solid performance by “FINAL FANTASY XIV” in the MMO sub-segment.

-

In the MMO sub-segment, we released expansion packs in FY2022/3 for “FINAL FANTASY XIV” and “DRAGON QUEST X ONLINE.” In particular, we are extremely pleased with the performance of “FINAL FANTASY XIV.”

We are expecting a considerable earnings contribution again in FY2023/3.

-

These are the main titles in our Games for Smart Devices/PC Browser sub-segment. Among our new titles, “ECHOES OF MANA,” which launched in April, got off to a solid start. In the summer of 2022, we are slated to release “FULLMETAL ALCHEMIST MOBILE,” which has turned out very well and received great results on the closed beta test we recently ran. We expect to achieve further growth in FY2023/3 thanks to earnings contributions from new titles.

-

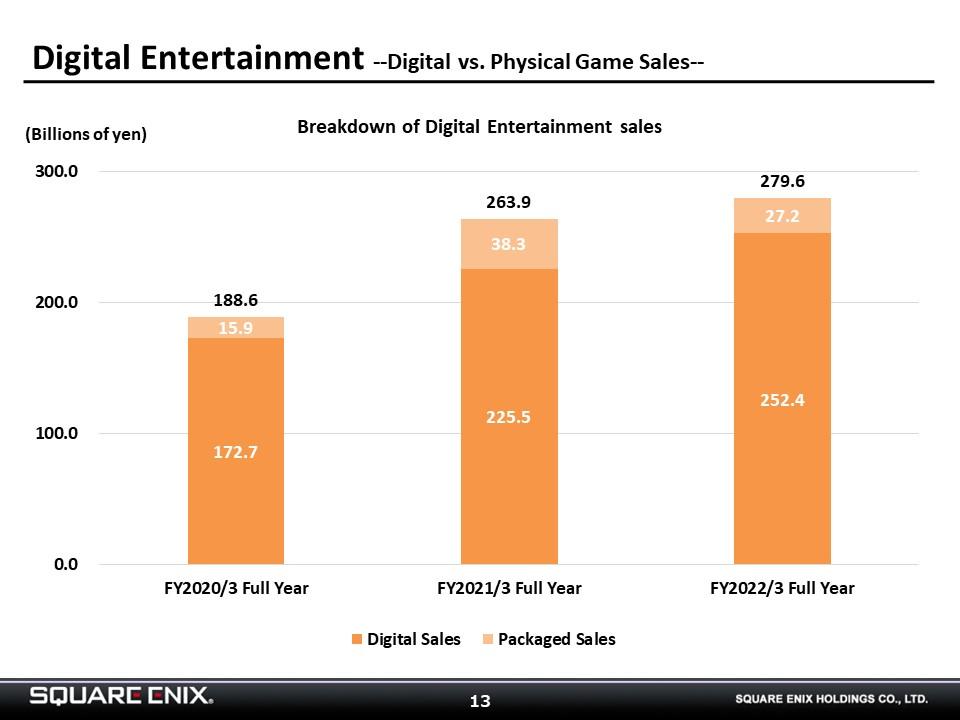

This slide shows the breakdown of digital versus physical sales in the Digital Entertainment segment.

