-

Print

-

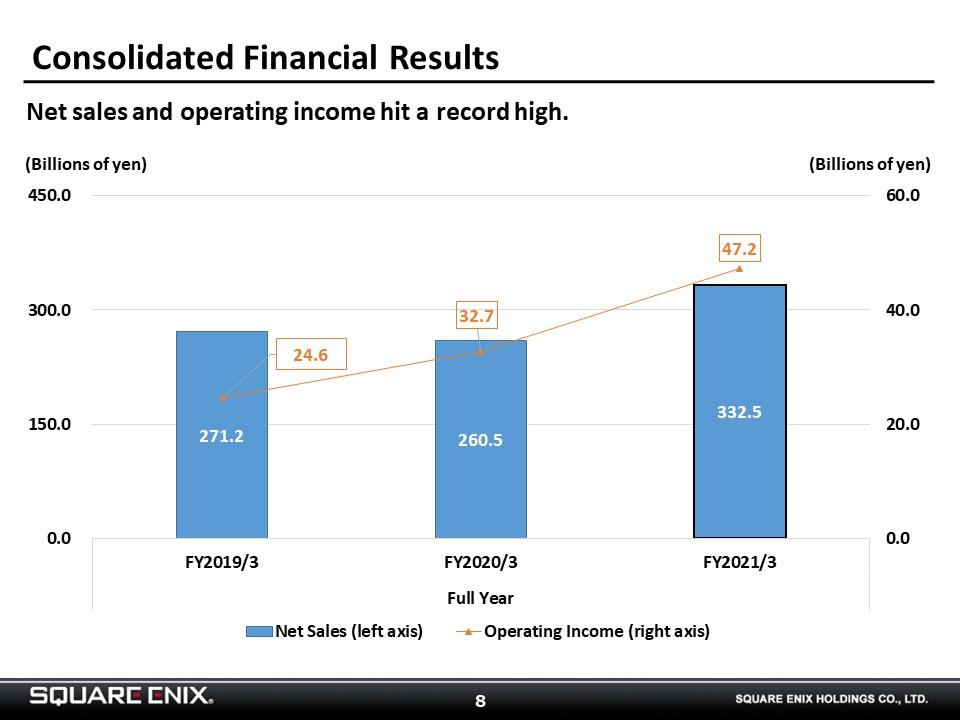

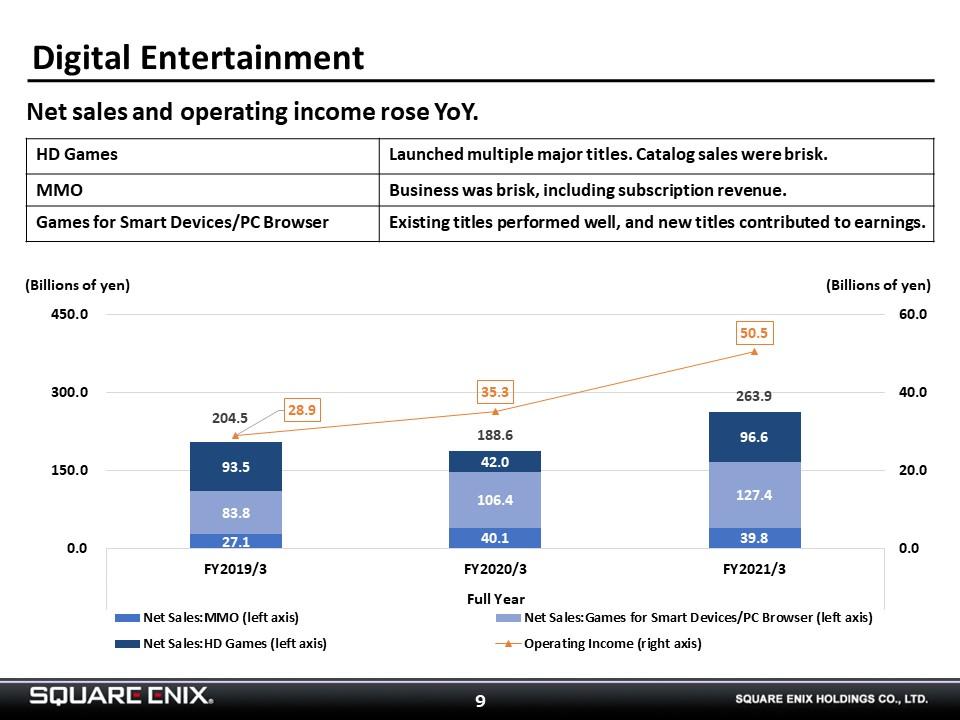

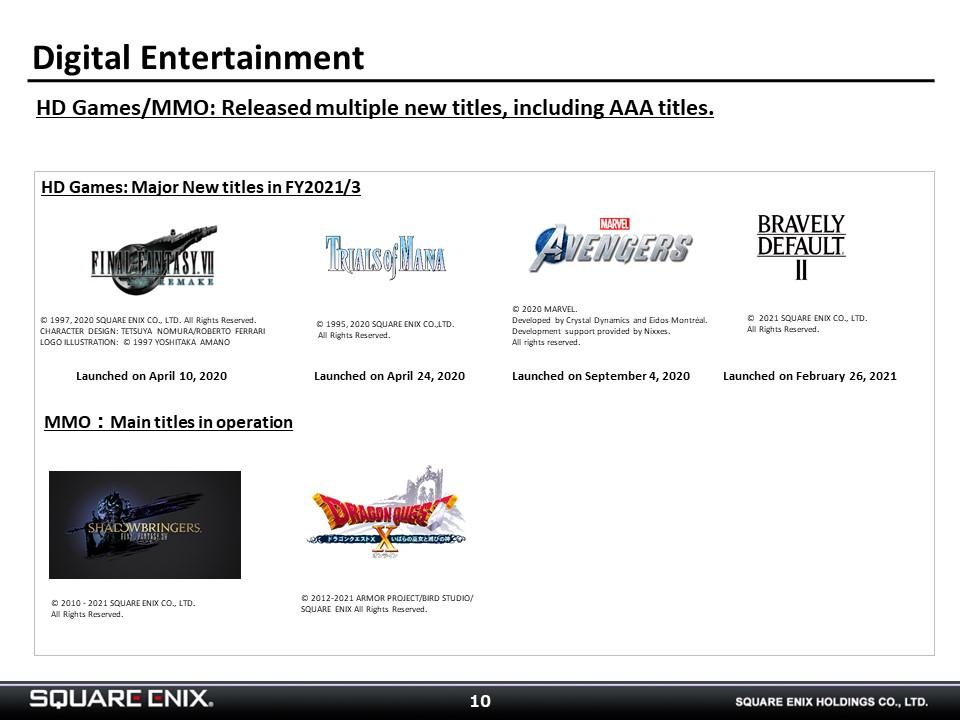

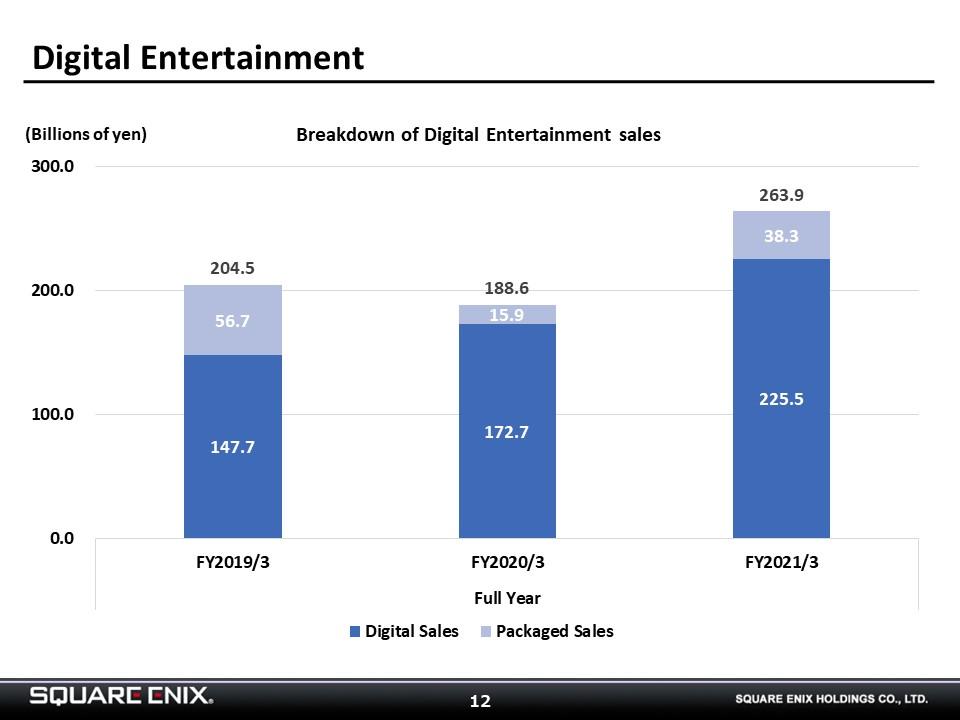

