-

Print

-

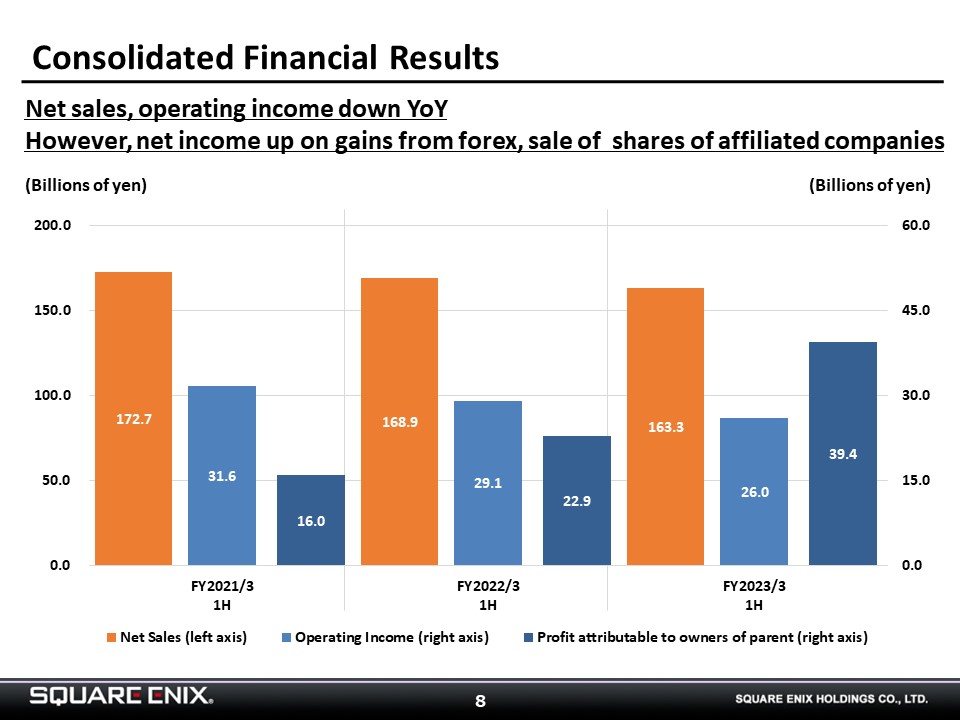

In 1H, net sales and operating income declined YoY, but net income rose mainly because we booked gains from foreign exchange and from the sale of shares in affiliated companies.

