-

Print

-

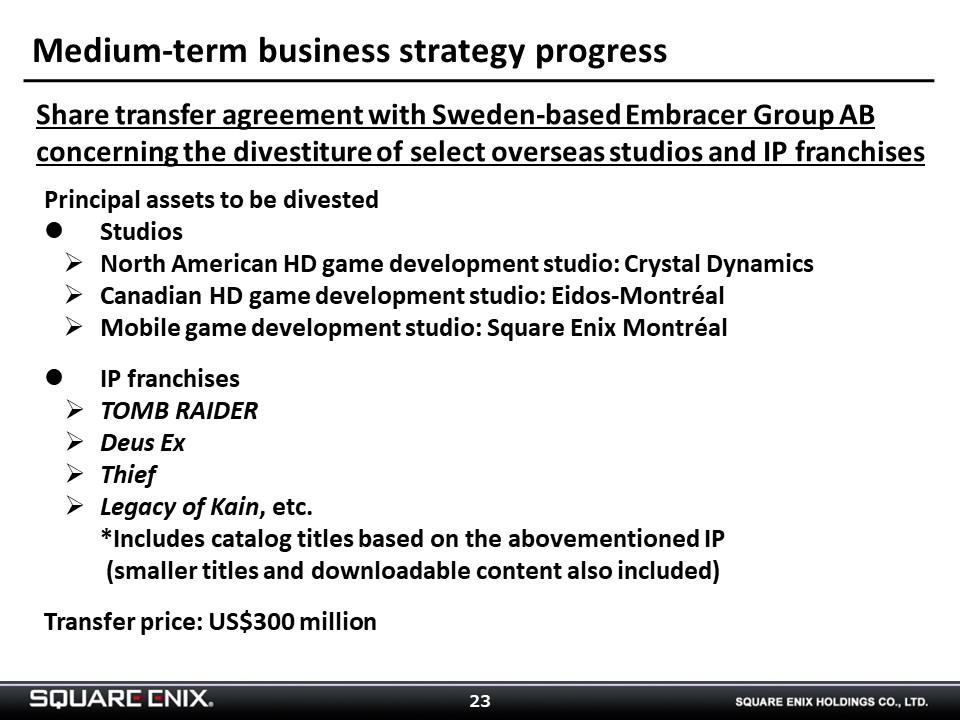

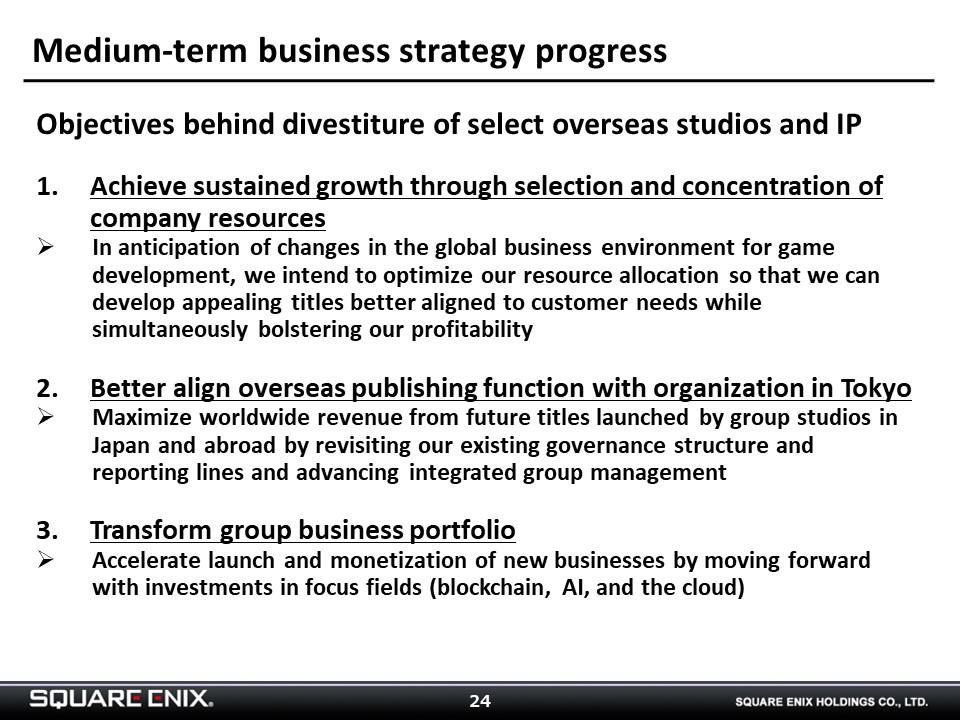

Our materials provide an overview and details of the Transaction, but I note that its primary purpose was a reorientation of our portfolio. We especially revisited our studio and title portfolios from the perspective of stepping up our offering of online titles that we develop for the North American and the European market. We want to focus on creating new titles that align with our strategy, including ones that leverage new IP. The JUST CAUSE franchise will remain our IP, and we are at work developing a new title in the franchise.

