-

Print

-

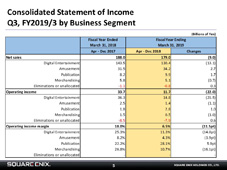

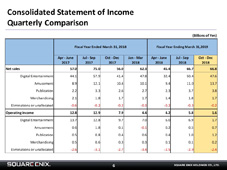

I will next break our results down by segment. The Digital Entertainment segment booked net sales of ¥130.4 billion (-¥13.1 billion YoY) and operating income of ¥14.8 billion (-¥21.5 billion). The HD Games sub-segment saw net sales rise YoY thanks to the launch of major new titles such as “SHADOW OF THE TOMB RAIDER” and “JUST CAUSE 4.” Meanwhile, operating income declined YoY due to greater amortization of development costs and increased advertising spending. The MMO sub-segment saw both net sales and operating income decline YoY due to the hurdle set a year earlier by the release of expansion packs for “FINAL FANTASY XIV” and “DRAGON QUEST X.” In the Games for Smart Devices/PC Browsers sub-segment, many of the titles launched since the previous fiscal year have performed below our expectations and failed to add to the revenues generated by existing games. A decrease in licensing income and an increase in advertising spending also contributed to a YoY decline in net sales and operating income. “Romancing SaGA Re;universe,” which was launched in December, is off to a good start, but its sales only began to hit our books as of 4Q. The Amusement segment posted net sales of ¥34.2 billion (+¥2.7 billion YoY) and operating income of ¥1.4 million (-¥1.1 billion). Net sales rose YoY thanks to solid arcade operations and the launch of new amusement machines, but operating income declined, in part due to greater amortization charges associated with changing out machines installed in arcades. The Publication segment posted net sales of ¥9.9 billion (+¥1.7 billion YoY) and operating income of ¥2.8 billion (+¥1.0 billion). Sales of printed comic books were on par with the same period of the prior fiscal year, but sales in digital formats grew sharply, resulting in higher net sales and operating income YoY. The Merchandising segment posted net sales of ¥5.1 billion (-¥700 million YoY) and operating income of ¥500 million (-¥1 billion). The YoY declines in net sales and operating income are owed to the high hurdle set in the same period of the prior fiscal year by the release of merchandise based on characters in the Group’s IP portfolio. This concludes my overview of our financial results.