-

Print

-

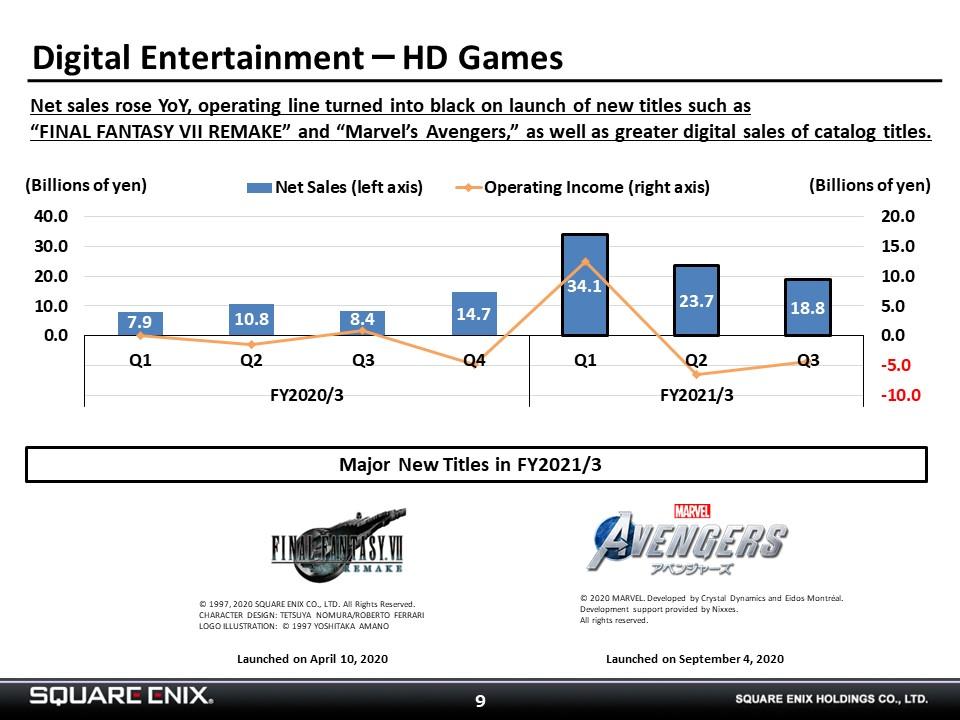

I will start with the HD Games sub-segment, where we booked a quarterly operating loss in 3Q, owed in part to the remaining “Marvel’s Avengers” development costs that hadn’t been fully amortized in 2Q and to relatively slow sales, on the whole, during the holiday season.