-

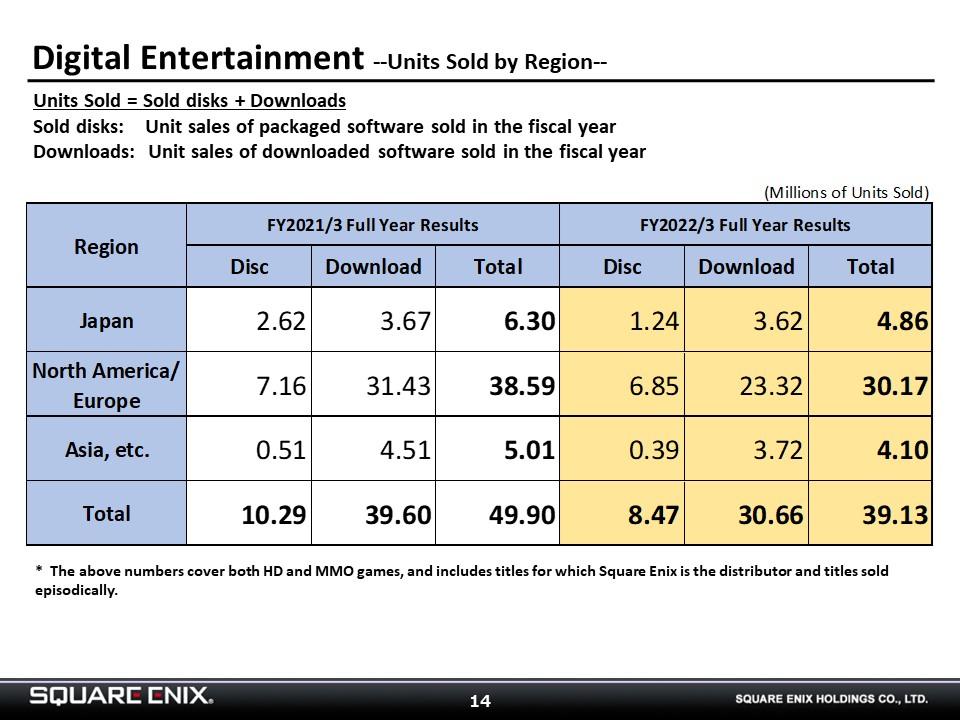

This slide shows units sold by region in FY2022/3. Units sold were down YoY as the previous fiscal year had seen the release of multiple major titles, as well as substantial back catalog sales due to the pandemic.

-

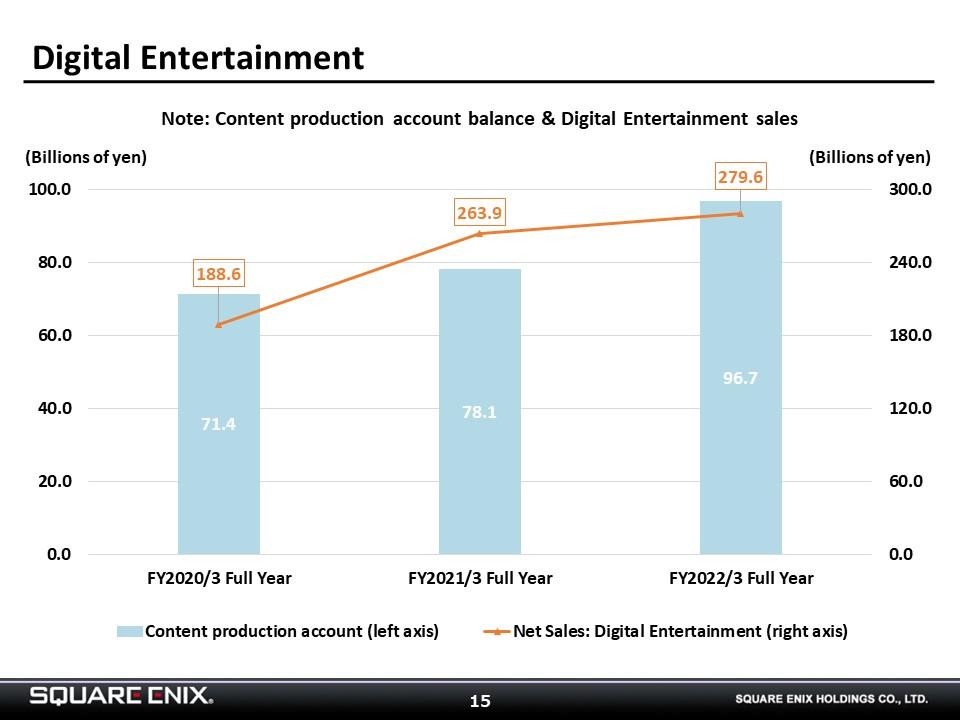

The content production account stood at ¥96.7 billion at the end of FY2022/3. This figure includes multiple major titles, and we are working to ensure the quality of each release.