In addition to reorienting our portfolio, we will also enhance our publishing function. We have created new Chief Publishing Officer (CPO) roles and will be working to optimize the processes in our publishing function and pursuing integrated group management.

I will provide a few additional comments on the Transaction. Firstly, we have included the financial statements for the main companies to be divested in a May 2, 2022 release entitled “Execution of Share Transfer Agreement with Change to Subsidiaries,” but please recognize that these are stand-alone figures for the individual entities within the consolidated group. Please also note that the assets to be divested include past franchise titles, small- and medium-sized titles, and DLC.

-

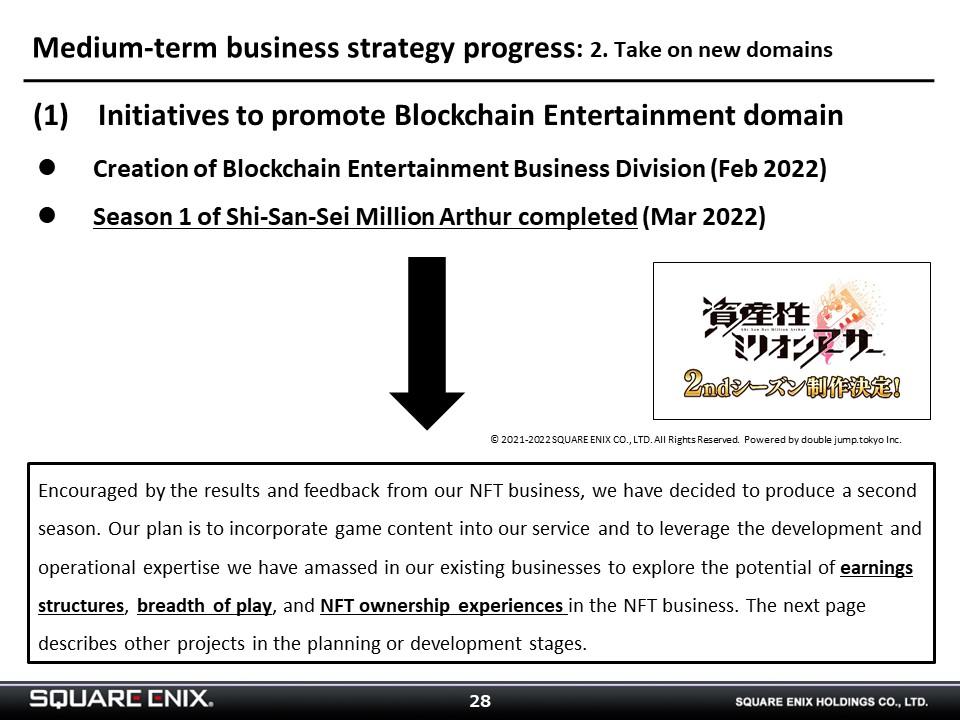

Rather than using the proceeds from the divestiture in new investment domains such as NFT and blockchain, we intend to use them primarily to fund our efforts to foster solid IP and to enhance our development capabilities in our core Digital Entertainment segment.

-

Our intention is to undertake fund raising efforts for our new investment domains separate from those for our core business, and we are considering various possibilities, including potentially establishing a CVC.

-

Our materials describe the status of our investment in key areas, but we are also exploring the possibility of undertaking multiple other investments.

-

I will lastly discuss our financial forecasts for FY2023/3.

As we mentioned in our May 2, 2022 release entitled “Execution of Share Transfer Agreement with Change to Subsidiaries,” we are in the process of carefully assessing the earnings impact of the aforementioned Transaction. This makes formulating reasonable forecasts difficult at present, so we are refraining from providing financial forecasts for FY2023/3 at this time. We will release forecasts as soon as we are able to formulate them.

In FY2023/3, we intend to undertake a variety of initiatives to pave the way for our achievement of the medium-term earnings targets we have set for FY2024/3, the final year of our medium-term plan.