-

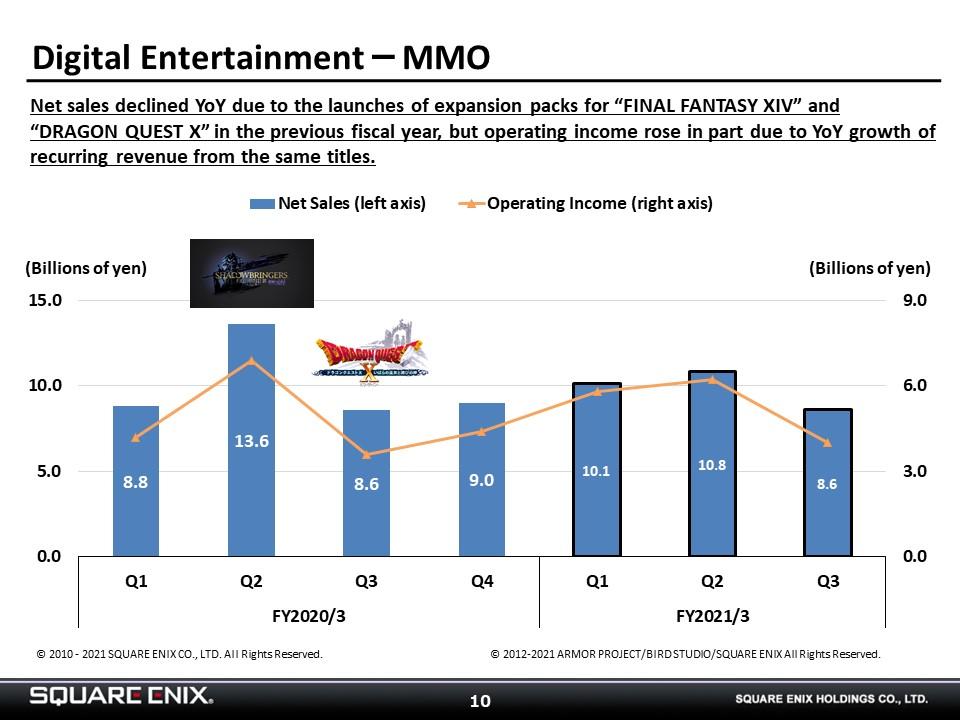

In the MMO sub-segment, we unveiled the update to “FINAL FANTASY XIV” on February 6, and that drove a lot of excitement and anticipation for more information.

-

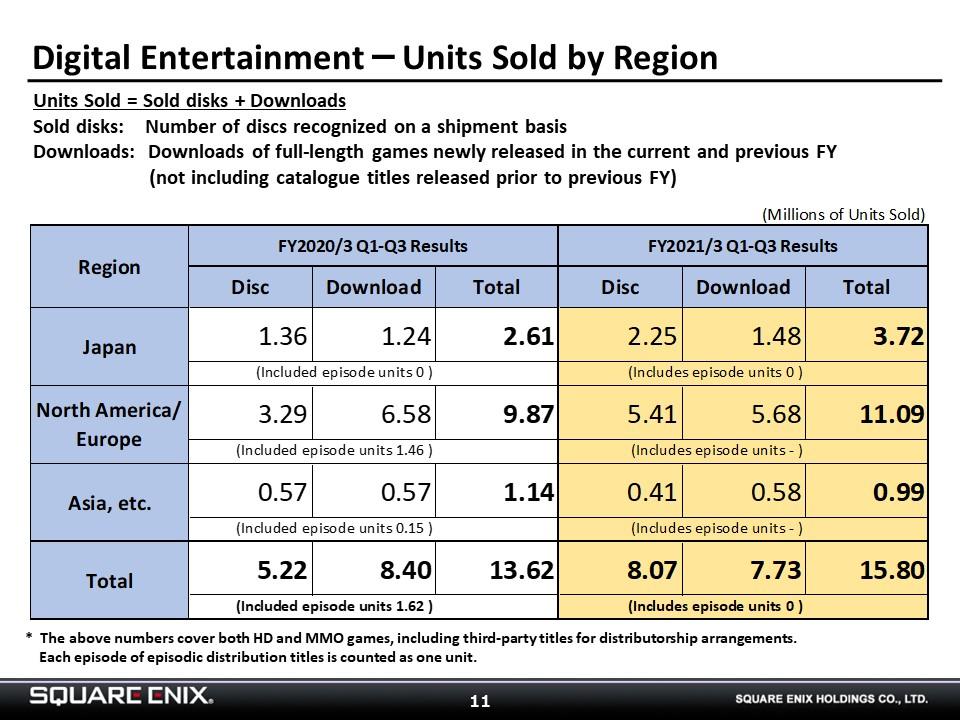

The percentage of our disc sales was up in FY2021/3 due to the release of major new titles, but the sales volumes we disclosed do not include sales of previously released catalog titles. When those are included, downloads account for the majority of our sales.

In addition, the catalog titles I just mentioned continue to sell well, and we expect the release of new games with links to these titles will spur even more growth in sales from our back catalog.