-

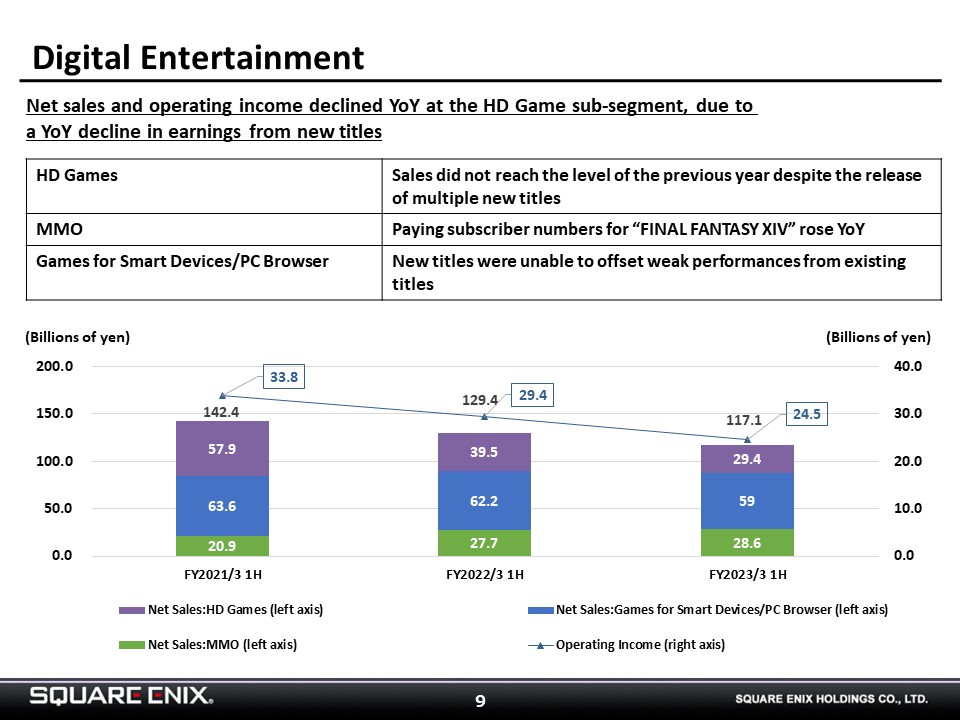

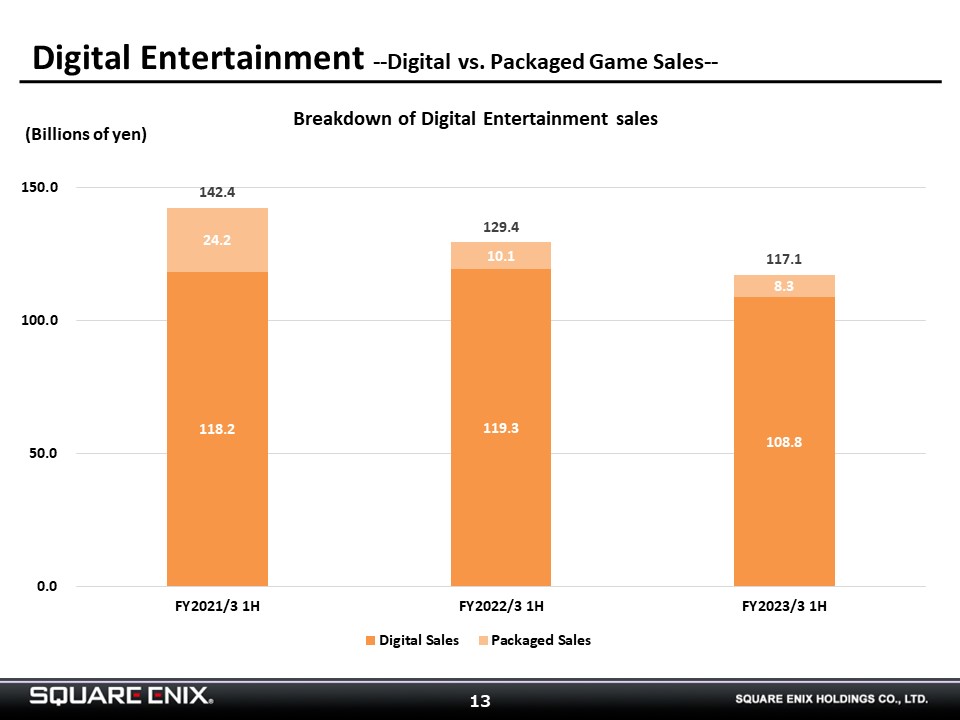

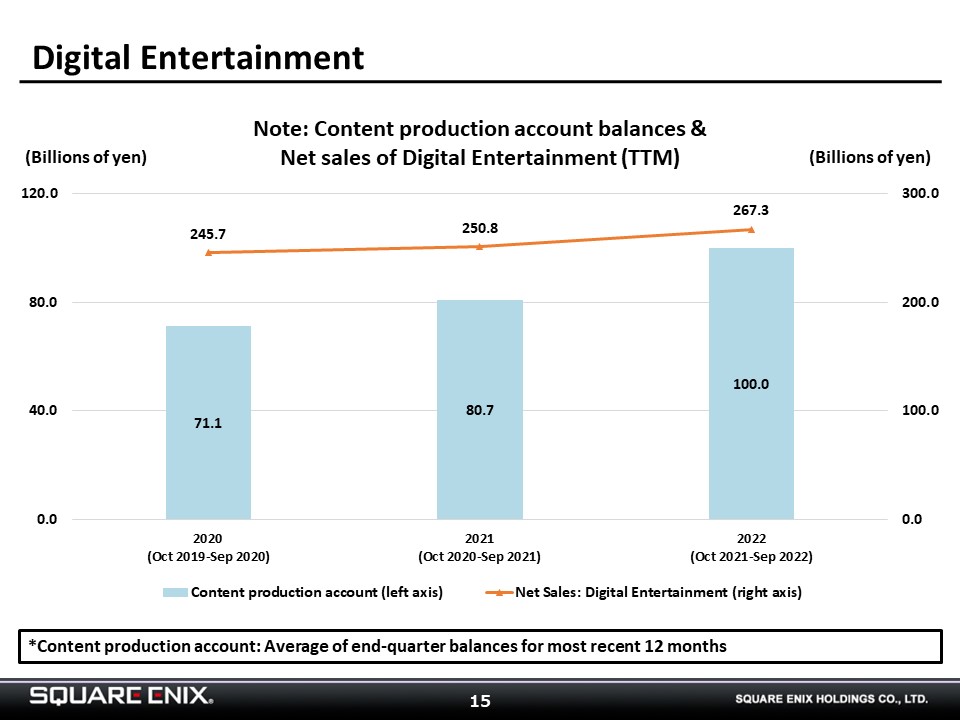

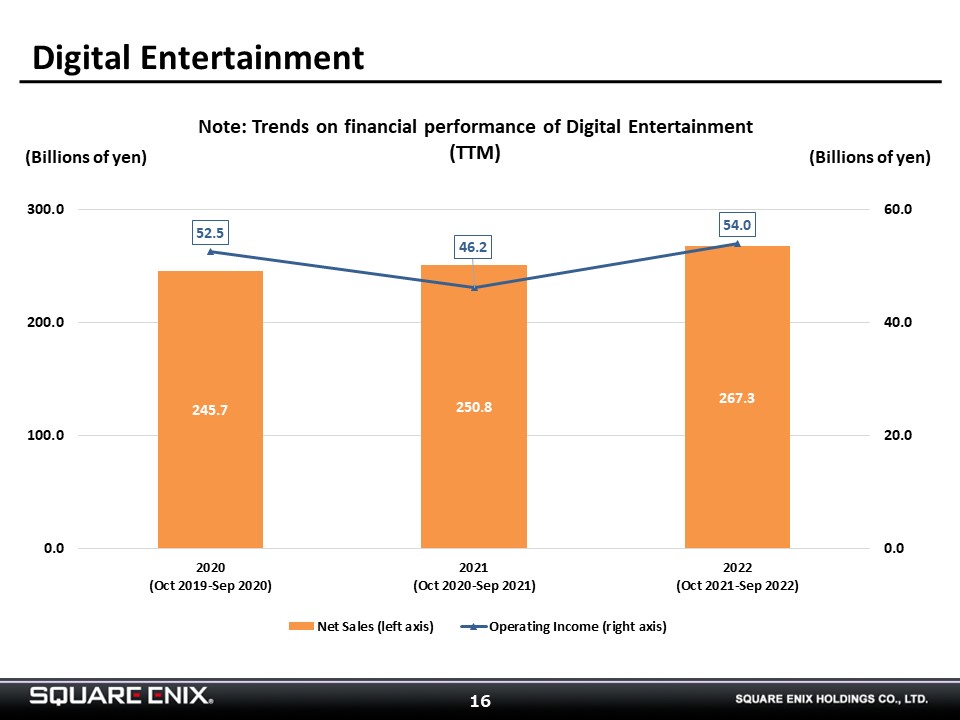

This is a breakdown of the Digital Entertainment segment’s performance.

Net sales and operating income declined YoY in the HD Games sub-segment due to new titles generating lower earnings than those of the previous year, and although “FULLMETAL ALCHEMIST MOBILE” got off to a strong start in the Games for Smart Devices/PC Browser sub-segment, it was not enough to fully offset weakness in existing titles.

-

In the MMO sub-segment, “FINAL FANTASY XIV” and “Dragon Quest X Online” both delivered solid performances.

