Starwing Paradox© SQUARE ENIX SUNRISE

Starwing Paradox© SQUARE ENIX SUNRISE

2018, 2019 SQUARE ENIX CO., LTD. All Rights Reserved. / SUNRISE

Net sales in the Amusement segment rose from the previous year to ¥46.2 billion while operating income fell to ¥1.9 billion in the fiscal year ended March 2019. Major new titles including “Starwing Paradox” contributed to the rise in sales, but this was not enough to offset the amortization of development costs. Meanwhile, arcade operations generated stable earnings throughout the year, and we also added to our arcade count, so we are steadily expanding the business. In the fiscal year ending March 2020, the number of tourists visiting Japan looks likely to grow as the Tokyo Olympic and Paralympic Games approach in July 2020. Meanwhile, we also anticipate the increase in Japan’s consumption tax. As such, the business environment is difficult to read, but by undertaking constant improvements in our arcade operations, we intend to bolster the segment as a whole.

The Publication segment saw both net sales and operating income grow in the fiscal year ended March 2019, with net sales reaching ¥14 billion and operating income rising to ¥3.9 billion. The key growth driver is digital sales. Nearly 40% of sales booked in the fiscal year ended March 2019 were digital, and the most recent monthly figure was in excess of 50%. Business is brisk for our MANGA UP! and GANGAN pixiv services, with both enjoying solid growth in their MAU (monthly active users) and DAU (daily active users) numbers. This has contributed significantly to the rise in margins for the segment as a whole. Meanwhile, sales of printed comics are growing in synch with digital sales, so the overall segment is demonstrating well-balanced growth. The drive toward digitization is irreversible, and we look for the digital weighting of our own business to continue to grow. We will create new IP using media well suited to the digital world and continue to grow the segment as a whole.

Both net sales and operating income fell from the previous year in the Merchandising segment in the fiscal year ended March 2019, with net sales dropping to ¥7.3 billion and operating income declining to ¥900 million. These results are owing to considerable upfront spending on the development of new products, but we will strive for growth in the fiscal year ending March 2020 and beyond as we release new products timed to coincide with the launch of major game titles and add to our product lineup. We do not see this segment as one dealing solely in products derived from and intended to complement our original IP. Today’s customers clearly tend to enjoy content in the context of an entire universe. The products and services we offer in this segment meet the needs of such customers while adding to the richness of our IP portfolio. By proactively working to develop this segment into an e-commerce business, we will make purchasing more convenient for our customers and make our products and services more a part of their lives.

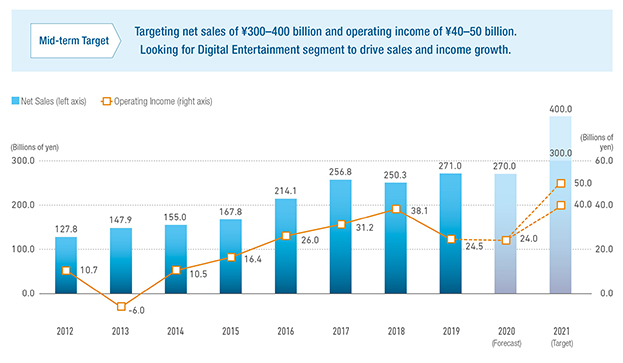

We are striving to create a business structure in or after the fiscal year ending March 2021 that will enable us to consistently generate net sales of ¥300 to 400 billion and operating income of ¥40 to 50 billion. In the fiscal year ending March 2020, when we had originally anticipated achieving our medium-term earnings targets, we now look to book net sales of ¥270 billion and operating income of ¥24 billion, a performance on par with that of the fiscal year ended March 2019. Our reasoning is twofold. Firstly, the titles we released in the Games for Smart Devices/PC Browsers sub-segment in the first through third quarters of the fiscal year ended March 2019 performed poorly, making it difficult to achieve the earnings we had originally anticipated. Secondly, we are taking a conservative outlook on additional sales of the new HD game titles we launched in the fiscal year ended March 2019. In order to achieve our medium-term earnings targets, we have been working on our strategic challenges of: 1) digital sales enhancement, 2) multiplatform utilization, 3) geographic expansion, 4) Games as a Service/Games as Media, and 5) e-commerce. To achieve our medium-term earnings targets as soon as possible, we have worked to expand stable recurring earnings while also continuing to invest in new IP. Sales of new HD game titles become a major contributor to profits once their development costs have been fully amortized. Provided we see expansion in our stable recurring earnings, I believe we will be able to achieve our medium-term earnings targets with our current pipeline.