-

Print

-

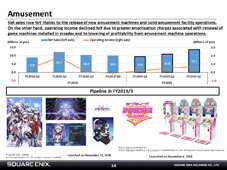

The Amusement segment saw net sales rise YoY on the launch of “Starwing Paradox,” but operating income fell due to sizeable initial amortization charges associated with the game’s development. We want to grow the game’s sales by working to make it a long-runner.

-

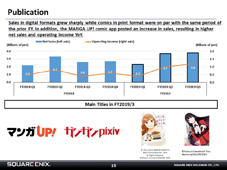

Both net sales and operating income rose YoY at the Publication segment thanks to brisk sales in digital formats. Rather than relying on major hit titles, we have established a library of smaller titles on “MANGA UP!” and “GANGAN pixiv,” which has helped to stabilize earnings. We have high hopes that digital sales will continue to provide a foundation for stable earnings in FY2020/3 and beyond.

-

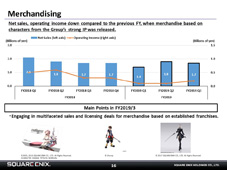

The Merchandising segment saw both net sales and operating income decline YoY. We intend to bolster earnings by forming a new business unit combining e-commerce, animation, stage productions, and music as of FY2020/3 to enable us to better leverage our content.

-

I will next discuss our full-year outlook. In 4Q, we expect to achieve significant improvement in earnings with the help of titles such as “KINGDOM HEARTS III” and “Romancing SaGA Re;universe.” Global shipments (including digital downloads) of “KINGDOM HEARTS III” have already exceeded 5 million units, and we expect sales volume to grow even further by the end of the fiscal year. In addition, “Romancing SaGA Re;universe,” which we launched in December, is outperforming our expectations. Moreover, given the thorough review we conducted of our content production account in 2Q, we see lower risk of incurring significant additional valuation losses in 4Q. Because we need to keep a close eye on such conditions, we have left our full-year guidance unchanged as of the end of 3Q.