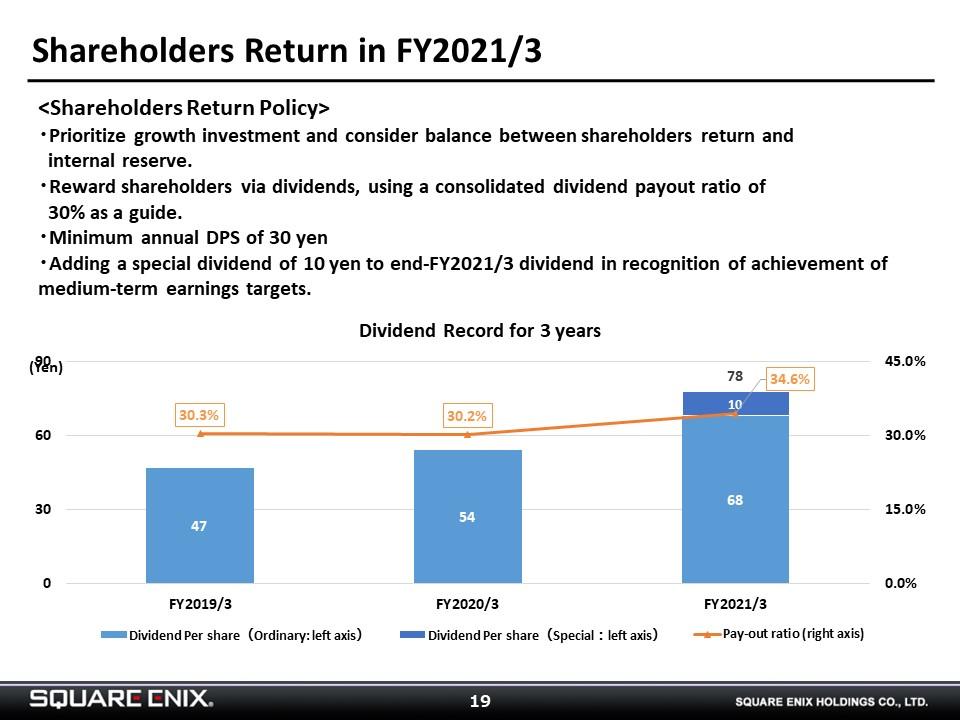

While “Marvel’s Avengers,“ which we launched in September, did not perform to our initial expectations, we were able to achieve our medium-term earnings targets of net sales of ¥300-400 billion and operating income of ¥40-50 billion thanks to the expansion of our base of stable recurring income from the MMO and Games for Smart Devices/PC Browser sub-segments.