-

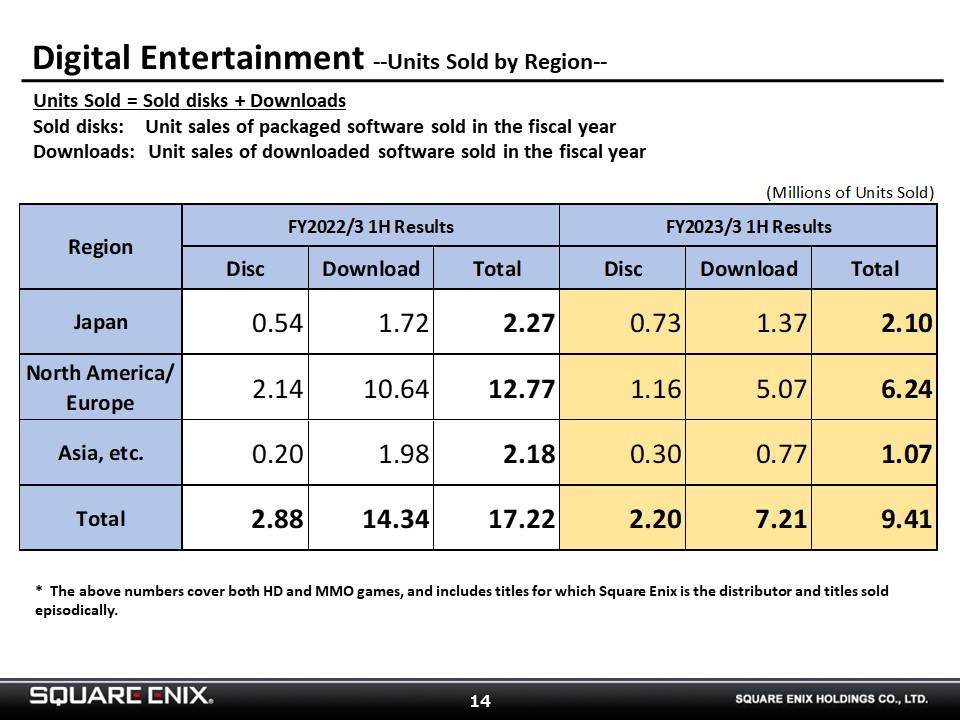

This slide shows units sold by region in 1H.

Sales volume declined sharply YoY, primarily due to the exclusion of sales from IP sold in the divesture of select overseas studios and IP, which were included in sales volume figures through FY2022/3.

-

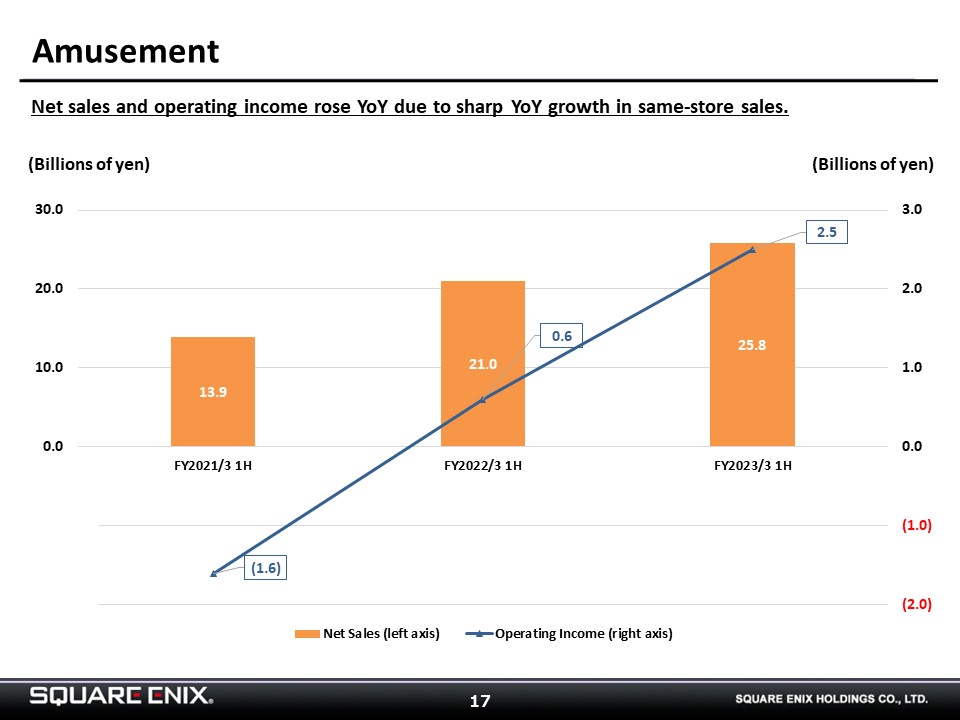

Net sales and operating income rose YoY in the Amusement segment thanks to sharp growth in same-store sales compared to the previous year. 1H sales in the Amusement segment were above pre-pandemic levels. We look forward to further growth as the weak yen and the easing of entry restrictions attract more foreign tourists to Japan.