-

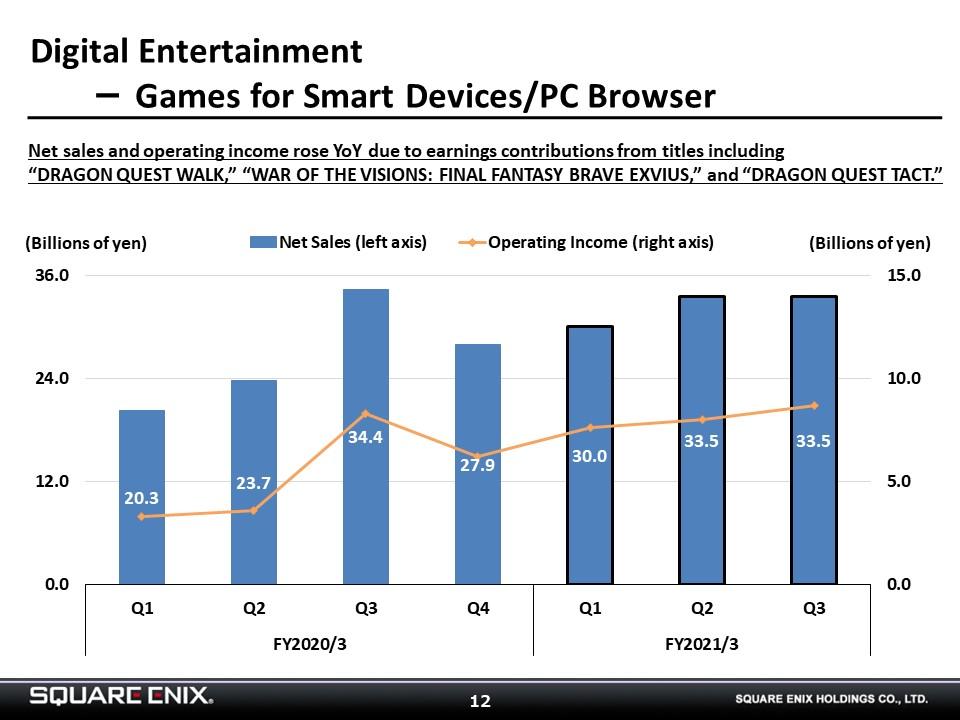

The Games for Smart Devices/PC Browser sub-segment performed well in 3Q. We are preparing a variety of initiatives in this sub-segment for FY2022/3, so we anticipate seeing benefits from those going forward.

-

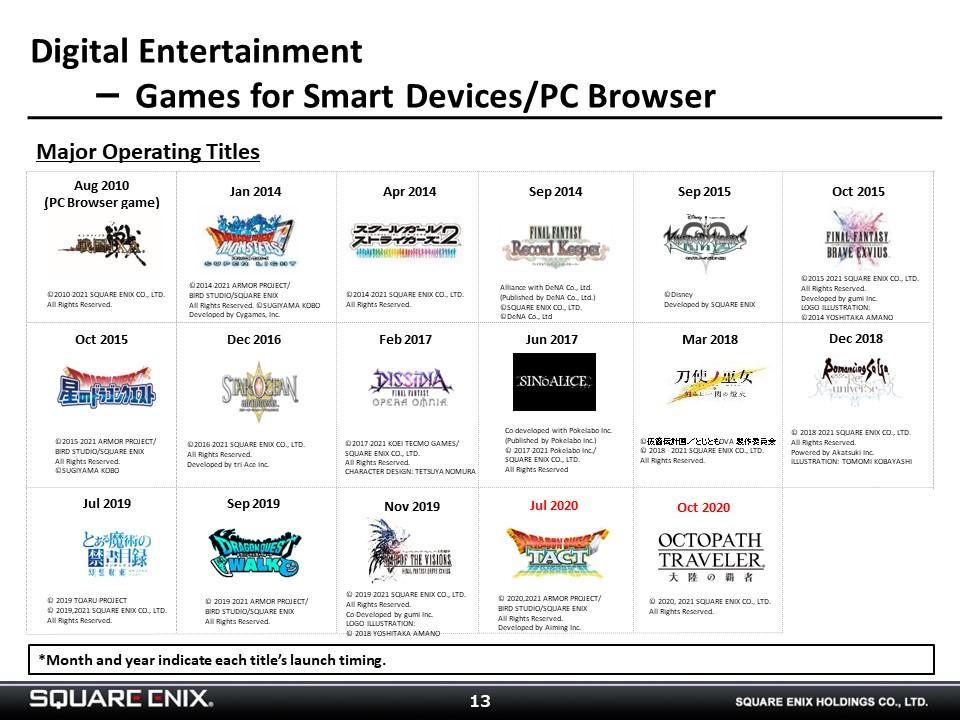

Here you can see the key titles that we currently have in operation. We are hoping that “NieR Re[in]carnation,” which is slated for launch on February 18, will be joining the ranks of our key titles.