-

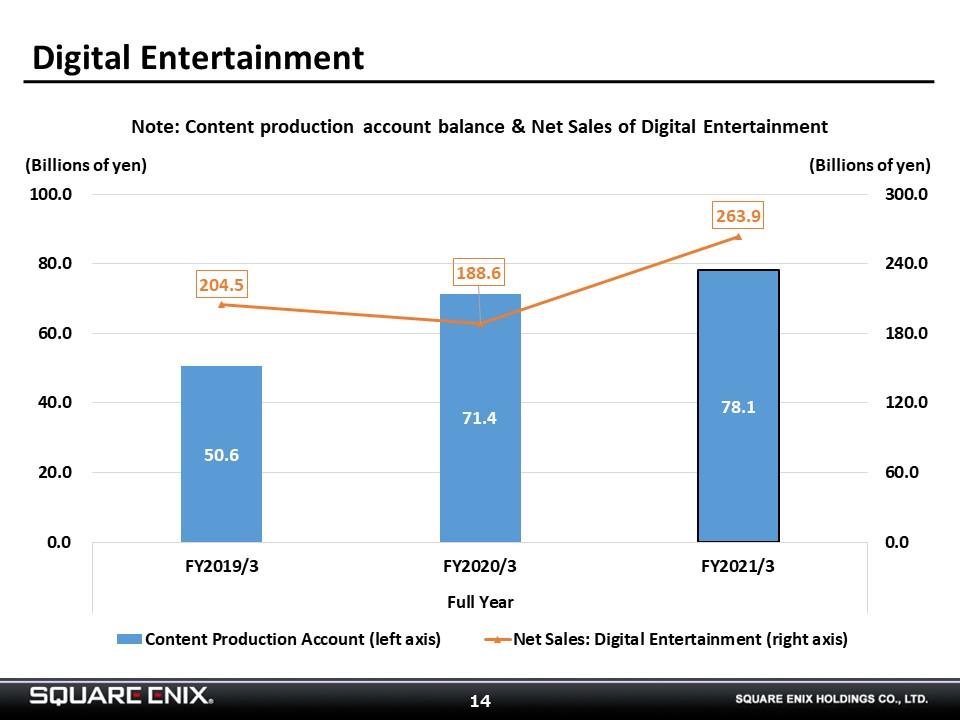

From this results presentation, we have ceased disclosing sub-segment profits in the Digital Entertainment business because the lifespans of current HD games and the way that we account for amortization costs make the profitability of our HD games somewhat difficult to assess on a quarterly basis.

In general, the lifespan of HD games is increasing. Until a new title is released, we treat it as a work-in-progress, posting its development costs to our content production account. We then amortize those costs within three months of the title’s release. As such, the timing of a game’s release and the amortization of its development costs can result in significant fluctuations in quarterly profit lines. We have therefore arrived at the conclusion that disclosing performance figures for the HD Games sub-segment on a quarterly basis is likely to mislead those attempting to assess that business. In addition, our strategy is to grow the earnings of the entire Digital Entertainment segment, inclusive of the MMO and Games for Smart Devices/PC Browser sub-segments. For this reason, we have decided that disclosing profit figures on a cumulative rather than quarterly basis is better aligned with our strategy and have therefore switched to that approach as of this results release.