-

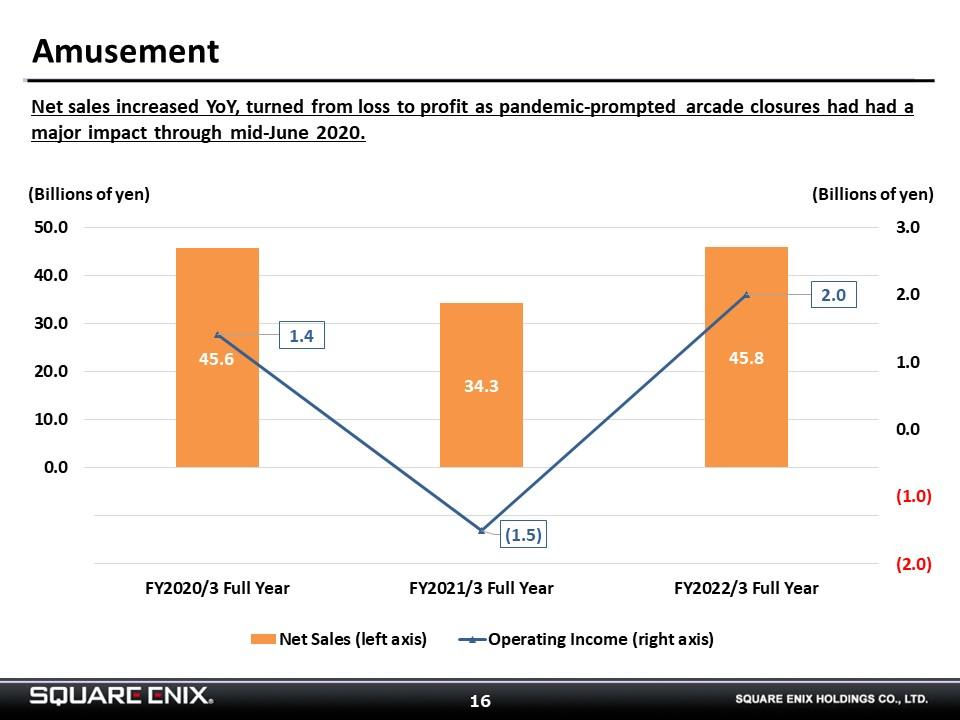

The Amusement segment saw net sales rise YoY, and the segment turned into the black at the operating line. We are hoping to see a further recovery in FY2023/3.

-

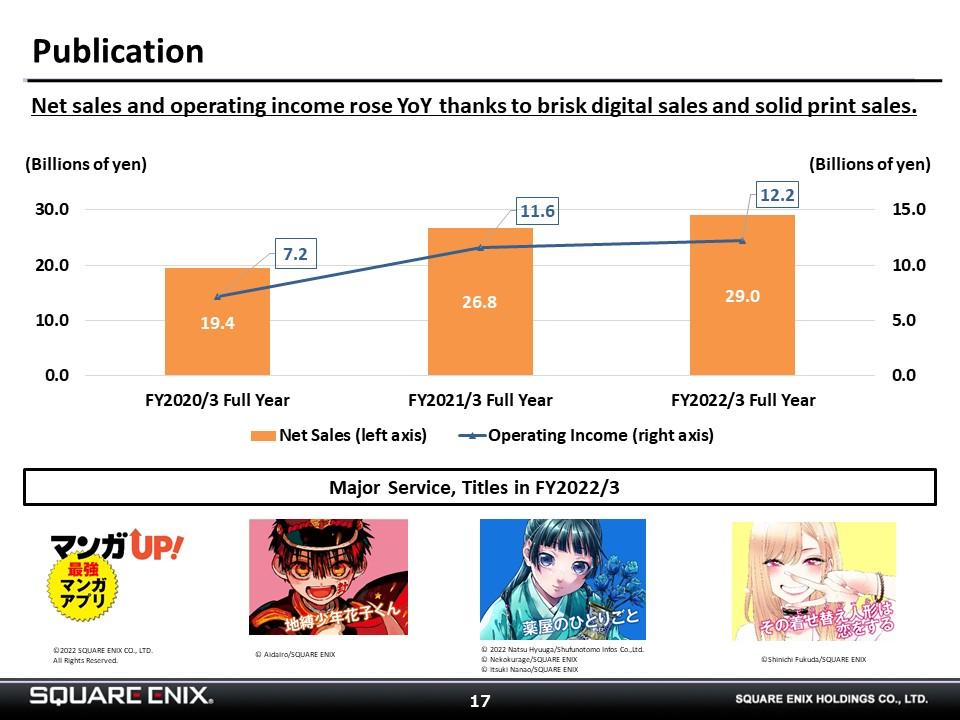

Net sales and operating income grew YoY in the Publication segment, thanks not only to brisk sales of digital media, but also to solid sales of print media driven in part by the major success of “My Dress-Up Darling.” We expect further growth in FY2023/3.