-

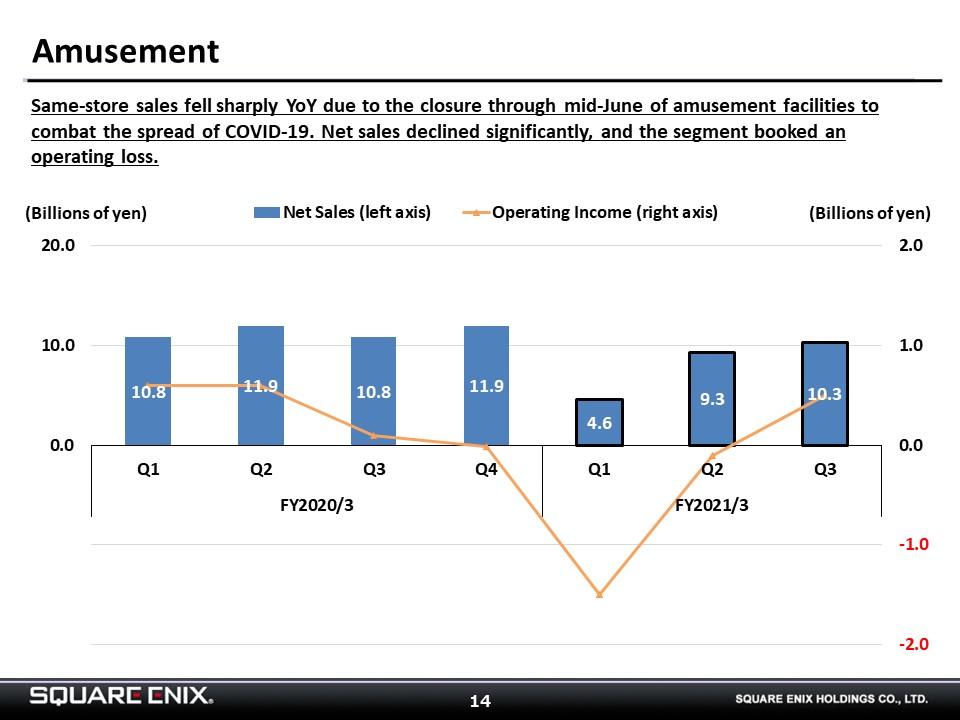

Next is the Amusement segment, which turned into the black in 3Q. We have implemented measures including reduced operating hours at some of our arcades in response to the state of emergency declaration issued on January 7. As such, we do not expect a promising outlook for the segment’s 4Q earnings.