-

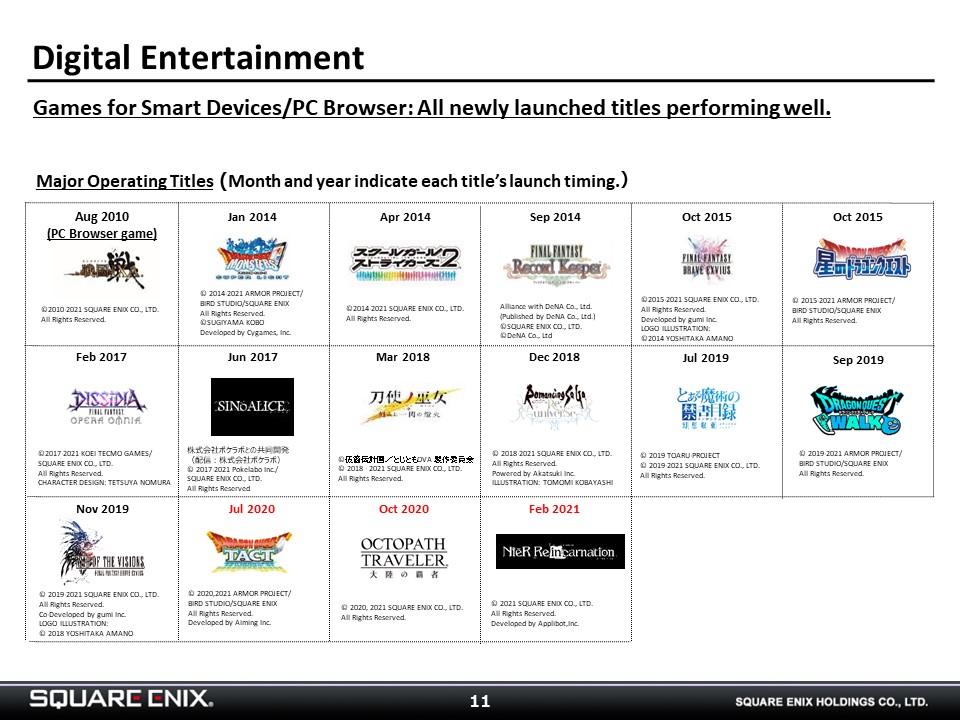

The Games for Smart Devices/PC Browser sub-segment launched “DRAGON QUEST TACT“ in July 2020, “OCTOPATH TRAVELER: Tairiku no Hasha“ in October, and “NieR Re[in]carnation“ in February 2021. All three titles began contributing to earnings in FY2021/3.

-

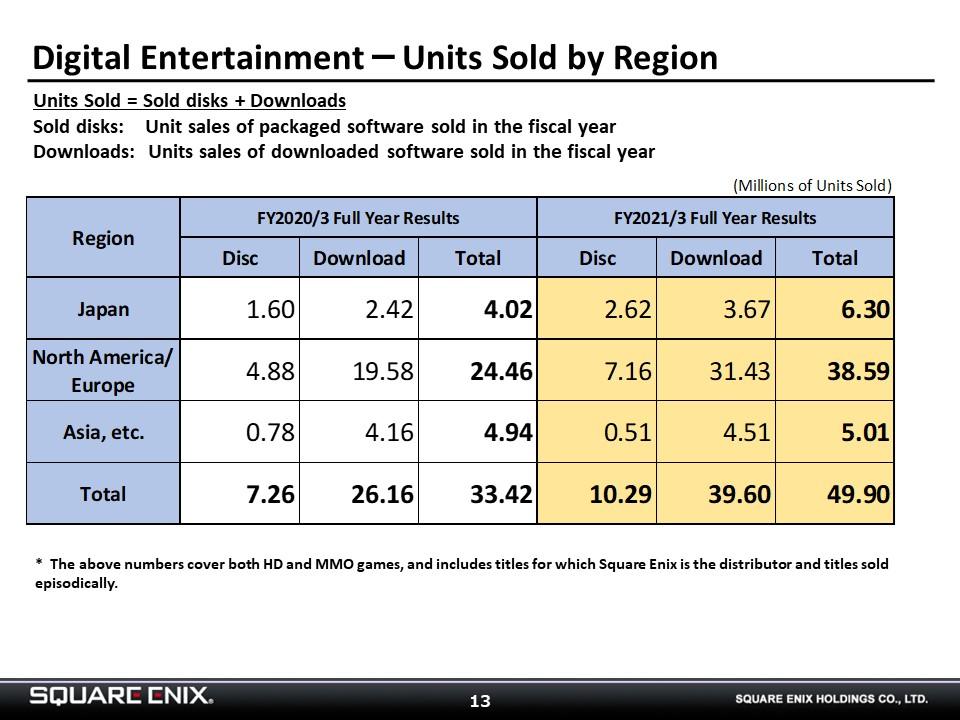

We have also made a change to how we disclose our units sold. Whereas the download sales we disclosed previously only included titles launched in the past two years, we now include all sales made during the relevant fiscal year, regardless of when a title may have been released.

This change was prompted primarily by the fact that we are making many more sales from our back catalog than we had in the past.

-

I will explain our content production account balance later when I discuss our medium-term earnings targets.