-

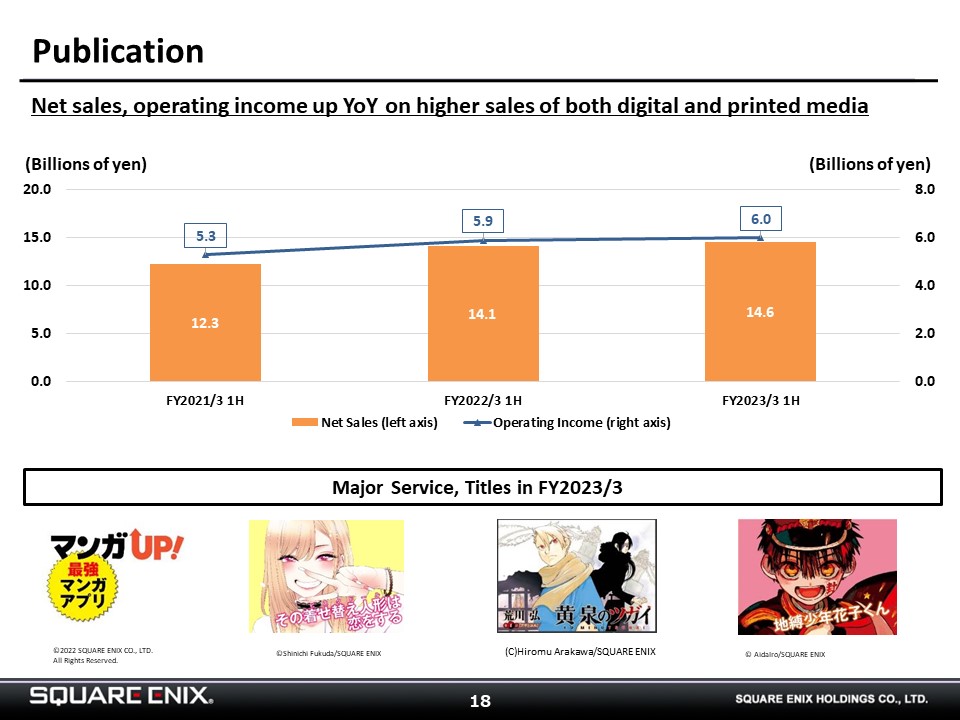

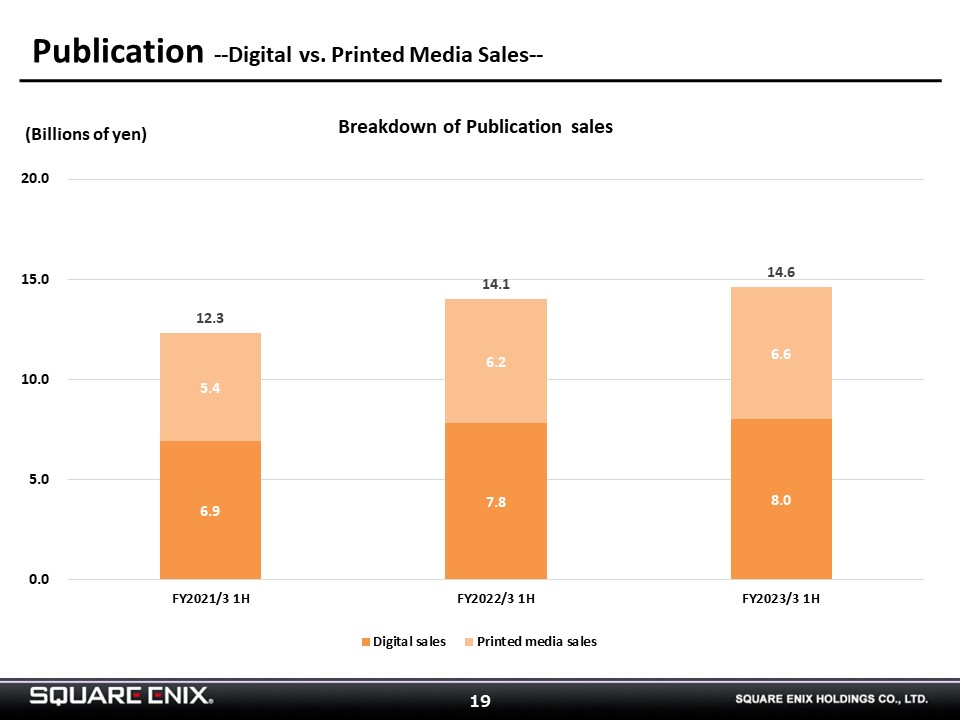

The Publication segment saw net sales and operating income increase YoY due to higher digital and printed media sales.

-

This shows the split between digital and printed media sales in the Publication segment. Sales in both categories are on the rise.