-

Print

-

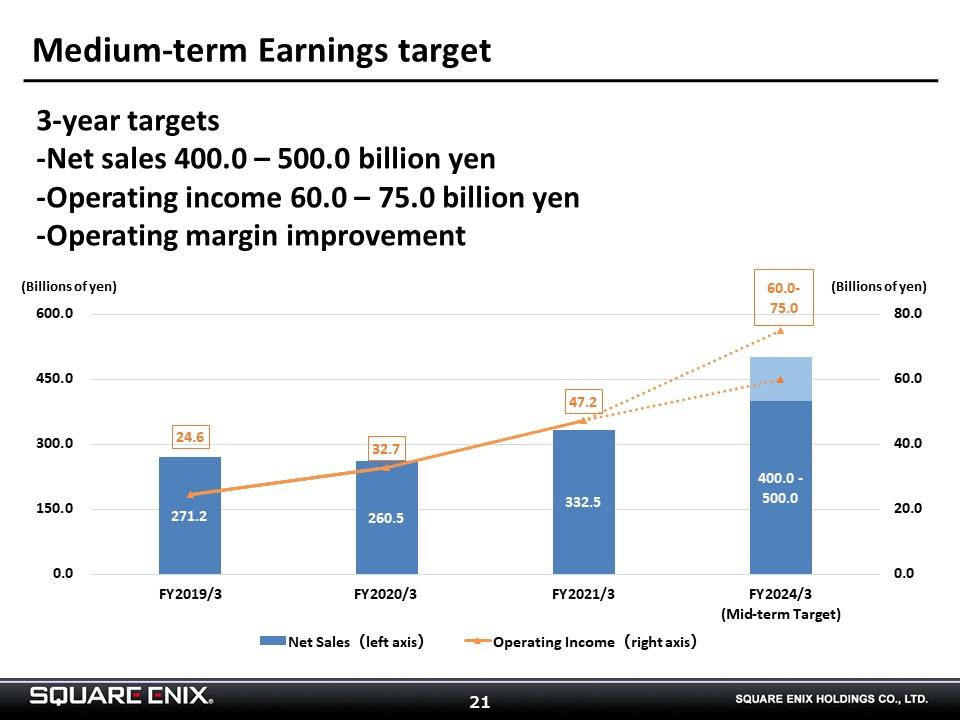

We have set medium-term earnings targets for three years out. Specifically, we will be targeting net sales of ¥400-500 billion, operating income of ¥60-75 billion, and operating margin improvement.

We want to improve our operating margin not only by growing sales but also by engaging in more efficient spending on development and marketing.

I will next discuss our content production account. To achieve our net sales target, it will be key that we establish a substantial pipeline of new titles and then release those titles s to generate the sales that we are expecting. In short, our content production account is also a leading indicator for our future sales.

I will now speak to the current size of our content production account and to the risk that we will have to take write-downs on it. The account is a collection of individual projects, and we evaluate it based on each project, meaning by applying project-based costing. As such, by the nature of the account, we do not post impairment losses equivalent to a consistent percentage of the balance at the end of each fiscal year. Moreover, growth in the size of the account does not dictate a commensurate rise in write-downs.

Write-downs are the product of our assessment of the likelihood that we will recoup the account’s costs based on our future earnings projections as of the end of each fiscal year. Major spec changes and other events that take place during the development process can also contribute to write-downs.

I will note one more point. Because of how “Marvel’s Avengers“ sold in FY2021/3, you may be wary of the risk associated with our future releases. However, as I mentioned a moment ago, because we manage development efforts and earnings project-by-project and studio-by-studio, nothing that happens with any one title impacts the others. It is based on that premise that we will build a pipeline that will enable us to consistently generate net sales of ¥400-500 billion.

While we cannot disclose a breakdown of the end-FY2021/3 content production account balance of ¥78.1 billion, I can say that titles that we plan to release in FY2023/3 and thereafter account for a substantial portion of the pipeline that the account represents. As such, while the balance may continue to increase, those titles will contribute to our future earnings and be key to achieving our medium-term earnings targets (for net sales and operating income).

