-

Print

-

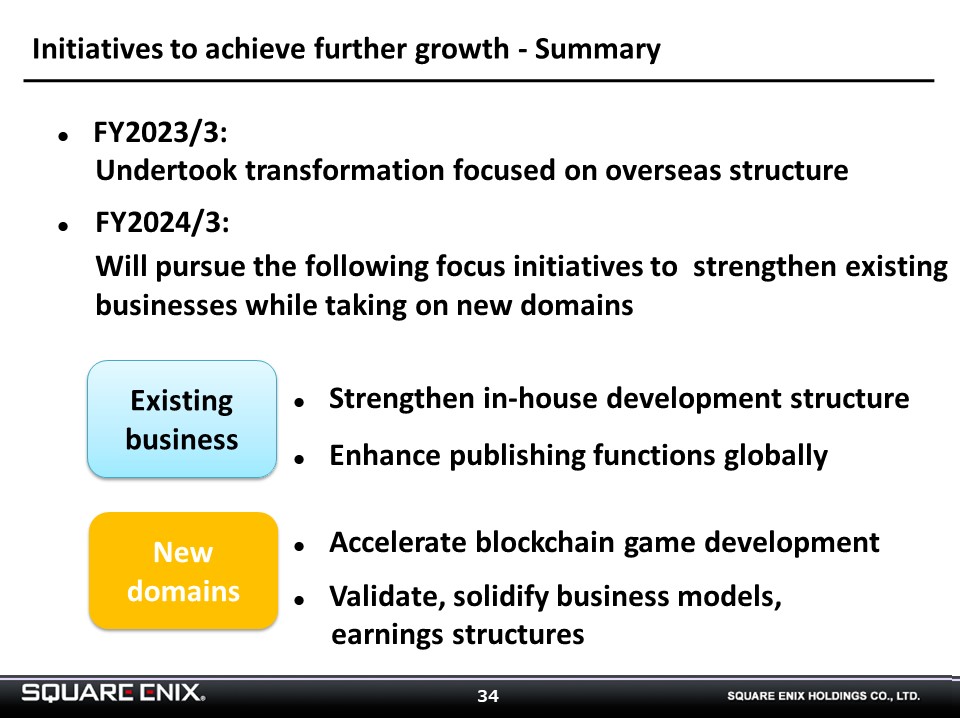

I would like to discuss our future plans now, starting with existing businesses.

In existing businesses, we will work on bolstering our in-house development capabilities to enhance our profitability and competitive prowess in the HD Games and Games for Smart Devices/PC Browser sub-segments.

In HD Games, we completed the consolidation of development resources within the Group with the merger of Luminous Productions into Square Enix Co., Ltd. However, there is an essential human element to content development, and we hope to succeed in integrating our people and cultures by the end of FY2024/3 to create a united Group HD game development function.

For the Games for Smart Devices/PC Browser sub-segment, the key to success lies in both development and operations, and the main aim of our reorganization efforts has been to strengthen both.

-

We are also focused on stepping up our recruitment of engineers and other development talent that are essential to strengthen our in-house development capabilities. In March, we announced an increase in base pay to boost our ability to attract talented new hires.

In our efforts to bring in talented external development resources to the Group, we will continue to consider inorganic opportunities, including M&A, setting up new studios, and taking minority stakes.

-

Now, I would like to explain our plans in our new domains.

In the realm of Web3 and blockchain, we are currently in an investment phase focused on the next stage of growth. On the inorganic side, we will pursue investments that limit our downside risk, while on the organic side, we will release multiple titles in order to both test the market and monetize our efforts.

-

We will leverage our own resources to pursue projects involving “Shi-San-Sei Million Arthur” and “SYMBIOGENESIS” in order to verify business viability and monetization potential.

-

While we search for growth opportunities in new domains, we will also work on initiatives from an inorganic perspective. We are already generating considerable financial returns and will now prioritize strategic returns for our entire business, by collaborating with partners who are committed to the business domain and taking minority stakes in them, with limited downside risk.

We also intend to diversify our investment vehicles by establishing a Corporate Venture Capital (CVC) unit, and undertaking preparations to form an overseas entity, which will allow for the creation of a Web3 business.

-

While our FY2023/3 reforms primarily pertained to our organization overseas, we plan to pursue focus initiatives in FY2024/3 on further strengthening existing businesses, while also taking on new domains.

-

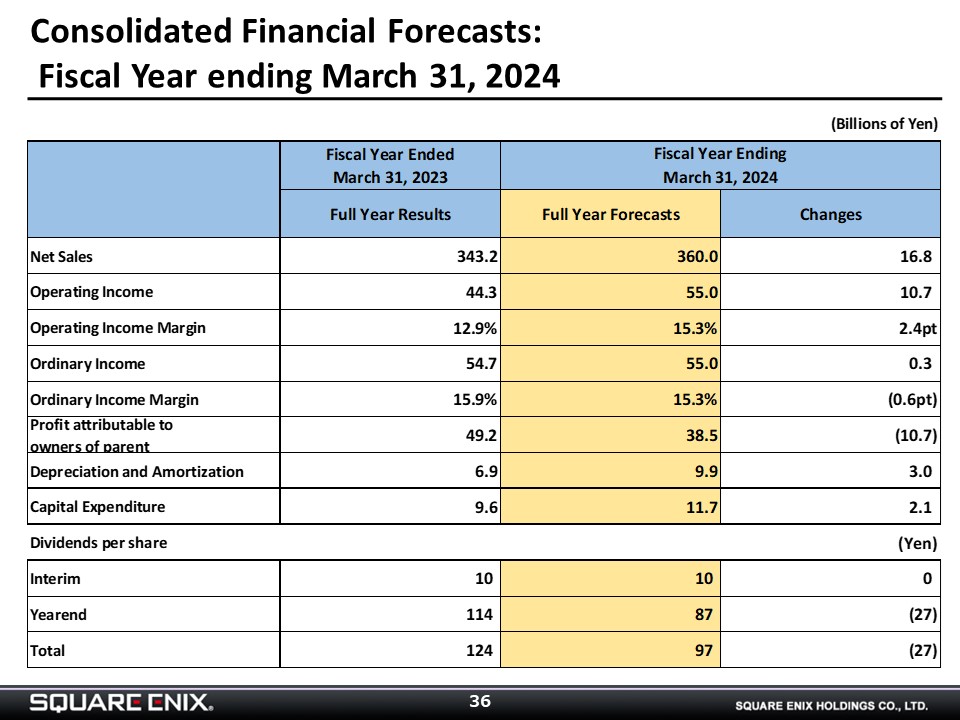

In FY2024/3, we forecast net consolidated sales of ¥360 billion, operating income of ¥55 billion, ordinary income of ¥55 billion, and profit attributable to owners of parent of ¥38.5 billion.

Although our consolidated operating income forecast of ¥55 billion is below the ¥60 billion lower-range boundary of our medium-term earnings target, we are still working to achieve our medium-term earnings objective.

Let me discuss our thinking on consolidated financial forecasts.

Our forecasts reflect uncertainties regarding our topline as well as efforts to improve our operating margin, but we also take into account the impact of higher personnel costs and the like associated with our efforts to strengthen our in-house development capabilities.