-

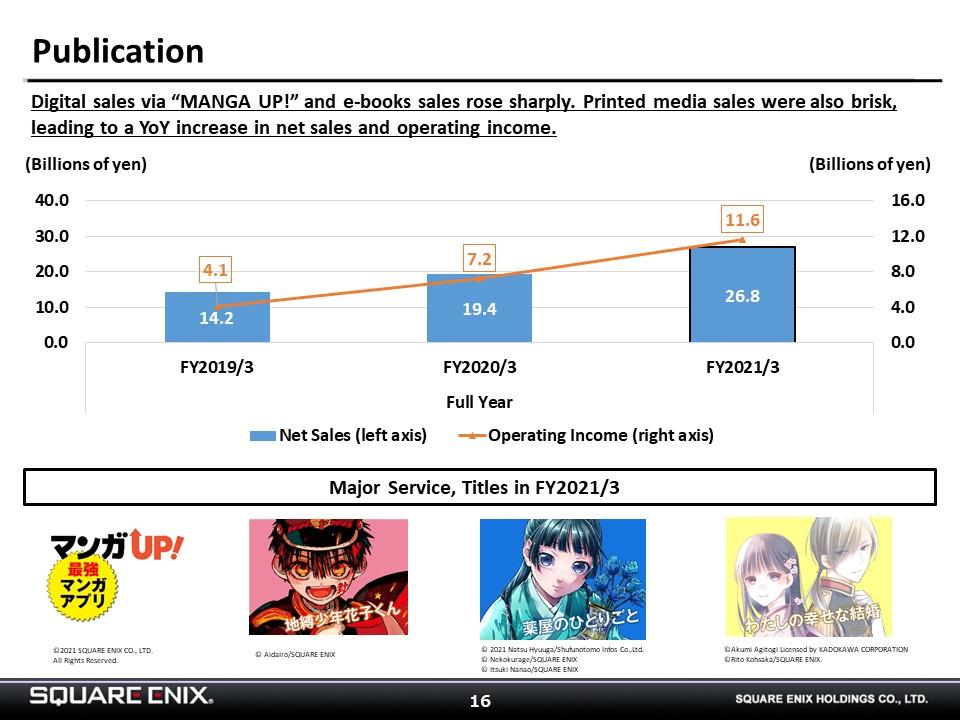

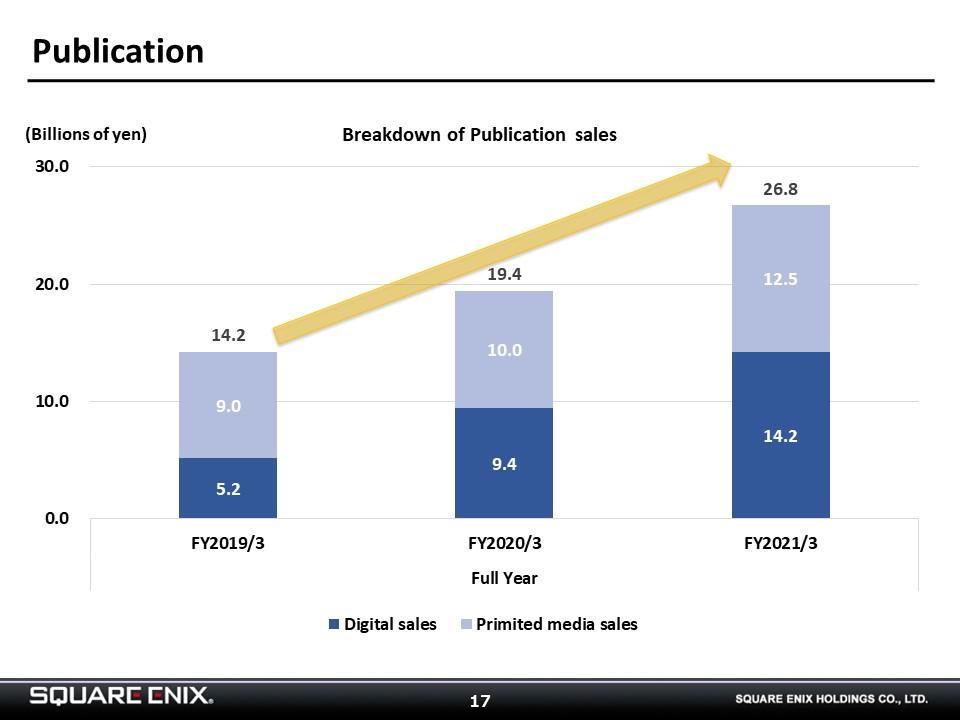

Our Publication segment continues to demonstrate pronounced growth, with digital and printed formats growing on an even keel. We expect the segment to make a fair contribution to FY2022/3 earnings as well.