-

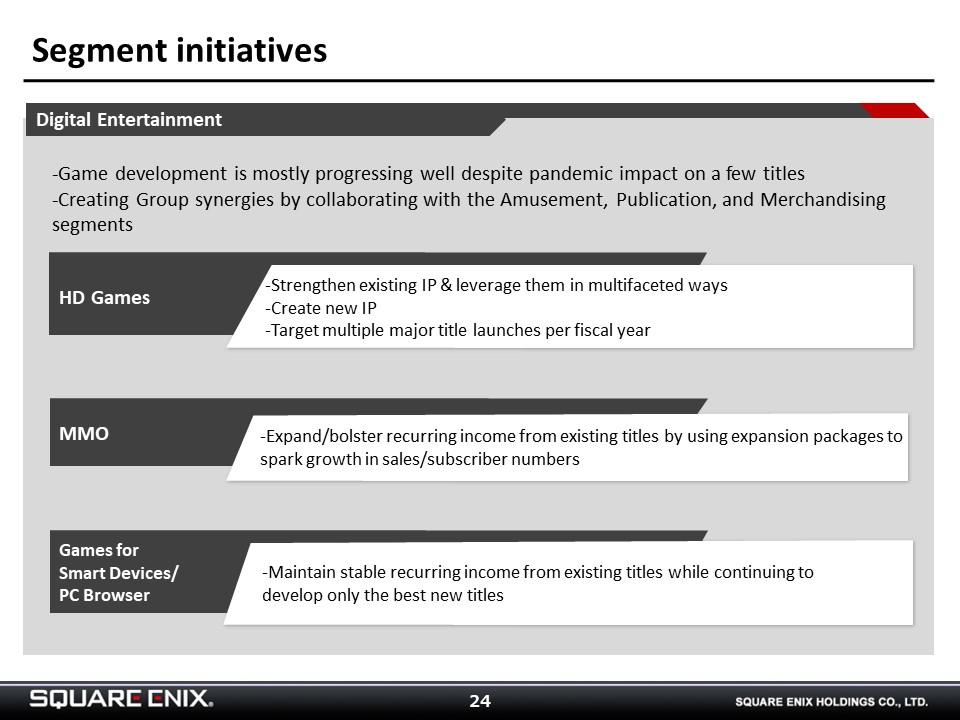

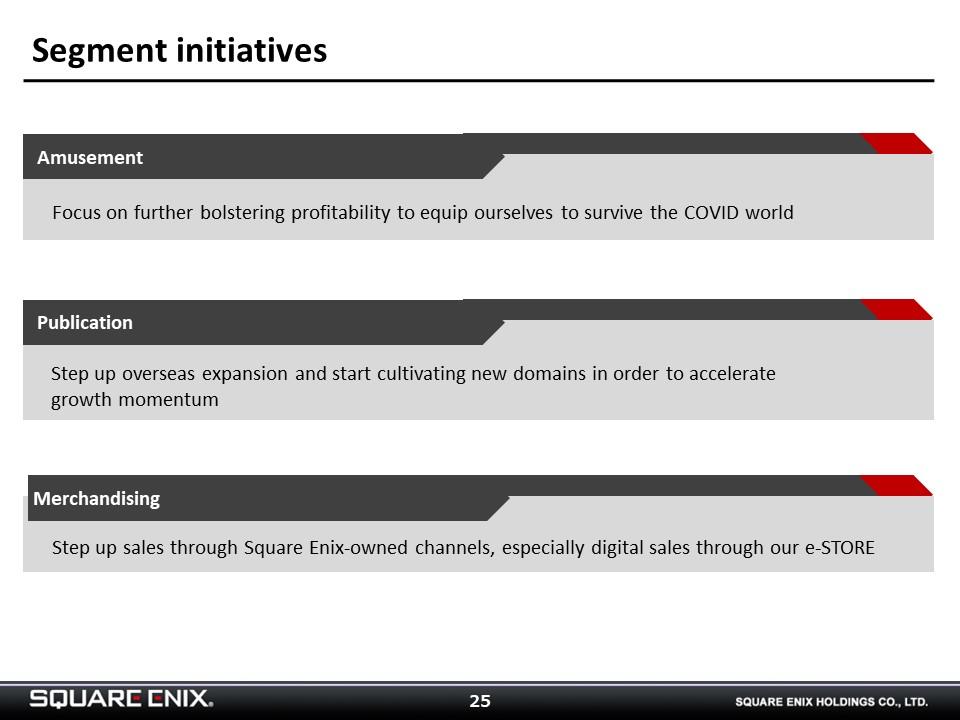

These slides cover the strategies that will get us to our medium-term earnings targets. I will refrain from describing them as they do not deviate significantly from the strategies we have previously presented.

-

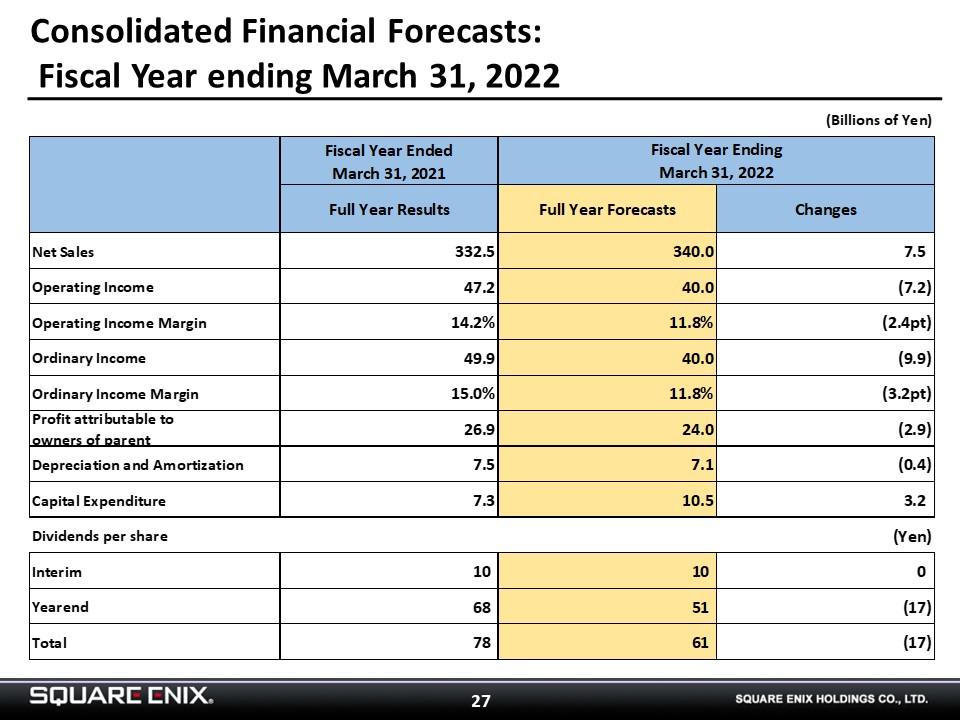

We are guiding for net sales of ¥340 billion and operating income of ¥40 billion in FY2022/3, which is the first year on the way toward our medium-term earnings targets. FY2022/3 lineup will consist large of new IP, and we are working on developing major titles with target release dates in FY2023/3 and thereafter.