-

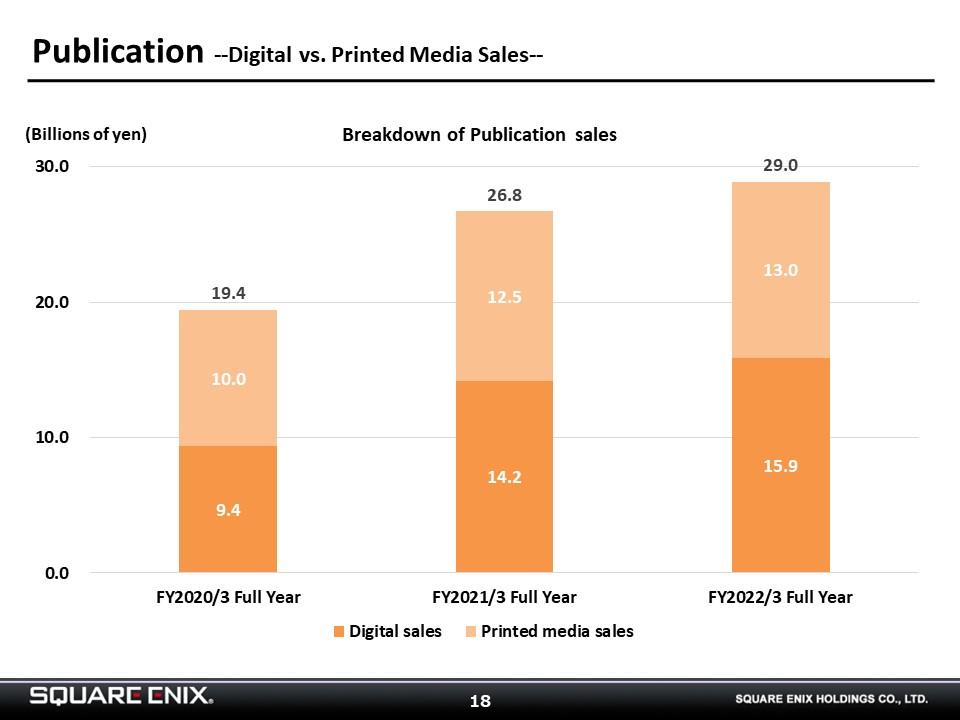

This slide shows the split between digital and print sales in the Publication segment, illustrating that we are achieving balanced growth in both.

-

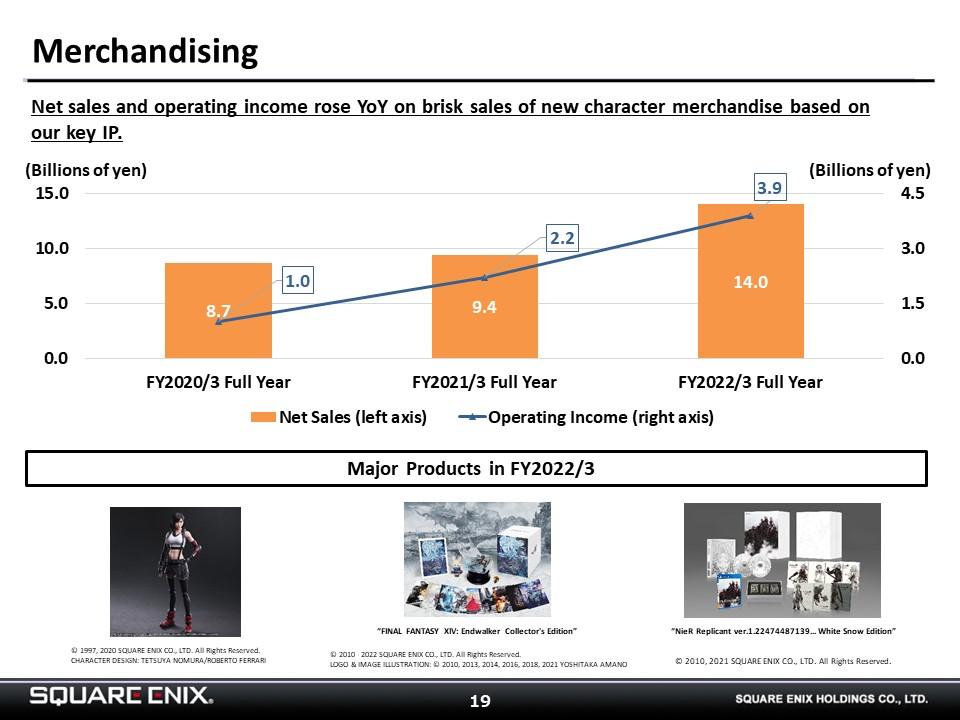

The Merchandising segment saw net sales and operating income grow YoY. We are expecting considerable earnings contributions in FY2023/3 as well.