-

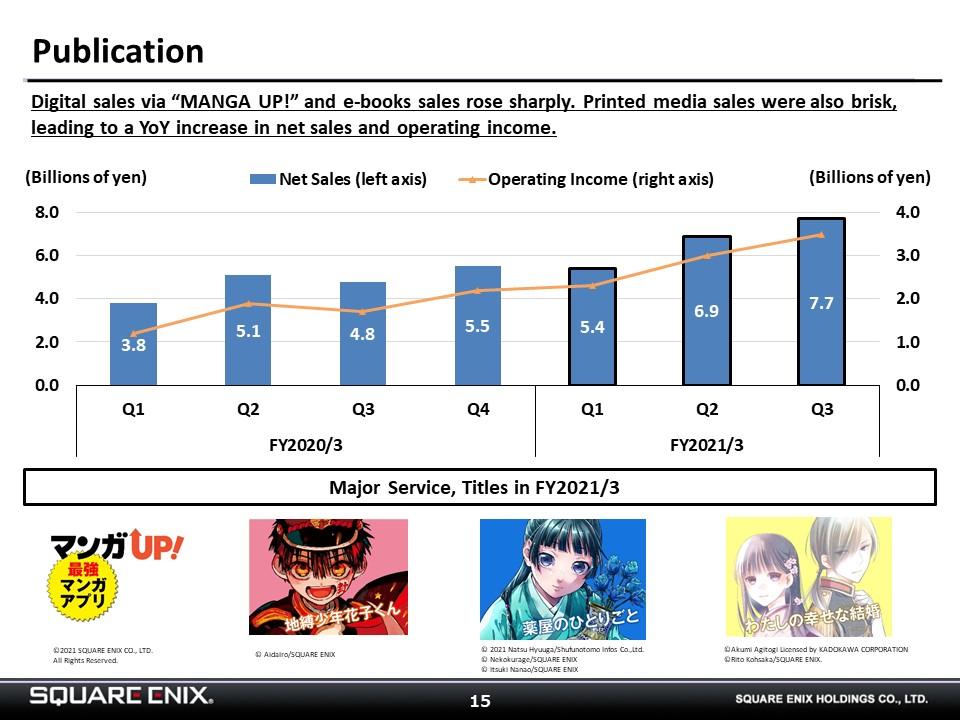

The Publication segment continued to perform well in 3Q, and we expect a similar trend to persist going forward.

-

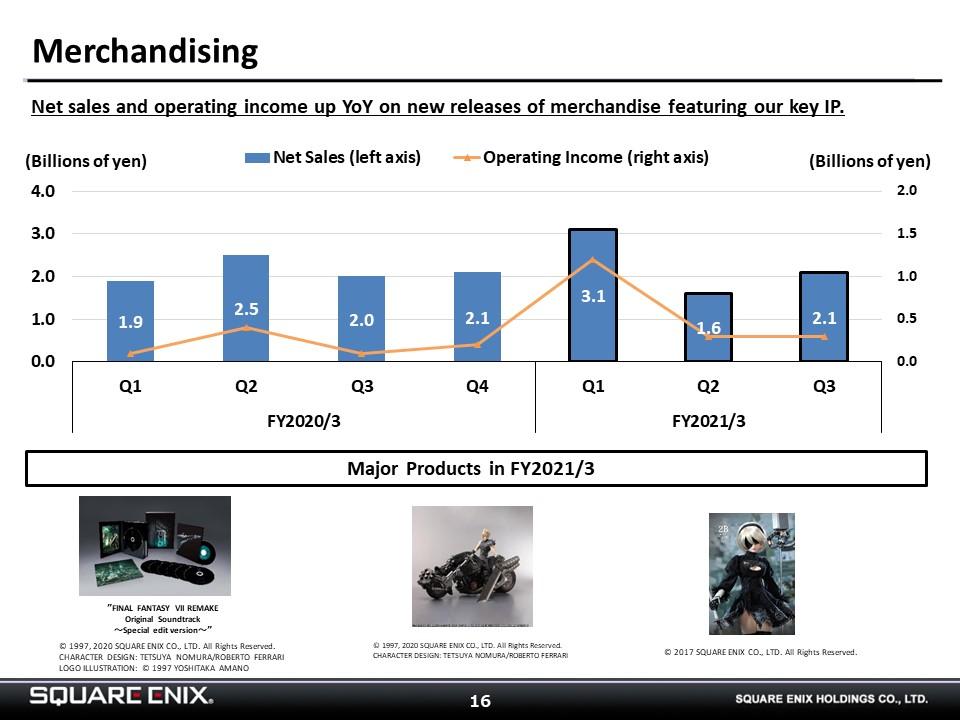

Earnings in the Merchandising segment fluctuate depending on the products we are selling. 3Q sales rose QoQ thanks to our focus on online sales.

-

Lastly, I would like to discuss our full-year earnings forecasts as they stand now. As a result of the state of emergency declaration prompted by the spread of COVID-19, the 4Q outlook for the Amusement segment, which had been recovering, became uncertain. The pandemic may also impact the timelines for titles under development. In light of these circumstances, we maintain our full-year guidance as of this point in time.